By DAVID BOYLE

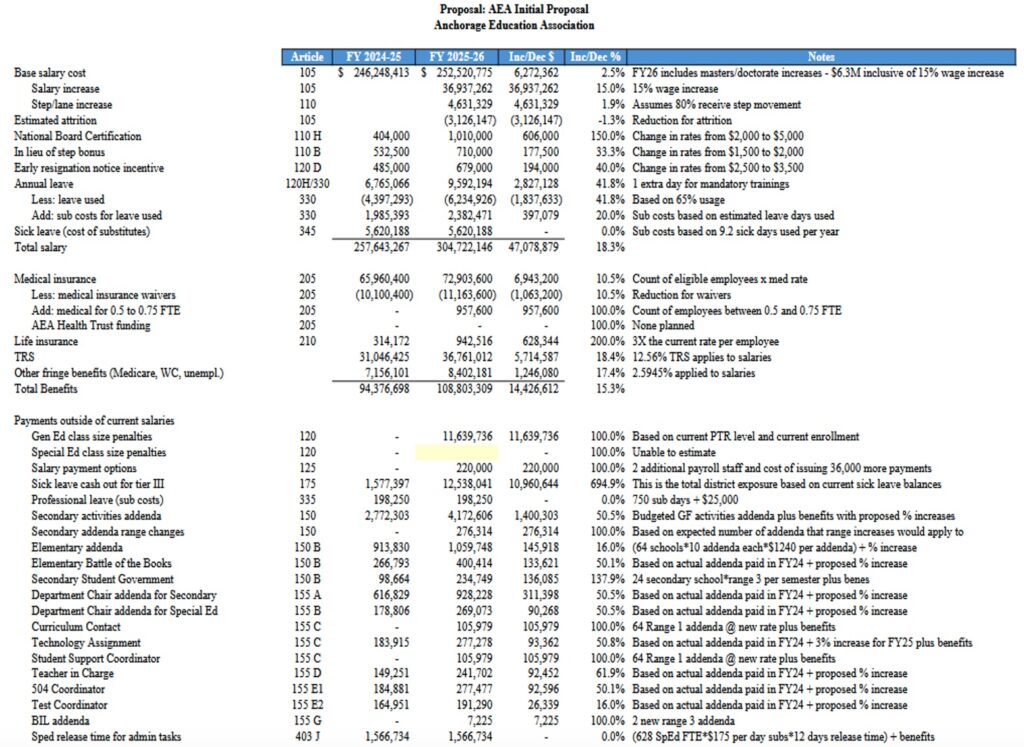

The Anchorage Education Association and the Anchorage School District have been negotiating a new contract since November. An analysis of the going-in position shows that the teachers’ union wants an amazing 15% across-the-board base salary increase for its nearly 3,200 members.

This union, an affiliate of the National Education Association, includes classroom teachers, non-classroom teachers, nurses, librarians, psychologists, librarians, physical therapists, and occupational therapists.

Just the 15% base salary increase would cost the district an additional nearly $37 million.

This salary increase would be for all AEA union members, regardless of their job performance. For example, a mediocre teacher would get the same pay raise as an outstanding and effective classroom teacher. There is no difference in compensation between the good and the not-so-good.

Has anyone else received a 15% salary increase not related to merit in the past year?

But there’s much more in the goody bag for the union members. The union also wants an additional annual 5% of salary for any member that has a doctorate degree. This would be an increase from the previous contract of 3%.

A member that has a master’s degree would get an additional 3% of salary annually. This was 1.25% in the previous contract.

Perhaps the worst part of rewarding a member with advanced degrees is those degrees don’t have to be in the person’s current subject area of teaching. The union wants to delete that requirement from last year’s contract.

One could get an advanced degree in gender studies; puppetry; or diversity, equity and inclusion (DEI) and get a substantial bonus.

This does not help improve student achievement.

There are other factors in the teacher’s union proposal that increase the cost to the district. The total increase in salary type items is $47,078,879.

One of the highest costs to the district is health insurance. This year the district pays nearly $66 million just for the teacher union members’ health insurance. Now the union wants an additional $6.9 million by requiring the district to increase the annual per member premium from $22,800 to $25,200. Health insurance is unsustainable. It would be much more cost-effective for all district employees to be placed on the State’s “Alaska Care” plan.

The AEA wants to increase the number of its members qualifying for health insurance by allowing the part-timers (.50 full-time equivalents) to enroll. This would add another nearly $1 million to the district’s cost.

All these insurance premiums go to the Public Employee Health Trust, managed by, guess who? The teacher’s union!

Notably, in the last Legislature, Rep. Sarah Vance sponsored House Bill 21, and Sen. Shelley Hughes filed Senate Bill 110 that would have allowed school districts to put their employees in the state’s health insurance plan. The Kenai Peninsula Borough School District and the Ketchikan Borough School District both supported this legislation, knowing that health insurance costs were unsustainable.

Similar health insurance legislation that was filed in past legislatures received support from four of the big five school districts. Only the Anchorage School District did not support the bills.

The union also wants to play a role in establishing state law by limiting the pupil/teacher ratio. Because the district is losing so many students the teachers union will probably be losing members. Thus, the union has decided to put limits on the number of students per teacher. This would increase union membership and power.

Here are some of the pupil/teacher classroom ratios the union wants to limit, and the penalties assessed to the district:

| GRADE | CLASSROOM SIZE LIMIT | COST TO DISTRICT |

| PreK | 18 students | $250/student/month |

| Kindergarten | 20 students | $250/student/month |

| Grades 1-3 | 22 students | $250/student/month |

| Grades 4-5 | 25 students | $250/student/month |

For example, if a third-grade classroom has 25 students, the teacher would get $750 more per month. That would be an additional cost to the Anchorage School District (taxpayers) of $9,000.

Here are the pupil/teacher classroom ratio limits the union wants on secondary classrooms and the increased cost to the district:

| INSTRUCTION TYPE | TEACHER WORKLOAD | COST TO DISTRICT |

| General Education | 140 students | $50/student/month |

| Physical Education | 200 students | $50/student/month |

For example, if a high school teacher has more than 150 students in his Algebra classes for five class periods (averaging 30 students per class), that teacher would receive another $500/month, at a cost of $4,500 to the district.

These are just a few of the class size limitations the union wants to force on the district.

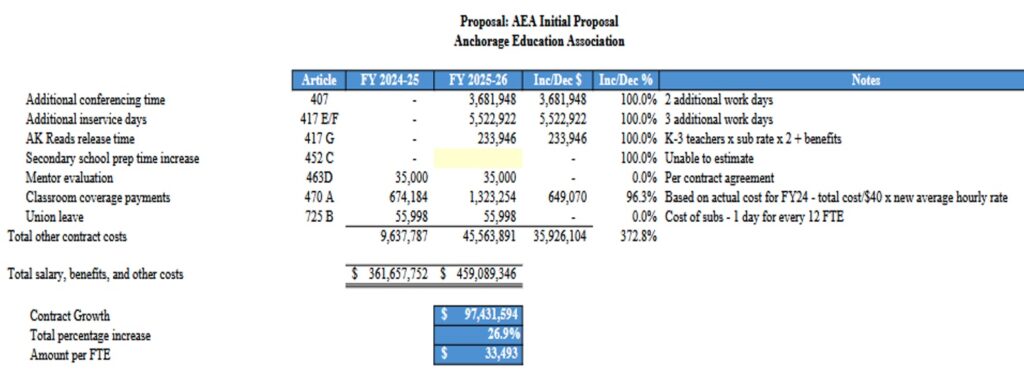

The district has done an excellent job of costing out the entire teacher union contract proposal, so taxpayers can see the projected total cost to the district.

That total cost is more than $97.4 million, an increase of 26.9% over the current contract and at a cost of $33,493 per full time equivalent worker.

That’s roughly 57,245 Permanent Fund dividends.

The total cost by line item of the additional cost by the teacher’s union can be seen here:

You can listen to the contract negotiations online and see the Anchorage School District’s and the teacher’s union going-in proposals here.

It is clear the Anchorage teacher’s union sees the loss of students as a threat to its monopoly over the district. That’s why it supports the massive spending in House Bill 69, with no accountability for increasing student achievement. It needs the spending to maintain its power.

You can voice your opinion to the Anchorage School Board.

You can also voice your opinion to your state legislator on HB 69. Send your email to [email protected].

It’s either that or lose what remains of your Permanent Fund dividend.

David Boyle is the Must Read Alaska education writer.