The largest interest rate increase since 1994 has been announced by the Federal Reserve. The three-quarter point rate hike is meant to combat inflation, which is at a 40-year-high. Raising the federal funds rate makes borrowing money more expensive, which impacts rates on credit cards, new and used car loans, mortgages, and business loans.

“The committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run,” the Federal Reserve said in its online statement. “In addition, the committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The committee is strongly committed to returning inflation to its 2% objective.”

The decision came at the end of the Feds’ two-day meeting, in which officials said further rate increases may be appropriate.

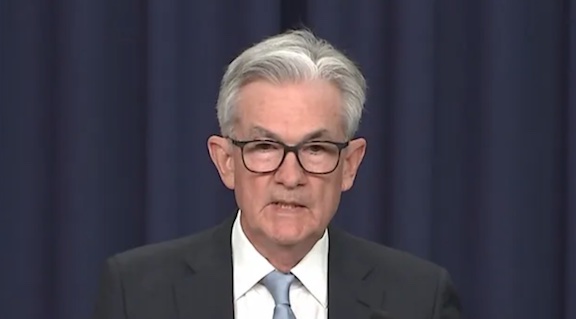

Fed Chairman Jerome Powell somewhat conceded in a press conference that while the Federal Reserve is not trying to create a recession, it’s becoming more likely that there will not be a “soft landing,” where inflation comes down enough and a recession is avoided.

“The events of the last few months have raised the degree of difficulty” of avoiding recession, he said. “There’s a much bigger chance now that it’ll depend on factors that we don’t control. Fluctuations and spikes in commodity prices could wind up taking that option out of our hands.”

Powell was asked by reporters why this rate hike was more aggressive than what he had hinted it would be. Powell said the latest reports show inflation to be heating up.

“We thought strong action was warranted at this meeting and we delivered that,” he said.

Even the mandated 2 percent is too high (think of what that does to you in 10 years) and the hikes are too small. Volker is probably choking in his cigar right now.

Currency depreciation (so-called “inflation”) is a tax on all those least able to afford it.

Yea because that makes sense Everything is more expensive, therefore let’s increase interests to match the rising costs of…well everything.

This is all part of a strong restructured economy….also this isn’t Biden’s fault he’s only been president for 19 months….

Rising commodity prices, largely caused by the Obama/ Biden 2014 coup in Ukraine, in which the chickens have come home to roost with a full-scale invasion of Ukraine by Russia, will make even the most draconian interest rate hikes impotent. Under Biden’s watch the dollar is rapidly losing its status as a safe & stable world reserve currency. In addition to begging for more oil output from Saudi Arabia, Sloppy Joe will be begging the Saudis to not allow China to buy its oil with the Yuan, which could be a fatal blow to US hegemony.

To slow the rate of inflation stop printing fresh money at a blinding rate. 80% of US fiat currency in circulation has been printed w/in the last couple three years. Think there might be a coincidence?

That cash stash you have in the mattress is now worth a hell of a lot less than it was when you put it there; stick a hundred dollar bill in and maybe you’ll get eighty bucks back if you’re quick. The hair sniffer’s poorly considered albeit kindly intended gestures of support to foreign nations by offering them monstrous amounts of hot-off-the-press cash is the foundation for a disaster and the only solution is to empty the trash. FJB. He’s far too stupid to be in that seat.

Comments are closed.