FTX, a cryptocurrency exchange scam that was run by Sam Bankman-Fried, sucked in thousands of investors into its sub-funds. The Alaska Permanent Fund was one of them, investing in Sequoia Capital’s Global Growth Fund III, which invested a sliver of funds into FTX. The APFC investment of $200 million, however, doesn’t represent the actual exposure to FTX, which has a value now of $0.

According to sources at the Alaska Permanent Fund, the fund has an indirect exposure of just about $4 million to FTX through APFC’s private equity program. The FTX exposure represents 0.03% of the fund’s $15 billion private equity portfolio, which is a portion of the fund’s $75 billion portfolio. APFC is not a direct investor in the cryptocurrency markets, but there may be minimal indirect exposure to the FTX meltdown through other private equity external managers that the fund invests with.

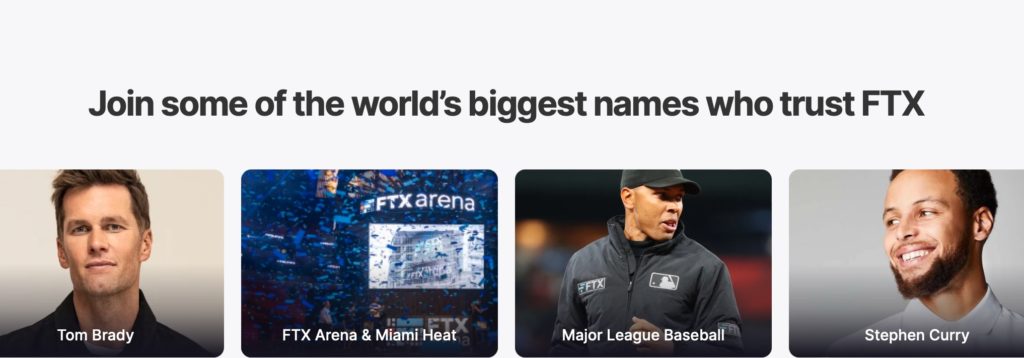

In related news, a new lawsuit has been filed in Florida against FTX’s former CEO Bankman-Fried. The lawsuit names numerous celebrities who lent their names to the enterprise that now appears to have been criminal in nature. The lawsuit names comedian Larry David, Japanese tennis star Naomi Osaka, the married couple Gisele Bundchen and NFL quarterback Tom Brady, NFL star Trevor Lawrence, basketball players Shaquille O’Neal, Steph Curry, Udonis Haslem, and the Golden State Warriors, baseball players Shohei Ohtani, and David Ortiz, and celebrity investor Kevin O’Leary. The celebrities are included due to their promotion of FTX across the media.

“The Deceptive FTX Platform maintained by the FTX Entities was truly a house of cards, a Ponzi scheme where the FTX Entities shuffled customer funds between their opaque affiliated entities, using new investor funds obtained through investments in the YBAs and loans to pay interest to the old ones and to attempt to maintain the appearance of liquidity,” the lawsuit reads.

“Part of the scheme employed by the FTX Entities involved utilising some of the biggest names in sports and entertainment – like these Defendants – to raise funds and drive American consumers to invest in the [yield-bearing accounts], which were offered and sold largely from the FTX Entities’ domestic base of operations here in Miami, Florida, pouring billions of dollars into the Deceptive FTX Platform to keep the whole scheme afloat.”

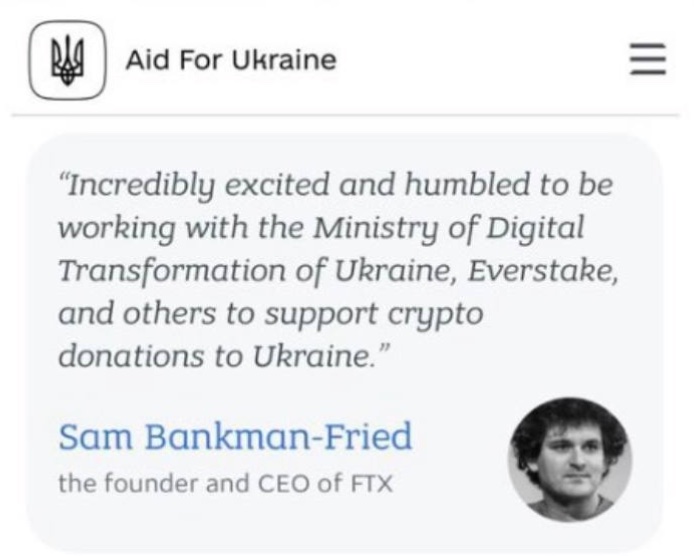

It’s now believed that the cryptocurrency exchange created various pass-through funds to Democratic candidates and causes, and was also allegedly helping Ukraine finance its defense against Russia’s invasion.

Among the crypto tokens sold by the exchange was one called TRUMPLOSE, another indication of what kind of political operation FTX was engaged in at the expense of investors.

“Published by the Financial Times, the balance sheet triggered disbelief and amazement in financial circles, especially after Bloomberg’s Matt Levine highlighted its many bizarre attributes. These include assets in the form of illiquid shitcoins that FTX had conjured out of thin air, including $2.2 billion of “Serum” tokens and over $600 million of “Maps” tokens, as well as $7.3 million of a mysterious illiquid asset called TRUMPLOSE. And then there is a line for $8 billion of liabilities that is described on the spreadsheet as “Hidden, poorly internally labeled ‘fiat@’ account.” Huh? I can’t begin to describe how outlandish this is in terms of standard accounting, so I will leave it to the inimitable Levine,” writes Jeff John Roberts in Fortune Crypto.

“If you try to calculate the equity of a balance sheet with an entry for HIDDEN POORLY INTERNALLY LABELED ACCOUNT, Microsoft Clippy will appear before you in the flesh, bloodshot and staggering, with a knife in his little paper-clip hand, saying, ‘Just what do you think you’re doing, Dave?’ You cannot apply ordinary arithmetic to numbers in a cell labeled ‘HIDDEN POORLY INTERNALLY LABELED ACCOUNT.’ The result of adding or subtracting those numbers with ordinary numbers is not a number; it is prison,” Levine said.

Roberts wrote that it’s not an exaggeration to say prison may be ahead for Bankman-Fried, “as I explained earlier, these sorts of accounting shenanigans combined with knowing deception translates into federal wire fraud, which can carry a term of 20 years.”

In addition to the criminal side, “there’s the question of how the company produced such a dog’s breakfast of a balance sheet in the first place. One reason is that U.S. regulators have long refused to produce any helpful guidance for crypto accounting, which has meant professional bean counters have failed to come up with a system for integrating crypto assets into financial statements,” Roberts wrote.

Yeah they dumped a load. I was reading the other day that Brady along with curry and the youngling Jacksonville jaguars quarterback Trevor Lawrence who personally I believe is a Tim Tebow wannabe and overrated, last a bunch of money. I was remembering back when Brady gave that one fan some Bitcoin in trade for his record setting football. I hope that guy sold it off quickly.

Lawrence throws a better ball than Tebow ever dreamed of.

And nobody will be head accountable because the big guy needs his 10%. This will be swept under the rug just like everything else that the politicians do. Alex Baldwin and

Hunter Biden is still free case in point.

According to some reporters for Fox News and other sources, SBF regularly visited the Whitehouse (WH), donated $10M to Biden’s campaign, lobbied the WH to send money to Ukraine, and donated millions to other left-wing politicians and groups. The WH sent money to Ukraine, Ukraine invested the money into FTX, and FTx sends money to the leftist politicians. Hows that for money laundering? No wonder there was no oversight with the billions we have sent to Ukraine.

While the $4 million seems like a small amount, there is no way on God’s Green Earth that investment in cryptocurrency complies with the “prudent investor” rule. The risk profile of cryptocurrency is off the scale. For that failure those at the Permanent Fund Corporation must be held accountable. For me, that means termination, suspension or reprimand. Stewardship of Alaska’s assets is not a game.

All that for a bad investment move made by a secondary fund manager? Remember, you are talking about 3/100ths of one percent of the fund’s portfolio. That is by far an acceptable amount of risk.

I mis-spoke…But even still it is a relatively tiny amount.

You seem to want to minimize the potential loss but totally ignore the principle: No investment in crypto is justified under the prudent investor rule.

JMARK. You are absolutely correct. It doesn’t matter how much was invested. I want APFC held accountable. Someone should be fired.

This may have already happened for another matter since the former director of the Permanent Fund was fired over another matter. It would be prudent, however, for the Permanent Fund to re-evaluate their portfolio and get out of cryptocurrency and any other problem investments. As you have indicated, stewardship of Alaska’s assets are a serious matter.

What does a cashless economy look like?

Venezuela. Ask people there what they think of Bitcoin, not the hucksters who try to repackage it. Madoff did it with the almighty dollar.

There still needs to be an investigation into the methodology used to invest in this Ponzi scheme.

What’s to investigate? AKPFC invested 200 mil in a private fund that is managed for risk. 4mil of that investment was in FTX and we took a haircut. estimate that the other 198 Mil earned 5 percent this year and that is likely a very low estimate. Our return is still 9.9mil.

Bob, maybe you are not an investor. We have lost millions in this scam. Our money should never, ever, ever have been given to FTX. This was not an investment, this was a gamble.

How many other “investments” like this have been made with our money. This is madness.

I just love how everyone in the media, and all the ponzi-‘coin’ issuers themselves, just love to, and have to, portray a real, physical, usually golden coin any time one of their fantasy cryptid-currencies is discussed or mentioned. It’s almost like subliminal influencing, or something. I guess a photo of air, or of empty space, would be just too real and honest.

Air and empty space are more directly related to fiat currency.

Trouser, I wonder if you are a fan of block chain?

As for fiat currency, one of my Hero’s, Walter E. Williams once told me that Central Banks, rob one of his wealth through… currency devaluation. Huh? Who Knew?

Good to know…these items were not available for me to know and access to such “classes” were completely unavailable for me at UofA.

If the holders of the United States public debt ever demanded payment our government would be in the exact same boat as FTX…….

Remind my again, who owns all that debt?

Sounds a lot like Trump “University”.

Kim Kardashian just paid a $1.26 million fine for promoting crypto. Everyone of the celebrities listed have the same exposure for doing what Kim K did, basically being Soapy Smiths.

So investors taking investment advice from football players, rappers, sports figures, bad comedians, and dumb actors got burned. Why is this a problem? What are fools for if you can’t separate them from their money.

Comments are closed.