Before President Joe Biden’s angry and loud State of the Union address on Thursday, Alaska Rep. Mary Peltola put out a brief statement saying that rich people don’t pay enough in Social Security. She wants them to pay even more than they already do.

Peltola is going after the pipeline workers, the pipe fitters, plumbers, and fishermen of Alaska, not just the super-wealthy, although she’s going after them too, including the CEOs of Native Corporations. She wants working, wage-earning Alaskans taxed to the max.

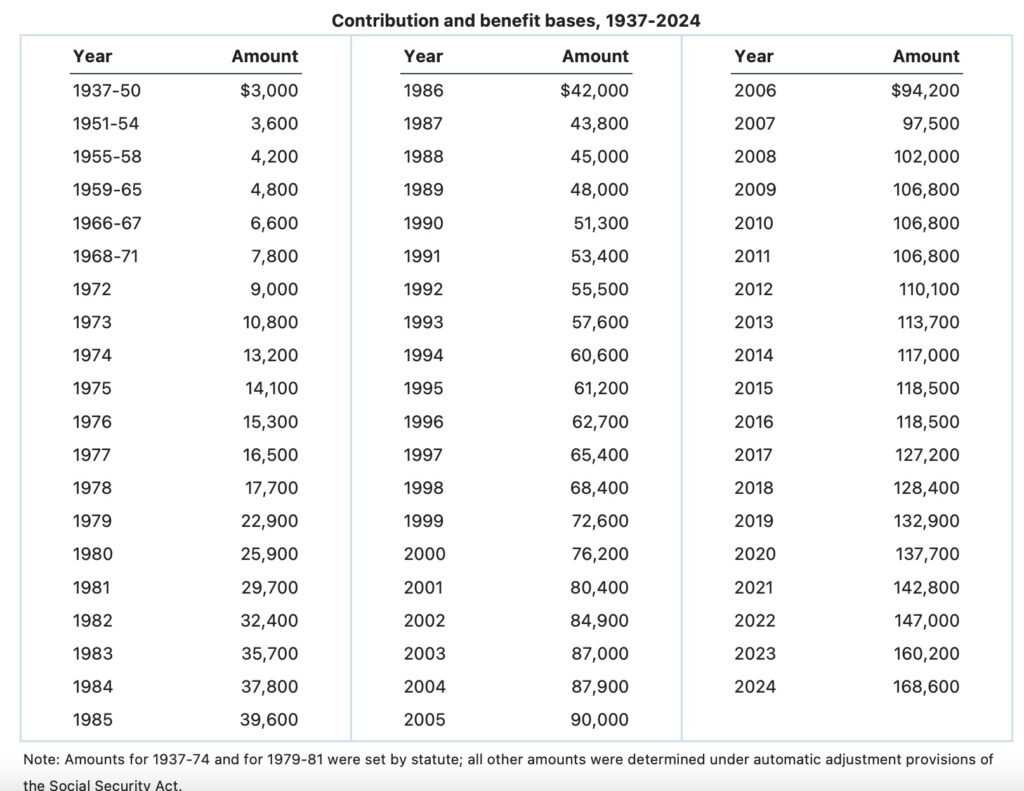

“Did you know that high earners only pay social security tax on the first $168,600 they make in a year? If millionaires paid into Social Security at the same rate as the rest of us, we could afford to protect and expand benefits for everyone. It’s time to #ScrapTheCap,” Peltola wrote on X/Twitter on Feb. 29.

These were talking points passed around by the Biden Administration and parroted by Democrats on Capitol Hill to prime the pump in the class warfare theater of the nation’s center of policy and power. Sure enough, in his speech on March 7, Biden said that millionaires should pay more Social Security tax.

But there’s a problem with that, according to Reason magazine writer Eric Boehm. “Raising the payroll tax cap could generate up to $1 trillion over 10 years, but Social Security faces a $2.8 trillion deficit.”

What’s more, it’s not millionaires who would be hurt, but anyone making more than the cap of $168,600 a year — less than 17% of what another person who makes $1 million a year makes. The two different income earners are in different categories altogether. In fact, millionaires often make much of their money through investments, not necessarily wages.

Peltola herself makes more than $174,000 a year and House of Representative staff members are capped at $199,000 per year, also not in the millionaire category, considering the cost of living in Washington, D.C.

Reason Magazine’s writer acknowledges the $168,600 cap is arbitrary. “In trying to draw a contrast between his own plans and what he claimed Republicans are aiming to do, Biden claimed that ‘working people who built this country pay more into Social Security than millionaires and billionaires do. It’s not fair.'”

To be fair, it was not just working people who built the country, but risk-taking investors, business owners, and job creators. Also others, from soldiers to scientists.

Biden said he plans to “protect and strengthen Social Security and make the wealthy pay their fair share.”

“Though he did not spell it all out in Thursday night’s speech, those two comments seem to be pointed toward the same aspect of how Social Security is funded. Under current law, the payroll tax that funds Social Security is capped so that, for this year, only the first $168,600 in earnings are subject to it,” Boehm wrote. That cap went into effect in 2024.

To be fair, $168,600 in New Mexico is not the same as $168,600 in New York City. But eliminating the cap is the Democrats’ idea to stop the bleeding for Social Security, or as Peltola would have it, expand Social Security to more people.

The Social Security growing deficit is set to create a major insolvency problem in nine years, which could mean a 23% benefit cut. Peltola and Biden want a massive tax that would not guarantee the insolvency would be fixed, because, as Peltola puts it, she wants to expand benefits.

There’s no doubt that raising the cap would generate more revenue that could be used to help keep Social Security afloat, Boehm explained in his article. “The Congressional Budget Office estimates that applying payroll taxes to higher income levels could raise $1 trillion in revenues over a 10-year period (though the amount of revenue would depend on how the cap was altered, and whether benefits increased as well).” It’s just not enough to close the $2.8 trillion gap.

Here’s where it gets tricky: Taxing people who are clearly not millionaires is a penalty on hard-working Americans to transfer their wealth to both retirees and the expanding federal definition of disabled people.

“A significant portion of that tax increase would fall on people making less than $400,000 annually—remember, the cap is currently set around $168,000—a cohort that Biden promised again in Thursday’s speech would not face tax increases,” Boehm wrote. Thus, anyone making $400,000 would pay a Social Security tax on the next $231,000, or at least $17,700 more in taxes, or nearly $36,000 more if self-employed. The Peltola-Biden Plan is especially hard on small business owners.

The announcement of the increase of the cap came in October when the Social Security Administration announced that the maximum earnings subject to Social Security tax would increase from $160,200 to $168,600 in 2024 — an increase of $8,400. It wasn’t the only change. Due to the cost of living going up, Social Security recipients received a 3.2% cost-of-living increase for 2024. For most recipients, it means less than $100 a month more than last year.

Peltola and other Democrats started their coordinated #ScraptheCap campaign in lockstep in the days leading up to the State of the Union. It went like a virus through the Democrats on Capitol Hill and she was just another vector among many.

Sen. Bernie Sanders, a socialist from Vermont, parroted the same phrase: “At a time of massive income and wealth inequality, we have a radical idea that maybe the people on top should start paying their fair share of taxes … #ScrapTheCap,” he said.

Rep. Pramila Jayapal, the socialist sympathizer from Seattle, also used the phrase the same day that Peltola did:

“Did you know that Saturday is when millionaires stop paying into Social Security for the year thanks to arbitrary caps? That’s not right — they need to contribute all year, just like the rest of us. It’s time to #ScrapTheCap and make the ultra-rich pay their fair share,” she said.

So did Rep. Mark Pocan of Wisconsin: “Millionaires will stop paying into Social Security for the year on Saturday, while the rest of us continue to pay into the system with each and every paycheck. It’s time to #ScrapTheCap to ensure the ultra-wealthy pay their fair share!”

The list goes on and on, with representatives and senators from the Left using almost the exact same phrasing in the days and week before Biden’s speech.

At the Manhattan Institute, senior fellow Brian Riedl has written about the myths surrounding these fixes:

“Eliminating the tax cap would either raise benefits as well (reducing the proposals’ savings), or—if the accompanying benefits are canceled—turn Social Security into a true welfare program by delinking contributions and benefits,” Riedl wrote in The Dispatch in “Ten Myths Sabotaging Social Security Reform.”

As a former Senate budget staffer, he has studied the problem for years: “Moreover, eliminating the cap would not bring permanent solvency or avert the need for benefit changes….The system would return to deficits by 2029. Lawmakers would still need to reform benefit levels and the eligibility age.”

The contribution salary cap has been around since the beginning of the program. When Joe Biden was born, only the first $3,000 a person made was taxed by the Social Security Administration. By the time Peltola was born, that had gone up to $10,800. It kept rising with inflation. In 2016, it was $118,000. By the time Biden took office, it had risen to $137,700. Now, people are taxed all the way up to the first $168,600, and Democrats want it all now — Social Security tax on every penny earned.

Go ahead. Try it. Give it 50-50 it passes.

Watch the money fly out of the country, people use every possible dodge, more people not pay taxes, and crash a staggering economy. Plus more.

Best of all, watch Trump walk right in to the White House.

So go ahead. Commit career suicide.

Freebies always buys votes. That’s why on day 1, Milei in Argentina said no more claiming anything from the government could be called ‘free.’ But it still buys votes from those who want more in return than they produce.

Can’t argue that. It’s the medium speed road to hell, but it’s made Princess Lisa’s career.

Eventually the piper must be paid.

MA – the adults in the room would like an explanation of how do you “crash a staggering economy”? Let alone “more people not pay taxes”? It seems like a kind of a “slingblade” explanation of the topic at hand. Please enlighten us.

The adults already know. Children like you don’t understand and don’t want to.

Go away child. Adults are talking.

Children should be seen, not heard.

Flies in the face of the basic fact that Social Security was not intended to be a welfare program that transfers from rich to poor. FDR would have never gotten the law passed in the 1930s if that was the original intent.

The payout after retirement is intended to reflect what you had paid into the system over your working lifetime. ‘Rich’ or ‘Poor’ never was intended to enter into the equation.

Are they planning on massively increasing the payouts for individuals who paid over the traditional income cap, or are Democrats just trying to soak the professional class in order to buy more welfare votes?

Yes, thats a rhetorical question. These are socialists we are talking about.

Life expectancy was 65 when SS became law. Since over half of the nation pays no taxes and the bottom 60% of earners actually get more back than they put in when totaling all government programs and other benefits. Money isn’t magically created by “the wealthy”…. think of California now with this…. SS at 13%, state at 14% and feds at 39%. *California from there I went, after all my money they went and spent). Google “fair tax” and see that some want a total tax burden of at least 70%. So … make $200K and keep 60. Which is less than total services to welfare recipients in NYC.

You act as though the fix isn’t already in.

You act as if it isn’t.

That’s cute.

I think the politicians need to pay more say a few million per politician every 6 months.

Shall we the people vote on that?

The November election cannot get here soon enough.

I know, 4 more years of responsible leadership should clean up the 4 disastrous yrs of that Crooked NY conman.

LMAO!!!

Really want to save Social Security? Stop spending the money to fund social programs.

Gee Mary do you suppose it has anything to do with the fact that you can only receive so much?

Just when you think she can’t be any more out of touch and ridiculous, she goes and does this.

Members of Congress do not pay the payroll tax and receive far more benefits than they should. Raising the tax cap is definitely needed to keep it as is, but expanding the benefits would not help it at all. The other thing people don’t know about SSI benefits is that they are not a right and you have to apply for them and can be turned down. Let that sink after paying into it for 40 years.

If you meet the criteria (pay into the system for 40 quarters) for receiving social security retirement benefits, they can’t legally turn you down. What they can do is have congress pass law to change the criteria… It’s social insecurity. SSI – supplemental security income – is a tag-on welfare program added to the social security system for which no one has a “right”

The congresswoman can donate the additional money she should be paying to the federal govt for SS taxes. Here’s the address:

https://www.fiscal.treasury.gov/public/gifts-to-government.html

No, I didn’t think so.

Social Security explained:

You are way too stupid to manage your own affairs. You are too stupid to plan for your own retirement. So we’re from the government, and we are going to take your money involuntarily to manage your affairs. If you do not cooperate with our socialist scheme, we will put you in prison.

One problem, despite the social security lockbox that Gore promised us- Republicans and Democrats have created a massive, multi trillion dollar deficit with Social Security. And mostly its Democrats that want to bribe voters with more welfare (disability benefits) because they need to buy votes for their low IQ voters.

Actually it’s a bit more than that.

The seeds were planted in the depression by Roosevelt. Millions lost jobs, homes, everything through no fault of their own. The middle class didn’t really exist then, and most people were borderline poor. It was the last vestiges of the gilded age and society was still very socially stratified.

The concept, which was a supplement plan only, came to fruition under LBJ, who managed to ruin everything he touched. The idea, reasonable to people at the time, was to create a pad against something like the Depression happening again.

In our own time we see people have their investments hijacked and devalued by woke investment firms. Government policies create scenarios where the cost of living has effectively gone up $1000 a month from Trump era. Most people, especially those no longer working, can survive on annual $12,000 a year increases.

Your concept, except for spending the money promised to be invested on behalf of the people who paid into the system, is over simplistic.

“Most people, especially those no longer working, can survive on annual $12,000 a year increases.”

Huh?

Government spending- such as conducted under Trump and Biden are the core trigger for massive inflationary increases. Between the two of these spendthrifts our debt has increased by at least $12 trillion. The more debt they incur, the more the US dollar will devalue.

There is no free lunch kiddo.

And again, your statements are simplistic and nonsensical.

I have neither time nor inclination to explain to you how inflation works, especially when the market is being manipulated by political, not economic forces.

Equally, it’s not a free lunch when people who worked their entire adults lives and paying into the system get said money returned to them.

MA. The nonsensical statement at the top- in my response- is yours. I thought you might wish to clarify because it makes no sense to me or anyone else.

You clearly do not understand the role massive, federal, deficit spending by both Trump and Biden has on devaluing the US dollar.

This is a snippet from a news article that clearly illustrates the problem:

” Republicans have attacked Mr. Biden over inflation since he took office. They denounced the $1.9 trillion economic aid package he signed into law early in 2021 and warned it would stoke damaging inflation. Mr. Biden’s advisers largely dismissed those warnings. So did Mr. Powell and Fed officials, who were holding interest rates near zero and taking other steps at the time to stoke a faster recovery from the pandemic recession.”

“Economists generally agree that those stimulus efforts — carried out by the Fed, by Mr. Biden and in trillions of dollars of pandemic spending signed by Mr. Trump in 2020 — helped push the inflation rate to its highest level in 40 years last year.”

Quit sending our money to foreign countries! Morons!

Send her back to her village. Let her graft there, screwing it up and leaving us alone.

She’ll never live in village again . DC is her village now ! RCV is reason this dumb dumb even went to DC . I’d focus on Rank Choice Voting and get rid of her . Believe me she will only go to village for campaigning

Be a lot cooler if I got to keep the fiat notes I work for.

Suppose the Social Security schtick’s just another shell game to divert public attention from where the money’s actually meant to go once it disappears into Social Security.

.

Could it be that someone must be forced to feed, clothe, shelter, and pay Mr. Biden’s battalions of fighting-age males, including platoons of Venezuelan sicarios, pouring into America, lest they get upset and take matters into their own hands?

.

Someone has to be forced because no productive American in his right mind would volunteer to subsidize entire invading armies of illegal aliens, no?

.

Is that someone, fellow suckers, us?

What a hell of a deal, we’ve got one as smart as Marjorie Taylor Greene. And Jeffries…out sniffing around the dumb ones. Cheer him on: he’s given her the political kiss of death. Apparently, she’s been swept off her feet with the esprit de corps of the D. C. Democratic society! Jeffries is streetwise: politically speaking, he knows how to woo a damsel who’s on the prowl–a free dinner, a pat on the ass, and an atta girl! Cheer her on, “Bye-bye, sweetheart!”

FJB. Stupid arrogant damrats ripped off my retirement, inflated prices out of anything like reason so that with two jobs and both my wife’s and my social insecurity benefits we’re just scraping to get by. Now poopypants and his bootlicker Ms Mary want to raise my taxes! So they can give more of my money away? Seriously? They think this is a benefit? (Time out while I throw a screaming hissy fit…)

NO NEW TAXES. NO NEW GIVE-AWAYS. NO EXPANSION of government or programs or spending. Grow the economy, don’t “fundamentally change America”… Growing the economy makes a bigger pie to divide and all of us get a bigger piece, including the government. Damrat economics just steals from those they purport to support, to give to those whose votes they wish to buy.

So now Peltola wants the pipe fitters and working people to pay more. Did anyone tell her that most of whom she wants to tax more are union members? The kind that usually vote democrat? It’s called biting the hand that votes for you. Let her keep talking herself out of a job. Please.

There are processes available for being able to free yourself legally from paying federal taxes. Ann Vandersteel and others talk about these processes. Maybe it really is time for Americans to be looking into this.

Social Security is the biggest Ponzi scheme ever devised and will necessarily collapse, as all Ponzi schemes eventually do. Meanwhile, Congress blows though money like they are at a casino, while skimming off enough to keep themselves in office and taking advantage of sweetheart deals and insider stock trading.

I wonder if our Alaska leadership ever experienced being panhandled when they go to a presumed safe event and someone isn’t casually goes up and asks “do you have some cash?” “Do you spare change for food” I’m tempted. Just to see the look on Sullivan’s, Peltola, or Murkowski face. Or my local legislative leadership face. Then I can tell you all if they refused and embarrassingly looked away and turning me down. Cause when our Alaskan leadership go to their safe political events and photo shoots with the public no one panhandles them, do they’d be caught off guard if I went up to them pretending I’m homeless begging for some money though I don’t need it. I will have a hard time keeping straight face and looking serious like how the Anchorage Homeless ask us for money. It would be so worth it to play actress looking pitiful and begging a local leader for money when they expect to be safe from that kind of disturbance.

Hmmmm, tax the middle class…..brilliant idea democrats.

I think it’s a crying Shame the government can deduct for social security, unemployment, and Medicare, when the government knows I won’t ever collect that money back again. When I was single without dependents I can now understand family men co workers in my previous workplace complaining about why he has deductions while last year the federal government took away 2,000 plus from my earnings. I’m a millennial I know I won’t see that money again. Everybody paying attention knows Social Security is already spent, so it’s highway robbery for the federal government still deducting from GenX, Millennials, and GenZ.

Jen, it’s a tax… The promise is gone even for those of us “fortunate enough” to be able to draw some benefit from the program. Social insecurity benefits don’t pay enough to live on, even if your house and car are paid for – thank you bidenomics – and if you work to supplement your benefits or have additional retirement income, they tax it out of existence by charging you for obummercare – “Medicare Part B”, which you are required by law to be part of. What the damrats really want is for everyone to die before age 65 so no one can receive benefits except those unwilling to work and “undocumented” illegal aliens.

You can’t pay your hundred and fifty dollar part b?

Then I heard through my workplace, my boss sharing with me the Federal government wants to push the retiring age to 79. They are trying to keep GenX and Millennials from retiring. The federal government knows the deductions they took is all gone, and there is nothing left for GenX and Millennials.

They’re trying to force baby boomers back to work so they must pay taxes to support bums and illegal aliens.

I wish we could take away US congressional leaders salary and they can volunteer their service running this country while they live in a public dormitory like college students.

This would see which congressional leaders stay serving our collapsing nation if they lose their salary and must live in a dorm room while they serve. You can tell the heart of a leader or a pastor if you take away their salary.

it isn’t their salary that causes this, it is the budget they have to employ a large staff of political professionals that is several times more impactful.

There will never be enough of someone else’s money for greasy politicians to spend.

Taxing Alaska native corporations, their non-profits, health clinics, foundations and organizations would do much to fund rural Alaska’s anorexic government bodies and law enforcement.

There should be no non profits just look at what they have done.

Donald Trump also says he is going to preserve Social Security and Obama Care. On CNBC this morning he did not offer his plans.

He said preserve Social Security and make obummercare optional – destroy it.

Frank Rast: Often wrong, but never in doubt.

This not only taxes individual more but also the employer who will have to match the amount. SS tax is currently set at 6.2% of income up to the set limit and the employer has to match it at the same rate.

So, not only would this be a burden on higher earners but also on their employers. One more thing to dampen our economy.

Pay more in taxes? YOU first Biden! Pay your fair share, YOU, HUNTER AND THE REST OF THE BIDENS who haven’t been paying your taxes. BTW, stop running some of the income you do report through S Corps, etc , to lessen the taxes you do pay.

FJB, Chapter S Corporations enable a business owner to reduce their exposure to payroll tax. Many small companies take advantage of this.

Social Security was NEVER meant to pay illegals nor for handouts for workers who refuse to work. For those who refuse to work; they need to be force to do some sort of community service (even the druggies) to earn what they take from OUR social Security. For the illegal foreign people who come for the benefits that are reserved for those citizens who have worked all their life to retire, need to pay back in community service or other community service..

To MA et al. Please dispense with the arrogant and smug comment “silence child, adults are talking”, it has grown tiresome. You might as well just say what you mean, “shut up and agree with me”. It is just people talking and yes even children need to be heard. In fact, many times they make more sense than the so called adults. Nuff said

We find the lefty trolls who so stupidly assert their opinions and/or lies to be tiresome and annoying. Some do so because they suffer from schadenfreude, enjoying the opportunity to anger conservatives. Some do so out of sheer stupidity – and their writing displays this. Why do liberals even read MRAK, much less comment? I, for one, enjoy a civil, truthful, scholarly debate on issues – but trolling and bs I despise. I sympathize with MA’s disrespectful admonition – he applies it a lot because it is deserved by the recipients.

Awwww Feddy. Did I trigger you? Child. Here’s a crayon and an imaginary puppy. Hope it helps.

Now be quiet child. Adults are talking. Don’t interrupt us.

If you don’t vote to get rid of Biden and his handlers you have no write to complain. it been reported that Biden has written an executive order to allow illegals and prisoners the right to vote.

Typical leftist.

Spend other people’s money so you can look good.

.

Any bets on whether Congressional pay is exempt?

Coming soon……NB3 to the rescue!

How about we just tax per diem payments paid to the politicians. That should make up for the differences.

Ultimately, the problem is the majority of social security payments do NOT go to retirees. It has been used as the bank for socialist programs for decades. The whole arguement that it is insolvent is due to that reason.

An American working his entire life for an average of $32,000 per year gets about $1,300 per month in Social Security retirement. An illegal alien trespassing into our country is given $2,200 month indefinitely (for life if need be) plus housing, SNAP and a multitude of other benefits. Do these facts make any sense to anyone?

With RCV and two Republicans running to beat her she is all but guarantied to win re-election. Alaska Republicans make a lot of dumb mistakes, time after time.

Sorry to admit it. My own mother touted the morning liberal show “The View “ and the Barry Hussain’s policies out of one side of her mouth. Then complain dearly out the other side as to the illegals getting three times her Social Security monthly.

While having never paid a dime into it.

RIP mom. Will never stop loving and missing her.

I think anyone in Congress who had any money in the stock market should be the first to pay into Social Security, right, Pelosi? Just stuff your profits right in there.

I said that RCV

Really wasn’t for me

But then they stola

By votin’ in Peltola

Counting not one vote, but three

Record amount of immigrants each month and now a call for more taxes for welfare? Whose that welfare for?

That 1937 $3000 bought what it takes $65,600 to buy now. Just saying.

yeah going to need extra money for the illegal aliens!

for every Alaskan you see here in Alaska, there are 12-14 illegal aliens in the USA, let that sink in for a minute!

The problem with removing the cap is that, at present, only the income a person earns below the cap is considered when calculating the benefit they receive in retirement. A “millionaire”, therefore, receives the exact same benefit as someone earning $168,000 per year. If the cap is removed there are 2 options:

1. The cap on benefits must be removed as well such that a “millionaire” has his full $1,000,000 of income considered in his benefit calculation, which will somewhat offset the revenue gains from such a scheme.

2. The government will finally be forced to admit the truth which is that Social Security is just another tax, loosely linked to just another welfare program, and your “contributions” have nothing to do with the benefit to which you are entitled.

Don’t know if you know about the “windfall Elimination Provision” that reduces your SS payments by anything you get from your pension plan

Comments are closed.