The largest interest rate increase since 1994 has been announced by the Federal Reserve. The three-quarter point rate hike is meant to combat inflation, which is at a 40-year-high. Raising the federal funds rate makes borrowing money more expensive, which impacts rates on credit cards, new and used car loans, mortgages, and business loans.

“The committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run,” the Federal Reserve said in its online statement. “In addition, the committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that were issued in May. The committee is strongly committed to returning inflation to its 2% objective.”

The decision came at the end of the Feds’ two-day meeting, in which officials said further rate increases may be appropriate.

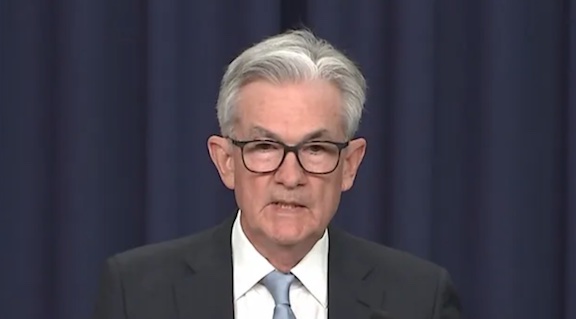

Fed Chairman Jerome Powell somewhat conceded in a press conference that while the Federal Reserve is not trying to create a recession, it’s becoming more likely that there will not be a “soft landing,” where inflation comes down enough and a recession is avoided.

“The events of the last few months have raised the degree of difficulty” of avoiding recession, he said. “There’s a much bigger chance now that it’ll depend on factors that we don’t control. Fluctuations and spikes in commodity prices could wind up taking that option out of our hands.”

Powell was asked by reporters why this rate hike was more aggressive than what he had hinted it would be. Powell said the latest reports show inflation to be heating up.

“We thought strong action was warranted at this meeting and we delivered that,” he said.