FTX, a cryptocurrency exchange scam that was run by Sam Bankman-Fried, sucked in thousands of investors into its sub-funds. The Alaska Permanent Fund was one of them, investing in Sequoia Capital’s Global Growth Fund III, which invested a sliver of funds into FTX. The APFC investment of $200 million, however, doesn’t represent the actual exposure to FTX, which has a value now of $0.

According to sources at the Alaska Permanent Fund, the fund has an indirect exposure of just about $4 million to FTX through APFC’s private equity program. The FTX exposure represents 0.03% of the fund’s $15 billion private equity portfolio, which is a portion of the fund’s $75 billion portfolio. APFC is not a direct investor in the cryptocurrency markets, but there may be minimal indirect exposure to the FTX meltdown through other private equity external managers that the fund invests with.

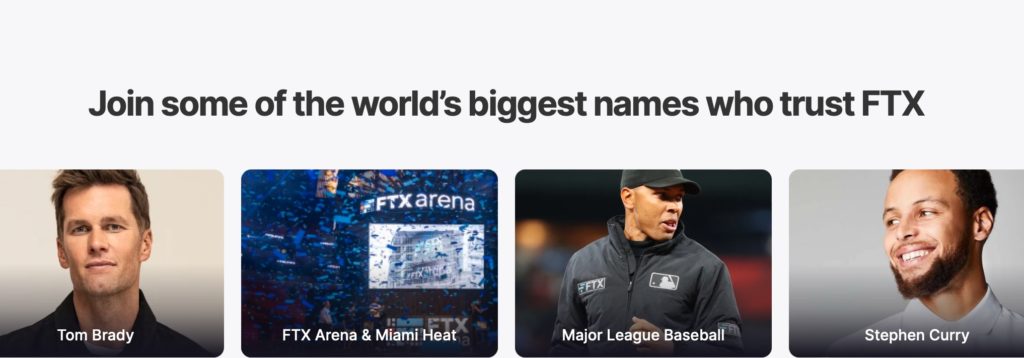

In related news, a new lawsuit has been filed in Florida against FTX’s former CEO Bankman-Fried. The lawsuit names numerous celebrities who lent their names to the enterprise that now appears to have been criminal in nature. The lawsuit names comedian Larry David, Japanese tennis star Naomi Osaka, the married couple Gisele Bundchen and NFL quarterback Tom Brady, NFL star Trevor Lawrence, basketball players Shaquille O’Neal, Steph Curry, Udonis Haslem, and the Golden State Warriors, baseball players Shohei Ohtani, and David Ortiz, and celebrity investor Kevin O’Leary. The celebrities are included due to their promotion of FTX across the media.

“The Deceptive FTX Platform maintained by the FTX Entities was truly a house of cards, a Ponzi scheme where the FTX Entities shuffled customer funds between their opaque affiliated entities, using new investor funds obtained through investments in the YBAs and loans to pay interest to the old ones and to attempt to maintain the appearance of liquidity,” the lawsuit reads.

“Part of the scheme employed by the FTX Entities involved utilising some of the biggest names in sports and entertainment – like these Defendants – to raise funds and drive American consumers to invest in the [yield-bearing accounts], which were offered and sold largely from the FTX Entities’ domestic base of operations here in Miami, Florida, pouring billions of dollars into the Deceptive FTX Platform to keep the whole scheme afloat.”

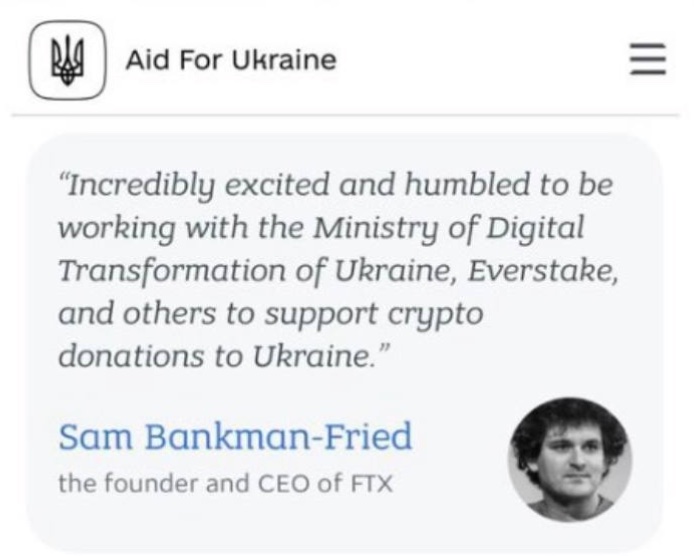

It’s now believed that the cryptocurrency exchange created various pass-through funds to Democratic candidates and causes, and was also allegedly helping Ukraine finance its defense against Russia’s invasion.

Among the crypto tokens sold by the exchange was one called TRUMPLOSE, another indication of what kind of political operation FTX was engaged in at the expense of investors.

“Published by the Financial Times, the balance sheet triggered disbelief and amazement in financial circles, especially after Bloomberg’s Matt Levine highlighted its many bizarre attributes. These include assets in the form of illiquid shitcoins that FTX had conjured out of thin air, including $2.2 billion of “Serum” tokens and over $600 million of “Maps” tokens, as well as $7.3 million of a mysterious illiquid asset called TRUMPLOSE. And then there is a line for $8 billion of liabilities that is described on the spreadsheet as “Hidden, poorly internally labeled ‘fiat@’ account.” Huh? I can’t begin to describe how outlandish this is in terms of standard accounting, so I will leave it to the inimitable Levine,” writes Jeff John Roberts in Fortune Crypto.

“If you try to calculate the equity of a balance sheet with an entry for HIDDEN POORLY INTERNALLY LABELED ACCOUNT, Microsoft Clippy will appear before you in the flesh, bloodshot and staggering, with a knife in his little paper-clip hand, saying, ‘Just what do you think you’re doing, Dave?’ You cannot apply ordinary arithmetic to numbers in a cell labeled ‘HIDDEN POORLY INTERNALLY LABELED ACCOUNT.’ The result of adding or subtracting those numbers with ordinary numbers is not a number; it is prison,” Levine said.

Roberts wrote that it’s not an exaggeration to say prison may be ahead for Bankman-Fried, “as I explained earlier, these sorts of accounting shenanigans combined with knowing deception translates into federal wire fraud, which can carry a term of 20 years.”

In addition to the criminal side, “there’s the question of how the company produced such a dog’s breakfast of a balance sheet in the first place. One reason is that U.S. regulators have long refused to produce any helpful guidance for crypto accounting, which has meant professional bean counters have failed to come up with a system for integrating crypto assets into financial statements,” Roberts wrote.