PART 1: A CASE FOR NATIONAL SECURITY

By SANDY SZWARC / FOR MUST READ ALASKA

Pebble Mine is just weeks away from clearing the last hurdle to a federal permit − after nearly two decades of scientific, engineering and environmental studies, and wading through the permitting process.

It reached this point despite well-organized and massively-funded opposition from Outside special interests that have done everything in their power to block the permit. Across the country, many believe that those behind the opposition are grassroots environmentalists, unbiased experts, local fishermen, and Native American Indians.

But virtually none of them are who they appear to be. Attempting to mislead the public with huge media campaigns repeating the same scary sounding claims and misinformation, and efforts to stop the mine permit with an army of lawyers, their goals have nothing to do with the mine itself or saving the environment.

The Pebble Mine project, proposed decades ago, is located in the remote tundra around the Iliamna region of southwest Alaska. The land is flat and barren and there’s not a single tree in 20 square miles. James M. Taylor, wrote a graphic description of the location when he was invited to visit the proposed mine site while managing editor of Environment & Climate News.

Most closely impacted by the proposed mine are the indigenous villages of Iliamna, Newhalen, and Nondalton in the Lake and Peninsula Borough, followed by the Bristol Bay Borough. This area is home to about 2,500 people, whose voices, drowned out by outsiders, have seldom been heard by the general public.

A small mine with extraordinary consequences, the Pebble Mine story is the people’s story. In this series, we’ll search for the real story, not the ones others may want us to believe.

AN ISSUE FOR ALL AMERICANS

Understanding Pebble Mine is critically important for each and every American. Why? One very big reason is our national security and independence from foreign suppliers.

- Pebble Mine is one of the largest undeveloped reserves of copper, molybdenum and gold in the world, according to the Alaska Department of Natural Resources, Division of Geological & Geophysical Surveys. Pebble’s mineral deposits also include silver and other critical metallic minerals such as pyrite, chalcopyrite, molybdenite, bornite, covellite, chalcocite, digenite and magnetite.

- Pebble’s copper production is expected to average 318 million pounds a year. Its deposits could supply as much as 25% of our country’s entire copper needs over the next century, said Ned Mamula, a geologist and former mineral resource specialist with the U.S. Geological Survey. It’s also expected to produce 14 million pounds of molybdenum, 362,000 ounces of gold, and 1.8 million ounces of silver per year.

- Pebble holds billions of pounds of rare earth elements. Pebble is rich in two strategically important and rare minerals, palladium, and rhenium. Pebble holds enough to supply the entire world’s needs for rhenium for nearly half a century

Today, the United States is 100% dependent on foreign countries for 20 critical and strategic necessary minerals, including rare earth elements. Our country relies 50% to 99% on foreign imports for another 30 key minerals. Our reliance on foreign mineral imports has increased 250% in the past 60 years, according to USGS National Minerals Information Center.

In fact, at no other time in U.S. history for over half a century has our country been so dependent on foreign imports to meet its domestic needs, according to a R Street Policy Study.

Yet, no country on earth has a greater abundance of critical and rare earth elements than the U.S. The estimated $6 trillion in undeveloped mineral resources could add up to $100 billion a year to our GDP, if our country supported responsible mining, according to the National Mineral Association.

America once recognized that mineral wealth is a major driver of economic growth, military effectiveness, and healthy trade balance. For the first 150 years of our nation’s history, the U.S. was self-sufficient in mineral needs and even had a surplus until the late 1920s.

The sharp rise in dependency on foreign suppliers is directly traced to a permitting process that hinders mining development, organized environmental opposition with litigation delays and burdensome regulations, and environmental movements that have closed vast areas of the West to any development, Mamula said. The permitting process is partly responsible for putting our country at risk.

America’s natural resources development policies have abandoned the conservationist ethic, “which balances environmental protection and unwise, careless resource exploitation, preserving the usefulness and productivity of our natural resources over the long term for the benefit” of the country and people, explained the R Street Policy Study. Instead, it’s adopted a “no use at all” stance.

By 2011, the federal Bureau of Land Management already controlled the natural resources on one third of the country’s entire landmass, putting much of it off limits to any development.

By 1994, mining experts had already alerted Congress that 62% of all public land had been made unavailable to exploration and mining development, and that the federal government owned nearly 60% of all land with known metallic mineral deposits − nearly all of it in the western states and Alaska. The situation is far worse today.

“America has rarely been in such a vulnerable position,” Mamula said. Our heavy reliance on foreign imports for minerals vital to everything our country needs and uses every day, including for military defense systems, is finally being recognized as a national vulnerability.

A 2017 Presidential Executive Order called for increased development and streamlined permitting in a safe and environmentally responsible manner. This wasn’t just a feel-good, political move. This is a much bigger issue.

Copper. Over a third of the copper we need is imported. The U.S. now imports over $37.6 billion a month in copper from China, according to Trade Economics. Only 6% of the world’s copper is produced in the U.S. as of 2018, according to the latest World Mining Data, and the U.S. lags behind at sixth in the world’s production.

Copper is essential for almost everything we use in modern life: electrical wiring, cables, electronic devices, motors, telecommunications, microwaves, batteries, and electric vehicles. The average single-family home in North America alone uses over 439 pounds of copper.

With mandated initiatives for a green renewable energy future, the need for copper will skyrocket because four to six times more copper is needed in the generation of green energy than in fossil fuel counterparts. Solar panels use 5.5 tons of copper per MW, a single 3 MW wind turbine uses about 4.7 tons of copper, a hybrid car needs nearly 90 pounds, and an electric bus can require up to 812 pounds of copper.

Molybdenum. China has the largest reserves of molybdenum in the world. Most of the world’s molybdenum comes from China − 98,420 metric tons (MT) in 2018 − 36% of the entire world’s production, according to World Mining Data 2020. The U.S. produces only 15% of the world’s supply, by comparison.

Molybdenum is essential in steel, cast iron and superalloys for hardening, strength, durability, temperature stability, and corrosion resistance. Industrial technologies need it for materials under high stress and in highly corrosive environments, as well as chemical applications including catalysts, lubricants, and pigments, according to the USGS. Its properties also make it needed for a range of electrical and semiconductor applications, as well as medical and agricultural fertilizer uses.

Rhenium and palladium. The U.S. imports 82% of the rhenium and 32% of the palladium our country needs each year.

Rhenium is used in jet engines, military applications, and in the production of high octane fuels. Palladium is an exceedingly rare metal and one of the six platinum group of metals known as super catalysts essential in catalytic converters enabling vehicles to meet modern emissions standards. It’s also used in hydrogen storage, electronics, dentistry, medical instruments, groundwater treatments, and carbon monoxide detectors.

Rare earth elements. According to USGS, rare earth elements (metals) are essential for more than 200 products, especially in high tech industries, computer technologies, monitors, electronics, communications, medical uses, renewable energy systems, significant defense applications, radar and sonar systems, satellites, guidance systems, and lasers. Like copper, renewable green energies couldn’t exist without rare earth elements. A single 3 MW wind turbine, for example, uses two tons of rare earth elements, according to Northwest Mining Association. Needs for rare earth elements are expected to increase as much as 2600% over the next 25 years, as renewable energy initiatives grow.

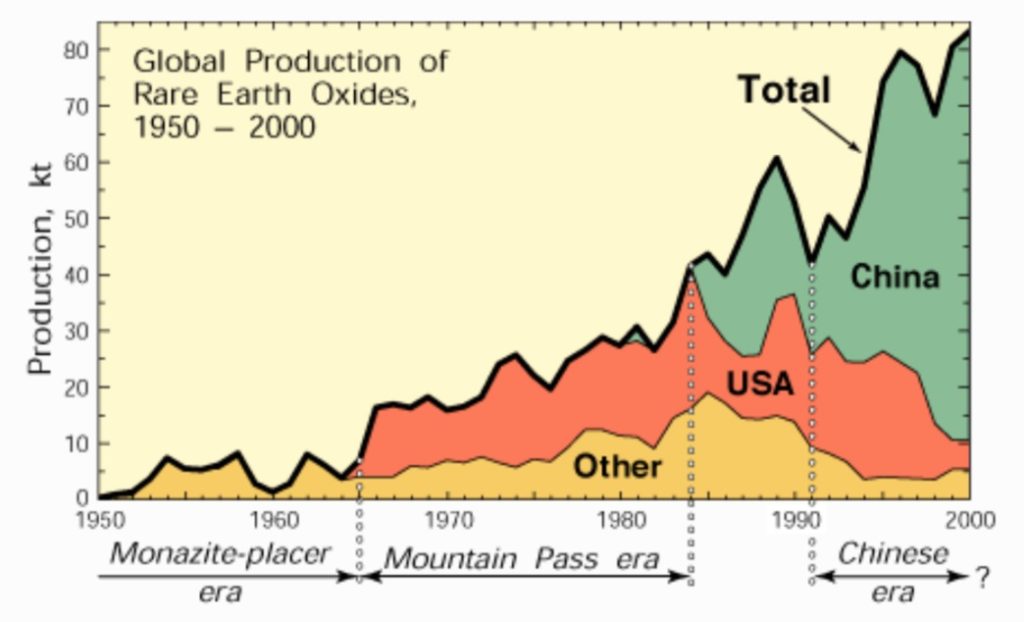

Until the 1980s, the U.S. was self-sufficient in rare earth elements and was even the global leader in production from the 1960s to 1980s. But since the late 1990s, China has dominated, supplying about 95% of the global market by 2014, according to the USGS. It also controls more than 85% of rare earth’s costly and time consuming processing. China was first in the world in rare element production, at 120,000 MT in 2018, according to the latest statistics from World Mining Data.

This didn’t happen by accident.

Chinese Communist officials actively set out to achieve world dominance in mineral mining − buying mines and equity in mines and forging agreements to take over mining companies.

The South China Morning Post reported last year that China is “ready to use its dominance in the industry as a weapon in the country’s year-long trade war with their customers in the United States.”

A July 2020 Power The Future report revealed that environmental activists are knowingly fueling Communist China’s dominance and threat to U.S. national security.

By opposing U.S. mine development, while pushing for a complete renewable future, they are helping ensure U.S. dependence on Communist China. “Going green” means dependency on Communist China.

To corner the rare earth market and to advance its own technologies, China has also aggressively used the stringent regulations in the U.S. that environmental groups have successfully driven. Its hegemony over rare earth elements was used to tighten exports, forcing U.S. manufacturing companies to move to China, where they are required to partner with Chinese companies, all for purposes of intellectual property theft, according to the Center for Strategic and International studies.

IP theft has cost the U.S. an estimated $180-$540 billion in losses a year, according to the National Bureau of Asian Research. “This technique has allowed China to skip generations of technology development” to advance its economic competitiveness over the U.S., said a 2108 ALG Research Foundation report.

But China’s strategy toward its goal of global supremacy has a much more ominous significance. China is waging an unconventional war against the U.S. for military power.

“The Communist regime has employed a total warfare strategy the likes of which the U.S. has never seen before,” wrote ALG’s author, Printus LeBlanc. Unfortunately, only a few politicians and policy makers are “starting to realize the danger China poses and the staggering breadth of the Chinese assault.”

“The U.S. was so unprepared for the type of warfare waged by China, it actually helped it achieve its current status,” LeBlanc reported. U.S. Army Special Operations Command described Communist China leadership’s planned offensive using: economics and trade warfare, cultural infiltration, technological warfare, resource warfare, diplomatic mediation, drug warfare, international rules and UN resolutions, and media propaganda.

Cultural warfare proved easy. American universities opened Chinese cultural institutes, fertile teaching grounds to groom academics and students and provide a voice for Chinese propaganda and global socialism. But China is especially adept at applying Russian-style strategies to manipulate U.S. and international law for its goals.

An especially insightful understanding of how China works to spread its influence and covertly gain an edge was written in the New York Times by Yi-Zheng Lian, former chief editor of the Hong Kong Economic Journal. “China manipulates, preferring to act in moral and legal gray areas,” he wrote.

“It masks its political motives behind laudable human-interest or cultural projects, blurring the battle line with its adversaries. When the job is done, the other side may not realize it was gamed, or that a strategic game was even going on.” – Yi-Zheng Lian

One of its key allies in its goal of global mining dominance is the Natural Resources Defense Council (NRDC).

It is no coincidence that NRDC is also the leader of opposition against Pebble and a central organizer and funder in every anti-Pebble coalition. Its unusually close relationships, access and influence with the Chinese Communist government had raised concerns that NRDC’s political activities in the U.S. had been influenced to the detriment of our national interests. Its activities led to a 2018 Congressional investigation by the House Committee on Natural Resources.

Communist China State-owned mining corporations have been noticeably active this year in acquiring and commissioning gold, copper and molybdenum mines, expanding its global production. A few examples:

- In January, China Nonferrous Metal Mining Company opened the Deziwa Mine, a copper and cobalt mine in the Congo with an estimated copper reserve of 4.6 million tons.

- In June, China’s Zijin Mining rushed to commission the largest copper mine in China, the Quolong copper mine, opening next year. The open pit mine is expected to produce 165,000 MT of copper and 6,200 MT of molybdenum a year.

- Zijin Mining is reportedly expecting to complete its Kamoa-Kakula copper mine in the Congo next year with an estimated annual copper production of 382,000 MT over the first ten years, with a planned increase in twelve years to 740,000 MT. Just the Quolong and Kamoa-Kakula copper mine acquisitions will initially increase China’s entire global production by 4%.

- Zijin Mining already has significant mining investment projects in 14 provinces and 11 countries and is also in the process of permitting the Rongmucola and Zhibula copper mines. By 2022, Zijin Mining’s copper mine output is expected to reach 670,000-740,000 MT a year, making the top ten across the globe.

- Last month, Zijin Mining completed the takeover purchase of Canadian-owned Guyana Goldfield, with an all-cash offer. It fell just below Canada’s review threshold level under new toughened takeover rules introduced by the Canadian government in April. Guyana Goldfields have estimated gold reserves of 2.24 million ounces. In March, Zijin Mning completed its purchase of Canadian-owned Continental Gold, which owns the Buritica gold project in Columbia, expected to produce 250,000 ounces of gold every year for the next fourteen years.

- Shandong Gold Mining Co Ltd, the largest of China’s State-owned gold mining companies with gold mines around the world, bought Canadian TMAC Resources in May. TMAC operates Hope Bay gold project in Canada with a 2,000 MT/day capacity plant, along with Doris Mine going into production this year. Shandong’s takeover offer for Australia’s Cardinal Resources, beating out a Russian contender, was accepted last Wednesday. Cardinal owns projects in Ghana and West Africa. Its Namdini project, for example, goes into production in 2023, producing an average of 280,000 ounces of gold a year.

China is clearly working to secure its global mineral standing. It’s little wonder globalist supporters would not want Pebble mine permitted, given its renowned reserves could help the U.S. break from its dependency on China.

National security experts in Canada and the U.S. have been concerned over Communist China’s dominance on supplies of minerals that are so absolutely critical to our free Nations.

Richard Fadden, former Canadian Security Intelligence Service director, reported of growing worries within Canada’s national security agencies about China’s concerted investing in Canadian mines, all carefully done so to be just under regulatory thresholds.

“Chinese seemed to be very knowledgeable about regulatory thresholds,” he said. China could instantly consolidate its interest into a takeover and “there would not be very much anyone could do about it,” he said.

“Canada should assume every Chinese State-owned investment in Canada is in part a strategic purchase for Beijing,” said military, security and strategic expert Rob Huebert. “It’s all part and parcel of the Silk Road initiative, which is ultimately the Chinese effort to become a global power,” he said.

The U.S. and Canada also recently worked toward a joint strategy to rebalance global metal supply chains to reduce all of North America’s reliance on China. It has especially “moved aggressively to control rare earth minerals that are critical to high tech and military products,” Fadden said.

With growing concerns that China may again limit critically needed mineral exports, the White House issued a memorandum to the U.S. Secretary of Defense in July, noting that domestic production is essential for national defense.

Pebble’s mineral reserves are among the largest known in world and will be crucial not just for our national defense, manufacturing and agriculture, standard of living, and energy technology success, but will keep all of North America in a healthier trade balance and all of us safer.

Given its critical importance, why has Pebble mine not been permitted after two decades?

It’s a long story, but to understand how we got into this regulatory mess, it’s an important human story to read.

EARLY YEARS

The Pebble Mine story began with the first discovery of the mineral deposit in 1988 by Comico Alaska. It was later acquired by Northern Dynasty Minerals Ltd in 2001.

Over the next six years, the company did extensive environmental data collection, and geotechnical and engineering studies. The project was then placed under the Pebble Limited Partnership in 2007, which continued resource development exploration and studies.

The first CEO of the Pebble Partnership, John Shively, first came to Alaska in the 1960s as a VISTA volunteer. He worked with Native villages on land rights and health issues, before working with the Rural Alaskan Community Action Program and the Alaska Federation of Natives, which awarded him the Denali Award for his contributions to the native community in 1992.

Shively later held various government positions, including commissioner of the Department of Natural Resources. He got his start in mining with the Native-owned NANA Regional Corp and helped it develop the Red Dog Mine, the world’s top zinc producer, northwestern Alaska.

Red Dog Mine exemplifies successful mining on Native lands, founded on principles of consensus, cooperation and mutual respect between the native people and mine operators, according to NANA.

Rural residents have benefited with well paying jobs and valuable skills training, while the mine has excelled in environmental excellence. The villagers and mine representatives work together to prioritize subsistence and environmental protection, through the Red Dog Mine Subsistence Committee.

Rose Dunleavy, Alaska’s First Lady, wrote of her father who was the first chairman of the NANA Board of Directors. He helped lead NANA for 17 years and was the former mayor of her home village of Noorvik.

As she wrote, the Native people of Alaska “share the value of education and the value of hard work….We all know the dignity and the self respect that jobs provide.”

Her father “committed the mission of NANA to provide economic opportunities for the more than 14,300 Inupiat shareholders and to protect and enhance NANA lands,” she said.

“We and other Native peoples throughout Alaska have taken our traditional values and used them to develop successful businesses throughout this great State and to partner with others….while preserving and protecting our lands and our traditional way of life.” – Rose Dunleavy

During the early exploration and study phase of the Pebble Mine project, Pebble Partnership likewise reached out to the local villages, businesses, tribal elders, and others.

By 2013, it had held hundreds of meetings in the communities to provide open forums and foster public input in the planning of the mine project and identify concerns, such as protecting fisheries and subsistence resources. “Our work with the Elders of the region remains among the high points of my time with Pebble,” wrote Shively.

They met with everyone, including those who opposed the project. “We progressed from an initial meeting full of fear and suspicion to later meetings full of constructive conversations,” he said.

“My interest in Pebble is what we can do for people who live in the region…I knew the importance of jobs for rural residences and the economic benefits the project could bring to the area from my time with NANA working on the Red Dog Mine,” said Shively. “I have seen the science and knew we could develop a mine that would not harm the fishery.”

Long before the permitting process began, Pebble Partnership had spent more than $750 million by 2015 in exploratory and environmental studies, and as the significance of the mine grew increasingly stronger, it focused towards a responsible mine development plan.

While the project is portrayed by outside interests as lacking objective scientific analysis or public input, that certainly isn’t the case. The Pebble Environmental Baseline Document analyzed the physical, biological and social environments of potentially impacted mine areas within the Bristol Bay and Cook Inlet regions, including hydrology, fish, wildlife, seismic and wetland examinations, using data compiled from 2004 and 2008.

It was written by third-party independent authors, more than 40 of the most widely recognized and respected independent research firms, and included over 100 scientific experts, engineering groups, laboratories and others with specific areas of expertise and Alaskan experience. This “scoping” document is approximately 20,000 pages, with 53 chapters plus appendices, and updates.

It is one of the most comprehensive environmental studies ever done for a natural resource project in Alaska.

Yet, how many Americans – including those eagerly weighing in on Pebble − have even heard about it, let alone read it?

Tomorrow, we’ll reveal the facts the opposition doesn’t want you to know. We’ll also look at how the permitting process was corrupted and federal environmental acts are attempting to overtake Alaska’s Statehood rights.

Sandy Szwarc, BSN, RN is a researcher and writer on health and science issues for more than 30 years, published in national and regional publications and public policy institutes. Her work focuses on the scientific process and critical investigations of research and evidence, as well as the belief that people deserve the most credible information available, and that public policies should be based on sound science and reasoned risk-benefit analyses, not politics, junk science, greed or fear.

(Pebble Partnership did not contribute to or have any role in this series.)

Thank you Suzanne for posting this.

For years and years, the ignorance driving the hysteria about the anti Pebble Project movement, has been nothing short of astounding.

I’ve always believed that the people who are so anti Pebble, should prove their commitment to their beliefs by getting rid of their cell phones and computers and other devices that cannot be manufactured without rare earth metals.

But they won’t, because they are rabidly hypocritical, and either knowingly or unknowingly…..supporting the Communist Party of China, and its global takeover of control of precious metals.

The multi-national anti-development NGOs are less our friends than the multi-nationals who seek to extract commodities from Alaska for the lowest possible cost.

The history of Pebble is even before its discovery, it begins with the State of Alaska’s land selection process and the people responsible for selection of state of Alaska mineral lands from the federal land base. Tell that story and you will have the rest of the story. The State of Alaska has been fortunate in its land selections over the years for revenue generation starting with Tom Marshall’s selection of the Prudhoe region on the North Slope. This process was critical in building a resource base for the state. The state’s mineral lands feed the permanent fund with dollars. We should thank those that have made it possible.

The other side to that is that federal lands selections have intentionally been done to lock up resources. And if that was not possible, to block access to resource development on state lands. Cheers –

Great read and looking forward to part two.

As my only hobby that doesn’t cost me money, I scrounging dumps. Among the many treasures is copper and brass.

I’ve recycled lots and have made friends with a man in Oregon that works for a huge recycler. Which leads me to the question of why America is so stupid?

Why do we spend the time collecting and recycling to ship everything back to China or some other hell hole of a country to be smelted and owned by the enemy?

I’m hoping this Lady adds in part three to her series on the amount of weight we ship out for recycle.

Congratulations on a great article.

Absolutely amazing report so far, and can’t wait to read the next two parts. I wish this got more media coverage to help the rest of America realize what’s really going on.

Excellent article. I don’t share the politics, but do respect the science. I’m neither conservative nor American. I’m a Canadian in Tokyo (for 30 years), and do the political economy of energy. If you do energy in Japan, you can’t help but notice its extreme import dependence on conventional fuels. And if you research alternatives, you run into extreme dependence on critical raw materials. Those materials have to come from somewhere. But the 100% renewable idealists don’t want mining in their own countries. They’d rather further despoil the Congo and other areas with poor governance and already visible damage to human rights and health. A recent rant sent to the European Commission about its plans to bolster material security shows that the rich-world myopia is generalized:

undisciplinedenvironments.org/2020/09/19/open-letter-to-european-commission-from-civil-society-organizations-on-critical-raw-materials-plans/

Thank you so much for writing this series! I look forward to the next two and I have shared on all social media, as I believe this is one of the biggest issues facing our country’s economic future. I truly hope people read it and start understanding what is at stake with the Pebble mine approval process. If it gets denied, our country has far more problems than we can imagine.

Very good read…

Fantastic article Suzanne, once again, love how you keep the facts out there without bowing to the Engo’s and politically correct mantra. Keep it up please, you are true Gem!

More BS from the pro pebble faction that denigrates those native-born Alaskans who have lived and worked in Alaska most of their lives, own homes here and whose elders are buried here. I am not an outside and do not receive a check from out of state sources. I oppose the Pebble mine and for darn good reasons you can call “ unscientific” all day long but to me they are just plain common sense.

For example, why do our natural resources have to go to a foreign owned company with an unproven safety record especially in a new venture of a type never constructed before. Why risk a renewable natural resource for a non renewable one when it is entirely possible that the salmon industry and all it entails could be adversely affected by a disastrous failure of the mine thereby leaking extremely harmful containment’s into the pristine streams and waters. C’mon Suzanne, pull your head out of the sand. Do you prefer to slight, offend and ignore the “local born Alaskans” in form oppposition to the mine?

Very biases reporting if you chose to do so.

I also challenge you to “ fess” up and tell us what’s behind your support of this project, any finances,support, kickbacks coming your way? A local native born conservative Republican and home owner residing in Anchorage.Alaska, John H Slone.

John, I appreciate your comments. I reviewed the author’s work and credentials and offered to compensate her for what I feel is a good representation of a side not often seen. Pebble Project had no oversight or prior review of this series and only has seen it at the same time the general public has seen it. The compensation comes out of my own pocket in fairness for the effort she put into the reporting, which is extensive. – sd

Very well done Suzanne! Balanced reporting is an honorable trait and you have shown time and time again that you are a class act! Keep up the good work and keep telling the truth whatever the truth may be!

Scott

The resources DO NOT go to a foreign owned company. Rather, they are sold to the highest bidder, whomever has contracts with the mining company.

Disastrous leaking? Of what? Acids, dissolved metals and ground up mountains? You need to review the geology of the region, particularly the Alaska Peninsula volcanoes upwind. Did you know that Chiginagak dumped its crater lake at downstream into the Bristol Bay watershed (King Salmon river) at least twice in the last 70 years? Lots of acids and dissolved metals. Killed a lot of salmon upstream. Downstream did a lot better. Your logic and the logic of the anti-Pebble crowd tells us all that such a dump from a mine will kill all salmon in the region for all time, something demonstrably false. As to the ground up mountains, the Kenai River carries a lot of them and the salmon seem to do just fine.

Alaska doesn’t have large scale mining corporations for the same reason we don’t have large scale oil and natural gas producers – we simply don’t have that sort of large, world class expertise and most importantly resources in the state. Would you prohibit all mining, oil or natural gas resource development until that sort of expertise and resources are built in state? That is both unreasonable and foolish, though it is a nifty way to make sure none of it happens. Pretty creative anti-development position, that. Cheers –

John,

In your comment you appeal to emotion and ‘common sense”. However you go on to try and discuss reasons it wont work. ACOE did the science and they do their science so that it can win in a court of law (regardless of who litigates an ACOE – either Pebble Partnership or the NRDC – either side, in court, will be up against the science, not the emotional ‘common sense’ that is not a scientific answer required by law.

John, respectfully, your comments are simply a rehash of the misinformation talking points from obstructionists.

1. Common sense opposition that is contrary to science is not common sense. That is the definition of emotional obstructionism.

2. Foreign company. You act like Canada isn’t our biggest ally and trading partner, it’s not China who you should be concerned about. It also shows a lack of understanding of how the world operates. Companies from all over the globe work all over the globe. Who do you think provides all the oil revenue to Alaska? The company will be hiring locals, providing tax and royalty revenue, building local infrastructure, and lowering the cost of energy, transport and food as a result. The economic benefits to Alaska are explained in the final EIS AND THEY ARE MATERIAL.

3. There is no risk to the “non renewable resource” aka fish. The actual science does not align with your opinion that it’s a trade off, it simply isn’t, the science shows no harm to the fishery.

4. Pristine streams and waters. The mine is 100 miles from Bristol Bay, it is located on tundra that looks like mars. Only 2 streams that account for less than 0.08% of the water flow into the fishery could be damaged at worst (scientific facts). Diesel fishing boats do more damage. In fact, given mitigation efforts, the study shows it could actually enhance the fishery, read the eis please.

5. Disastrous safety record? What? The company has never had a mine fail. And more importantly, they are an explorer, they partner with producers who build the mine. Groups like Barrick or Newmont who have immense experience doing so.

6. Mine failure. The Final EIS notes there is no relevant comparison between publicly cited dam failures and the proposed design. The bedrock foundation, dry storage, and construction methods secure the tailings. Basically, it’s sand.

It’s very important to know the facts before you make claims of bias from people who actually report the truth.

It’s unfortunate that many such as yourself will not read the final eis and accept scientific reality. The mine is safe and will not harm the fishery based on the largest scientific / environmental study in mining history.

Facts over feelings John

So you are Native alaskan. Bet you don’t live near the mine in poverty. What about these locals? You don’t speak for them. And if you know how to read take a look at the EIS. Zero impact on subsistence and commercial fishery, wetlands, etc and an economic boom

for the locals and the state.

Great article – factual and clear. -which is not the case with NGO’s and crooked government agency personnel as has been the case. I am not American but damn it – had to donate to this lady’s rational brainpower.

If anyone ever doubted that the “enviro crowd” is rabidly anti-America you have shown they the truth. Maybe that’s why so many liberals are spending the entire day changing “la-la-la-lla………..”.

Great article . thank you for an independent and reasonable point of view that takes into account all the various angles and considerations when evaluating such an important project.

William murphy

Thanks for publishing this in-depth report Suzanne. The Pebble opposition has certainly been well funded, organized and relentless. I’m looking forward to seeing Federal permitting wrap up this fall.

Thanks for publishing this in-depth report Suzanne. The Pebble opposition has certainly been well funded, organized and relentless. I’m looking forward to seeing Federal permitting wrap up this fall.

The truth is that Pebble is being forwarded by one main proponent, Northern Dynasty, a Canadian mining company whose forebears possess a dodgy safety history, and their minions, mainly Tom Collier, who stands to score 12.5 million US bucks if the project comes to fruition. This is the ultimate foreign company scam, with all the spoils going to the victors and all the destruction being left to those who remain behind, and the accompanying article here is shamelessly shilling for a project that brings with it all the hazards of sulfide, open pit mining with only the pitiful scraps accruing that accompany 20 years, or 40 years, of environmental rapine destined to leave the area the victim of mining technology which, despite its rosy scenario of jobs and tax payments and unicorns, leaves behind a wasteland.

If you doubt that, check out Montana. Or West Virginia. Or Chile. Or, for that matter, Canada.

So, in your line of reasoning then the 100,000 man hours of independent assessment and findings of the Army Corps of Engineers means nothing and must have been somehow paid for by the company as well?

The company has followed all legal guidelines, has done extensive additional studies, has encouraged local participation and input. RULE of LAW is being respected. All the subversive and dishonest false narratives have come from those opposed to the mine.

The mine proposal uses the latest and cleanest plans and ideas for mining responsibly. The company bought the deposit on good faith that it is set aside by the State for mineral development. They have done all their Due Diligence and followed all the proper steps to advance this project.

By what law, scientific proof, right or precedent do you justify denying this 20 year law abiding and just venture?

Why would any company in the future invest in the USA if they can not trust that RULE OF LAW will be followed.

By the way, the mining company is a discovery company that has always stated that they would sell or partner with another “mining” company that will develop the deposit. There is a very good chance that that company or companies will be American.

No offence intended in my comments. I would just like to understand your legal argument here and why emotion and personal judgement becomes more important?

“So, in your line of reasoning then the 100,000 man hours of independent assessment and findings of the Army Corps of Engineers means nothing…”

Yup. It is a scheme designed to come up with the desired results. The “newest and cleanest” phrase is always used to promote untested processes. In truth, Pebble will be an experimental mine without any precedent, other than that it will use techniques that have always polluted their environments.

“By what law, scientific proof, right or precedent do you justify denying this 20 year law abiding and just venture?”

The precedents are enough. All existing, polluting mines have passed the legal and scientific standards that have been foisted on the public to assure them they are safe. By the time people find out they are not, it’s too late.

There is a chance that the mining company doing the real work will be American, but there is a far higher probability that the company will be foreign, since those are the major mining companies doing this kind of work in the world today.

I don’t have a legal argument against the mine, other than that mining companies have been persuasive lobbyists and have influenced the laws meant to protect the public from them. My argument may well be emotional, since I have lived in areas where I have witnessed the destruction of this type of “safe” mining and know how devastating it can be. Check out the major superfund sites (Butte MT, Anaconda MT, Silver Valley ID, the list goes on) to see how this kind of mining has worked out in the past. You and I, taxpayers, end up footing the bill for the cleanup, and the people who live and work in the mines end up taking the financial hit, as well as the environmental and health hits, when the mines close down

What about the tailings dam that will have to be maintained in perpetuity? Are there perpetual funds for this? For me, I’ll gladly get rid of my cell phone and tv if there is no more copper. In fact, I welcome the day. The cost vs risk analysis still doesn’t work for me. It’s not a case of ‘if’ when it comes to natural disasters in Alaska, it’s ‘when’. It seems like one generation (the present one) will selfishly risk a hundred generations’ environmental security for short term financial gain. I am about as conservative as you can get and think this mine is in the wrong place and for the reasons.

I’m living on the Bering Sea and multiple times a day while campaigning for the house seat in 38, Bethel area, I’m getting asked the same questions.

1. Wheres the money for perpetual monitoring?

2. How come the revenue is going straight into the general fund for the thieves to spend?

3. How come there’s only one percent revenue tax on our mined resources?

The tailings will be dried and buried underground with an environmentally safe lining as per the FEIS. The byproduct water will not be held in large quantities, it will either be reused for processing or treated and returned to the source cleaner than before.

Rich corporations know it’s cheap to hire public relations experts who can write this garbage. And they know that the ignorant people will swallow it whole. It’s about the money. Not your money, of course, because you don’t have any. Greed is good. More is never enough.

You never actually wrote about the core issue, the effects on the local environment. You only cited a bunch of appeals to authority concerning it.

in a previous iteration the author states:

“The mine is not at the headwaters of Bristol Bay — as is often wrongly portrayed in photographs. It’s 230 miles away by river, or 100 miles by air, from Bristol Bay, and only touches three very small tributaries at the uppermost reaches, of the more than 50,000 tributaries.”

Anyone that knows anything about the topography and salmon knows this is not true in an important way: the mine is only miles away from lake Iliamna, which on average supplies around 30% of the BB red salmon run. Red salmon spend at least a year in freshwater (lake Iliamna). In a cocamamie effort to reduce costs, PLP proposed barging concentrate over Lake Iliamna; believe it or not! This shows how desperate they are.

In a perverse way I hope they get the federal permits as the battle within our state will be an epic one that they will lose. Tell me how they expect to get leases for the road, the majority of which must travel over land owned by an organization opposed to the very idea of the mine? I’ve always thought the federal part was the least consequential feature of this charade.

Great article. There are always detractors which means the information is on point. Pebble has received an inordinate amount of political opposition and ‘slamming’ over the last decade.

Why don’t all you man bun environmental experts present a factual argument that isn’t based on your man bun EMOTIONS!!!

I’m all for opening the mine smartly I’ve read the reports the one thing that sticks in my head is the 200 foot earthen dam to hold the tailings pond! I remember not that long ago over in Tennessee there was an earthen dam that broke wiped out towns and people’s homes it was in the news for a heartbeat then gone! So guess it something like this was to happen would there be a bond with enough money to cover all costs or will it be like most big companies just pull out and fight them in court! There should be earth here for all parties involved!

There’s nothing being put away for perpetual monitoring, disaster relief or the people of Alaska.

Two of the proposed largest mines in the world are going to be owned by foreign mining companies, lisenced with a get out of jail free card in the form of a Limited Liability Corporation.

If that isn’t enough, the legislature is going to allow the 1% resources revenue to go straight to the General Fund. That means it’s spent before they ever get it.

Nobody should think that Donlin and Pebble are a Republican thing. The Democrats are every bit as guilty of not putting protective measures and revenue sharing into Statute.

It took both parties to get a $1.8 Billion Deficit to deal with in January when the legislature convenes.