The Alaska Permanent Fund is one of the institutional investors that had exposure to the bankrupt cryptocurrency exchange FTX, which filed for bankruptcy on Friday, along with 134 of its associated companies. There will be losses.

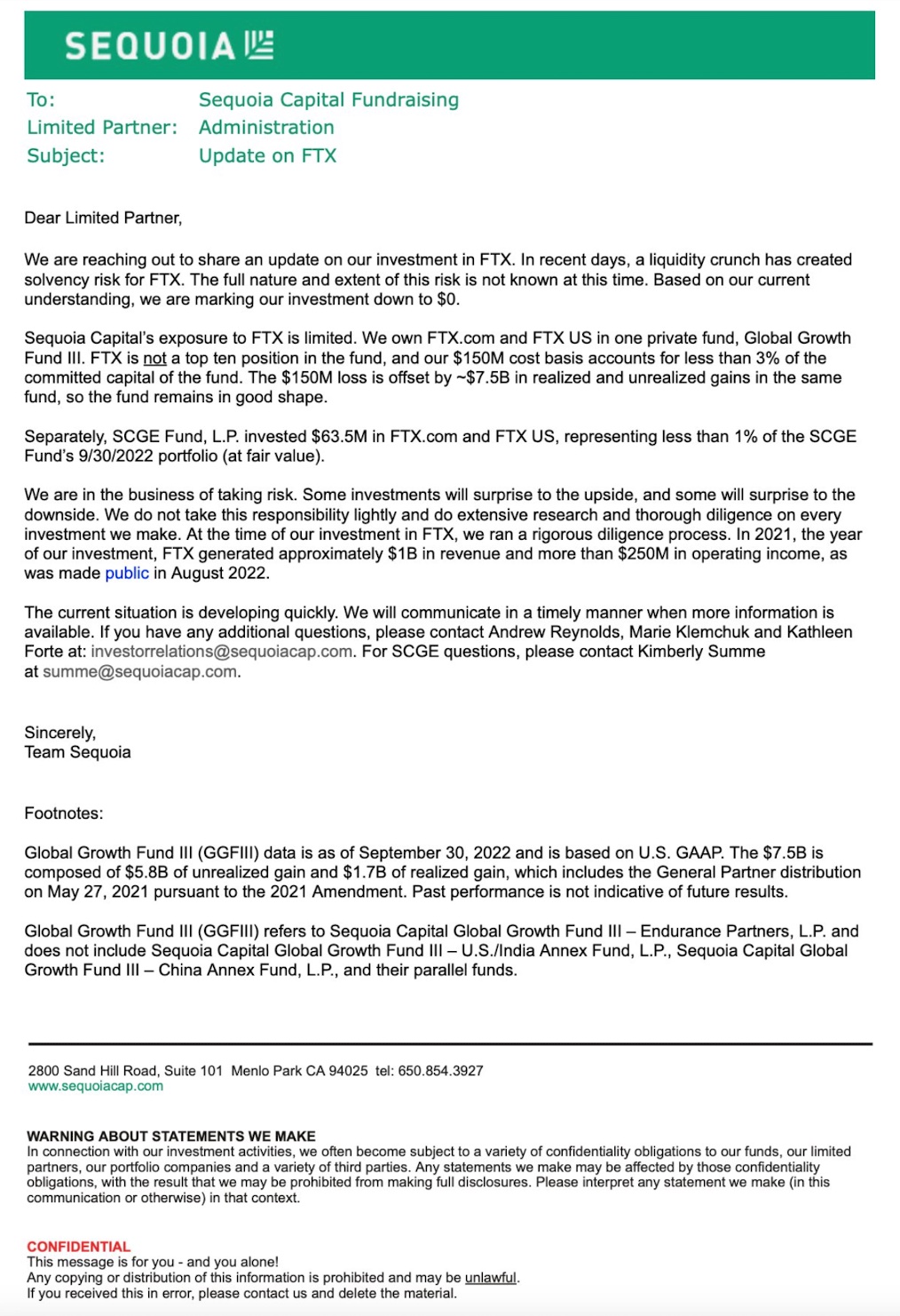

The Alaska Permanent Fund’s investments were through Sequoia Capital, headquartered in Menlo Park, Calif., and other venture capital firms. Sequoia sent a letter to its limited partners on Wednesday marking down the value of its investments in FTX to $0.

The Alaska Permanent Fund had committed as much as $200 million to Sequoia’s Global Growth Fund III, according to Pensions and Investments, an online blog. It was that fund that made the investment of up to $214 million of pooled money from various investors into FTX; thus, the Alaska Permanent Fund’s exposure was not the full amount.

Other institutional investors that had money tied up in FTX include the Ontario, Canada Teachers’ Pension Plan, and the Washington State Investment Board. The Ontario Teachers’ Pension Plan had $95 million invested in FTX Trading and FTX US, but reports that the loss will have a limited impact on the plan.

Sequoia Capital removed its glowing profile of FTX founder Sam Bankman-Fried from its website last week and replaced it with a markdown notice.

“A liquidity crunch has created solvency risk for FTX and its future is uncertain. Many have been affected by this unexpected turn of events. For Sequoia, our fiduciary responsibility is to our LPs. To that end, we shared this letter with them today regarding our investment in FTX. For FTX, we believe its fiduciary responsibility is first to its customers, and second to its shareholders. As such, FTX is exploring all opportunities to ensure its customers are able to recover their funds as quickly as possible.“

FTX users could be out as much as $8 billion in losses, after it appears that FTX CEO Sam Bankman-Fried used money from customer accounts to transfer to other accounts and fund risky investments. Those companies include FTX-owned Alameda Research, which owes FTX some $10 billion.

The loss on FTX is offset by the fund’s roughly $7.5 billion realized and unrealized gains, Sequoia said in its letter.

“We are in the business of taking risk. Some investments will surprise to the upside, and some will surprise to the downside. We do not take this responsibility lightly and do extensive research and thorough due diligence on every investment we make,” the letter explained, signed “Team Sequoia.”

“At the time of our investment in FTX, we ran a rigorous due diligence process,” the company said, although that is now in question, since it appears the CEO of FTX was running a Ponzi scheme to fund his political favorites in the Democrat Party.

Read: Meet young crypto billionaire who wants to change political fundraising

In 2018, the then-$81 billion Alaska Permanent Fund Corp. committed $200 million to Sequoia’s Global Growth Fund III, and the $161 billion Washington State Investment Board retirement system approved an allocation of up to $350 million, according to Pensions and Investments.

FTX founder and CEO Sam Bankman-Fried resigned Friday as CEO, and about 130 companies affiliated with FTX also began voluntary bankruptcy proceedings, according to FTX’s website.

Those companies that are also embroiled in the bankruptcy include:

1. Alameda Aus Pty Ltd

2. Alameda Global Services Ltd.

3. Alameda Research (Bahamas) Ltd

4. Alameda Research Holdings Inc.

5. Alameda Research KK

6. Alameda Research LLC

7. Alameda Research Ltd

8. Alameda Research Pte Ltd

9. Alameda Research Yankari Ltd

10. Alameda TR Ltd

11. Alameda TR Systems S. de R. L.

12. Allston Way Ltd

13. Altalix Ltd

14. Analisya Pte Ltd

15. Atlantis Technology Ltd.

21. Bancroft Way Ltd

28. Bitvo, Inc.

29. Blockfolio Holdings, Inc.

30. Blockfolio, Inc.

31. Blue Ridge Ltd

37. BTLS Limited Tanzania

38. Cardinal Ventures Ltd

39. Cedar Bay Ltd

40. Cedar Grove Technology Services, Ltd

41. Clifton Bay Investments LLC

42. Clifton Bay Investments Ltd

43. CM-Equity AG

44. Corner Stone Staffing

45. Cottonwood Grove Ltd

46. Cottonwood Technologies Ltd.

47. Crypto Bahamas LLC

48. DAAG Trading, DMCC

49. Deck Technologies Holdings LLC

50. Deck Technologies Inc.

51. Deep Creek Ltd

52. Digital Custody Inc.

53. Euclid Way Ltd

60. FTX (Gibraltar) Ltd

61. FTX Canada Inc

62. FTX Certificates GmbH

63. FTX Crypto Services Ltd.

64. FTX Digital Assets LLC

65. FTX Digital Holdings (Singapore) Pte Ltd

66. FTX EMEA Ltd.

67. FTX Equity Record Holdings Ltd

68. FTX Europe AG

69. FTX Exchange FZE

70. FTX Hong Kong Ltd

71. FTX Japan Holdings K.K.

72. FTX Japan K.K.

73. FTX Japan Services KK

74. FTX Lend Inc.

75. FTX Marketplace, Inc.

76. FTX Products (Singapore) Pte Ltd

77. FTX Property Holdings Ltd

78. FTX Services Solutions Ltd.

79. FTX Structured Products AG

80. FTX Switzerland GmbH

81. FTX Trading GmbH

82. FTX Trading Ltd

83. FTX TURKEY TEKNOLOJİ VE TİCARET ANONİM ŞİRKET

84. FTX US Derivatives LLC

85. FTX US Services, Inc.

86. FTX US Trading, Inc

87. FTX Vault Trust Company

88. FTX Ventures Ltd

89. FTX Ventures Partnership

90. FTX Zuma Ltd

91. GG Trading Terminal Ltd

92. Global Compass Dynamics Ltd.

93. Good Luck Games, LLC

94. Goodman Investments Ltd.

95. Hannam Group Inc

96. Hawaii Digital Assets Inc.

97. Hilltop Technology Services LLC

98. Hive Empire Trading Pty Ltd

99. Innovatia Ltd

100. Island Bay Ventures Inc

101. K-DNA Financial Services Ltd

102. Killarney Lake Investments Ltd

103. Ledger Holdings Inc.

104. LedgerPrime Bitcoin Yield Enhancement Fund, LLC

105. LedgerPrime Bitcoin Yield Enhancement Master Fund LP

106. LedgerPrime Digital Asset Opportunities Fund, LLC

107. LedgerPrime Digital Asset Opportunities Master Fund LP

108. Ledger Prime LLC

109. LedgerPrime Ventures, LP

110. Liquid Financial USA Inc.

111. LiquidEX LLC

112. Liquid Securities Singapore Pte Ltd

113. LT Baskets Ltd.

114. Maclaurin Investments Ltd.

115. Mangrove Cay Ltd

116. North Dimension Inc

117. North Dimension Ltd

118. North Wireless Dimension Inc

119. Paper Bird Inc

120. Pioneer Street Inc.

121. Quoine India Pte Ltd

122. Quoine Pte Ltd

123. Quoine Vietnam Co. Ltd

124. SNG INVESTMENTS YATIRIM VE DANIŞMANLIK ANONİM ŞİRKETİ

125. Strategy Ark Collective Ltd.

126. Technology Services Bahamas Limited

127. Tigetwit Ltd

129. Verdant Canyon Capital LLC

130. West Innovative Barista Ltd.

131. West Realm Shires Financial Services Inc.

132. West Realm Shires Services Inc.

133. Western Concord Enterprises Ltd.

134. Zubr Exchange Ltd

In July, Sam Bankman-Fried said he and FTX had a “few billion” on hand to shore up struggling crypto firms to prevent the collapse of the digital currency industry, and at the time he said the worst of the sector’s liquidity problem had likely passed.

Bankman-Fried, who lives in the Bahamas, and FTX, which is a company registered in the Bahamas, are now being investigated by as many as five U.S. regulatory entities, including the Securities and Exchange Commission, the Department of Justice, the Commodity Futures Trading Commission, the Texas State Securities Board, and California’s Department of Financial Protection and Innovation, according to decrypt.co.

Never invest in something you can’t easily explain.

But at least the legislature has a built in reason to deny the PFD this year.

Lol. The excuse will be:

“Sorry we invested your PFD money in the Democratic Party, a great investment seeing how well the Dems are doing in Alaska!”

You know what’s easy to explain? Physical gold and silver that the permanent fund could have bought and vaulted in Alaska… $200 million completely wasted. We can’t even burn the receipts for heat.

They already have a built-in reason: The people voted against a Constitutional Convention to ensure the PFD.

I don’t think that the Alaska Legislature needs any excuses to suck dollars away from residents, including 1 year old kids to fund a bloated government. They know who elects them.

Interesting that the guy running this scam, gave millions to Democrat politicians, second only to Soros.

Are Kanye, Kyrie Irving, D. Chapelle & Illan Omar on to something?

Follow the money.

PONZI scheme funneling $$$ to the Democrats, including our own. Who’d a thunk it? Just say’in. Why was Rodell fired? Just askin’. Snort!

I have great difficulty in finding that an investment in cryptocurrency complies with the “prudent investor” rule. Those at the Permanent Fund that were involved in this decision should resign or be fired. Time for some accountability. If we can’t fire these snakes, let’s at least publish their names.

Additionally and more specifically, the Permanent Fund needs to terminate the relationship with Sequoia Capital. If this is the quality of the advice and services they provide, Alaskans deserve much better. Bad judgment must not be rewarded.

Don’t forget that Ukraine allegedly took at least tens of millions of US war funding and deposited it directly into FTX. Some of that money made its way to Democrat reelection campaigns.

Last count $40 million was funneled to democrat candidates..

Dig deeper. I’m appalled that the permanent fund has or had any investments in crypto currency. Guess I/we need to pay more attention to how our “stake” is invested and who is pissing it away.

All of these financial gurus that insist cryptocurrency is the wave of the future should take note. Also see the corruption that can result when there are no real controls. The other article connected with this is highly illuminating. Bet there is no investigation on this, either, because the democrats are going to be in control of the senate. Ain’t democracy amazing?

We pay people hundreds of thousands a year to manage our investments and they invest in something that nobody with an IQ over room temperature would invest in.

When in doubt call BDO. Forensic accounting.

What account was used for investment is the ?

BDO – great firm. My experience. Worth the expense to hire them!

AMEN! Comment of the day in my humble opinion! My late aunt lost her life’s savings during the savings and loan debacle many years ago. Fast forward to 2022, and the investment schemes are much more sophisticated. Crypto – no thanks! My conservative financial advisor agrees.

Sequoia Growth is a venture capital fund. What percentage of investments FTX represented tells you something. A well balanced portfolio has a small percentage of high risk exposure. Tesla was a venture capital high risk company. The Dell Computer millionaire club and the original staff of Apple including the janitor made millions. It is called capitalism. Risk Reward. More was lost trying to build Government Hill bridge to MatSu, the Natural Gas Pipeline, Pebble Mine, Fish Proceeding Plant, and the list goes on. The Native Claims Settlement Act was and is Alaska jackpot. It opened oil development in the North Slope.

I never truly knew there were that many stupid people in the world. People like Curry, Tom Brady even the youngling Trevor Lawrence invested in it but they always have had more money than since. Brady now has lost two beautiful wives and two families by choosing football over relationships. How dumb is that? So don’t invest into something just because everybody else is doing it. With Twitter and Facebook going away, kind of makes sense to invest in more substantial things instead of the risk takers.

Crypto is, of course, easily understood. It’s exactly the same thing as going to Vegas.

FTX was a liberal money laundering machine.

They sent billions to the Ukraine, and the Ukraine turned around and invested in FTX. FTX then donated huge sums of money to liberal election campaigns.

Heck, the CEO’s mom is a huge liberal money bundler.

In fact, FTX is only number two in donations, right behind George Soros, to liberal election campaigns.

This is great reporting! Where else can we depend upon seeing facts that are so important to every Alaskan?

But I am compelled by this story to make a comment on a tangential issue. In the upcoming Legislature, beginning in about two months, there will be a strong push from public employee unions to revert the public employee retirement plans, PERS and TRS, to defined benefit. Public employees hired on and after July 1, 2006, are enrolled in a 401k type of retirement plan rather than a defined benefit plan. The beneficiaries make their own investment decisions now; the employers have no unfunded liability. When the Permanent Fund employees make an investment like the one described in this story all Alaskans lose, but it does not accumulate a liability that must be met. With a defined benefit retirement plan an investment like this one creates a constitutionally guarantied debt to employees and their dependents, and that is why every Alaska has a stake in making sure the state and the municipalities do not revert to defined benefit.

So that 5 billion shoved into the Corpus went to an unvetted political hack group who bought us more democracy or more midterm mayhem.

Crypto was the rage on the Dark Web to do all kinds of trading in drugs, weapons, you name it. Governments have caught on, everything on the internet can be traced, it is only a matter of will and applying available technology. The bloom is off of the crypto rose. The $ is still king and will be unless China gains dominance with the yuan.

Meanwhile. Did you know? Nuclear weapons have “core codes” and they were established in case of nations crying over spilt milk. In the WWII era? Yeah that’s old they are. Anyways. No matter what newbie upgrades they did or do, it can be cancelled and the codes overide new systems.

Gorillaz – Clint Eastwood. Think of it like Grumpy old men on steroids. International. Since WWII.

I have no idea what you are trying to say. Can someone translate, please?

Sounds like the Dogs of War still run things. Thank God for small favors. It means that humanity will survive. That’s the translation.

It’s rumored that NATO persuaded Poland to blame Ukraine so the war dogs would back down.

Great reporting Suzanne.

Charlie Munger is a well respected man who has worked with Warren Buffet for decades. Here’s what Munger said about Bitcoin/crypto:

“in my life, I try to avoid things that are stupid and evil and make me look bad … and bitcoin does all three.” “In the first place, it’s stupid because it’s still likely to go to zero,”…

Where are the guardrails at the APFC that keep our money away from ponzi schemes?

If we should get one, let’s not complain about the amount…this year.

Now do Blackrock.

Teacher’s Unions invested in it. That explains a lot, have to raise taxes to pay for the losses.

Why? What wokeism investment is this. Is this the same people that said LNG would never be of demand enough to support a pipeline?

Brandon, Ukraine, Pelosi, Democrat party and close ties to FTX, collapse by design.

Reading the small print, it looks like Sequoia’s exposure was very small and their fund actually made money off of its investment in FTX in 2021. A very small amount of the Permanent Fund’s $200 million stake in Sequoia was likely lost.

As I read Suzanne’s account, the extent if the PF’s investment in Sequoia is not clear. My point, made above, is that no investment in crypto would comply with the prudent investor rule and Alaskans need to be clear about that. Million here; million there; pretty soon we are talking about real money.

Now we can add no faith in Perm Fund management to our ongoing list of failing governmental bodies.

Yet the voters wanted more.

No surprise. The Ukraine has long been a center for money laundering with deep ties to self selected elites and political parties.

You are 100% right.

Do you remember 6 weeks ago the PM of Poland blamed the US and Ukraine for blowing up the Nordstrem also the PM of Norway made similar accusations.

I highly doubt Russia would fire on Poland. I smell a rat. Mostly our rotten media. Misinformation spreader.

A suggestion: at least a part of the PFD could be used revamp the North Pole Refinery to produce diesel, gasoline, and jet fuel. It is currently closed as it doesn’t meet EPA standards. Then we Alaskans would have a value-added product, vs shipping our crude to the lower 48 to be refined only to have it shipped back here at high prices. We would then be energy self-sufficient and therefore more secure. If we have excess, we can sell it for a much higher price than our crude, using any profits to pay for the cost of the refinery.

If you like this idea, let your legislators and the governor know!

I absolutely agree with you. The North Pole refinery can be renovated and brought into compliance with current regs to start producing locally and in doing so the carbon footprint of the production of usable fuel will shrink. The greenies don’t seem to see the entire picture. The carbon footprint associated with shipping our crude to the lower 48, refining it and shipping it back up here is exponentially larger than if we refine locally. Aside from the environmental impacts, the cost of fuel could go down because we’re no longer paying to ship down, refine and ship back. The current state of affairs is utter insanity.

Just curious, exactly how much of that stake did get invested in FTX? According to the source cited by MRAK:

“Late Wednesday, Sequoia, a lead investor in FTX, sent a letter to its limited partners saying it was going to mark down the value of its FTX investment to $0. Sequoia owned FTX and FTX.com in its Global Growth Fund III, although FTX is not one of the top 10 holdings in the fund, and its $150 million in cost basis represented less than 3% of the committed capital of the fund, according to the letter.”

If that is true, I’d be sort of surprised if the Permanant Fund had a million-dollar exposure.

$214 million from what I can see

The permanent fund should not have any exposure to this sort of investment. We need to know how much is invested in other risky schemes. The investment in a PONZI crypto scheme, as revealed, is a sign that the management of the Permanent Fund is not doing its job for the people of Alaska.

I think a certain amount of risk is tolerable. After remember the old adage, no pain no gain.

Let’s crowd source some money and put the ADN out of its misery

Frankly, this is shocking. What kind of idiot would invest billions of dollars of other people’s money in any type of a crypto investment. The risk in crypto is way to high for the kind of investing the state should be doing. Alaska gets dumber by the minute.

This is criminal malfeasance. The alternative explanation is we have people investing OUR money without looking at a balance sheet or any other information regarding the investment. This isn’t about crypto, this is about making investments without due diligence.

Comments are closed.