Before President Joe Biden’s angry and loud State of the Union address on Thursday, Alaska Rep. Mary Peltola put out a brief statement saying that rich people don’t pay enough in Social Security. She wants them to pay even more than they already do.

Peltola is going after the pipeline workers, the pipe fitters, plumbers, and fishermen of Alaska, not just the super-wealthy, although she’s going after them too, including the CEOs of Native Corporations. She wants working, wage-earning Alaskans taxed to the max.

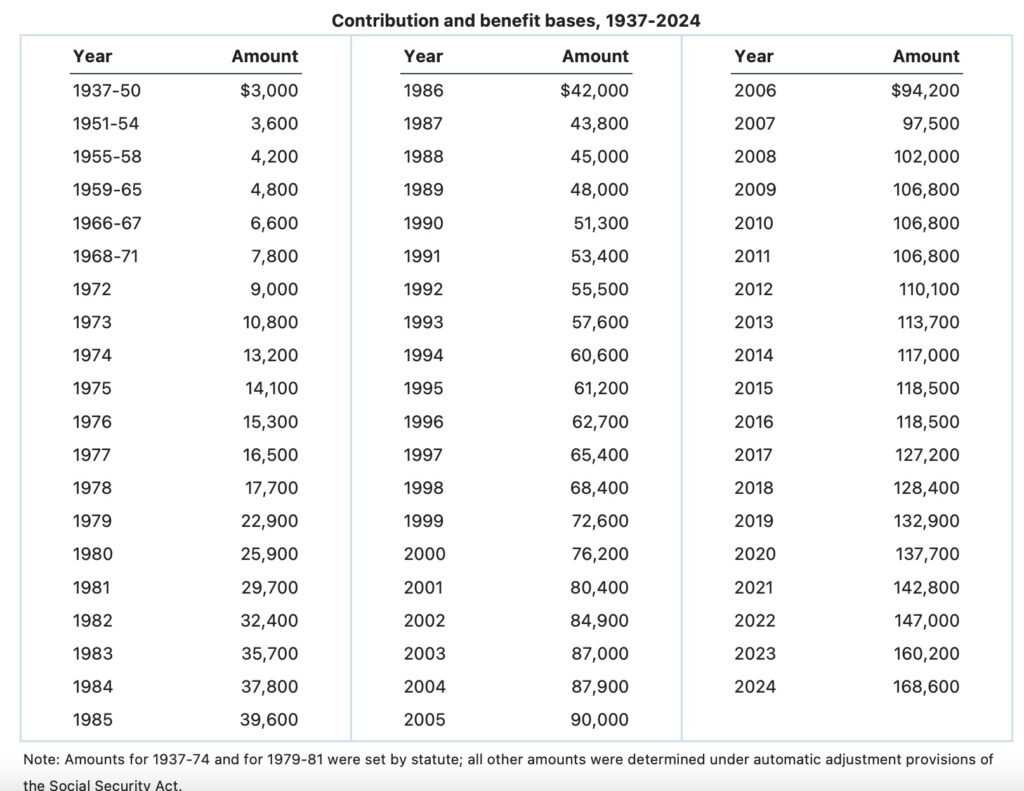

“Did you know that high earners only pay social security tax on the first $168,600 they make in a year? If millionaires paid into Social Security at the same rate as the rest of us, we could afford to protect and expand benefits for everyone. It’s time to #ScrapTheCap,” Peltola wrote on X/Twitter on Feb. 29.

These were talking points passed around by the Biden Administration and parroted by Democrats on Capitol Hill to prime the pump in the class warfare theater of the nation’s center of policy and power. Sure enough, in his speech on March 7, Biden said that millionaires should pay more Social Security tax.

But there’s a problem with that, according to Reason magazine writer Eric Boehm. “Raising the payroll tax cap could generate up to $1 trillion over 10 years, but Social Security faces a $2.8 trillion deficit.”

What’s more, it’s not millionaires who would be hurt, but anyone making more than the cap of $168,600 a year — less than 17% of what another person who makes $1 million a year makes. The two different income earners are in different categories altogether. In fact, millionaires often make much of their money through investments, not necessarily wages.

Peltola herself makes more than $174,000 a year and House of Representative staff members are capped at $199,000 per year, also not in the millionaire category, considering the cost of living in Washington, D.C.

Reason Magazine’s writer acknowledges the $168,600 cap is arbitrary. “In trying to draw a contrast between his own plans and what he claimed Republicans are aiming to do, Biden claimed that ‘working people who built this country pay more into Social Security than millionaires and billionaires do. It’s not fair.'”

To be fair, it was not just working people who built the country, but risk-taking investors, business owners, and job creators. Also others, from soldiers to scientists.

Biden said he plans to “protect and strengthen Social Security and make the wealthy pay their fair share.”

“Though he did not spell it all out in Thursday night’s speech, those two comments seem to be pointed toward the same aspect of how Social Security is funded. Under current law, the payroll tax that funds Social Security is capped so that, for this year, only the first $168,600 in earnings are subject to it,” Boehm wrote. That cap went into effect in 2024.

To be fair, $168,600 in New Mexico is not the same as $168,600 in New York City. But eliminating the cap is the Democrats’ idea to stop the bleeding for Social Security, or as Peltola would have it, expand Social Security to more people.

The Social Security growing deficit is set to create a major insolvency problem in nine years, which could mean a 23% benefit cut. Peltola and Biden want a massive tax that would not guarantee the insolvency would be fixed, because, as Peltola puts it, she wants to expand benefits.

There’s no doubt that raising the cap would generate more revenue that could be used to help keep Social Security afloat, Boehm explained in his article. “The Congressional Budget Office estimates that applying payroll taxes to higher income levels could raise $1 trillion in revenues over a 10-year period (though the amount of revenue would depend on how the cap was altered, and whether benefits increased as well).” It’s just not enough to close the $2.8 trillion gap.

Here’s where it gets tricky: Taxing people who are clearly not millionaires is a penalty on hard-working Americans to transfer their wealth to both retirees and the expanding federal definition of disabled people.

“A significant portion of that tax increase would fall on people making less than $400,000 annually—remember, the cap is currently set around $168,000—a cohort that Biden promised again in Thursday’s speech would not face tax increases,” Boehm wrote. Thus, anyone making $400,000 would pay a Social Security tax on the next $231,000, or at least $17,700 more in taxes, or nearly $36,000 more if self-employed. The Peltola-Biden Plan is especially hard on small business owners.

The announcement of the increase of the cap came in October when the Social Security Administration announced that the maximum earnings subject to Social Security tax would increase from $160,200 to $168,600 in 2024 — an increase of $8,400. It wasn’t the only change. Due to the cost of living going up, Social Security recipients received a 3.2% cost-of-living increase for 2024. For most recipients, it means less than $100 a month more than last year.

Peltola and other Democrats started their coordinated #ScraptheCap campaign in lockstep in the days leading up to the State of the Union. It went like a virus through the Democrats on Capitol Hill and she was just another vector among many.

Sen. Bernie Sanders, a socialist from Vermont, parroted the same phrase: “At a time of massive income and wealth inequality, we have a radical idea that maybe the people on top should start paying their fair share of taxes … #ScrapTheCap,” he said.

Rep. Pramila Jayapal, the socialist sympathizer from Seattle, also used the phrase the same day that Peltola did:

“Did you know that Saturday is when millionaires stop paying into Social Security for the year thanks to arbitrary caps? That’s not right — they need to contribute all year, just like the rest of us. It’s time to #ScrapTheCap and make the ultra-rich pay their fair share,” she said.

So did Rep. Mark Pocan of Wisconsin: “Millionaires will stop paying into Social Security for the year on Saturday, while the rest of us continue to pay into the system with each and every paycheck. It’s time to #ScrapTheCap to ensure the ultra-wealthy pay their fair share!”

The list goes on and on, with representatives and senators from the Left using almost the exact same phrasing in the days and week before Biden’s speech.

At the Manhattan Institute, senior fellow Brian Riedl has written about the myths surrounding these fixes:

“Eliminating the tax cap would either raise benefits as well (reducing the proposals’ savings), or—if the accompanying benefits are canceled—turn Social Security into a true welfare program by delinking contributions and benefits,” Riedl wrote in The Dispatch in “Ten Myths Sabotaging Social Security Reform.”

As a former Senate budget staffer, he has studied the problem for years: “Moreover, eliminating the cap would not bring permanent solvency or avert the need for benefit changes….The system would return to deficits by 2029. Lawmakers would still need to reform benefit levels and the eligibility age.”

The contribution salary cap has been around since the beginning of the program. When Joe Biden was born, only the first $3,000 a person made was taxed by the Social Security Administration. By the time Peltola was born, that had gone up to $10,800. It kept rising with inflation. In 2016, it was $118,000. By the time Biden took office, it had risen to $137,700. Now, people are taxed all the way up to the first $168,600, and Democrats want it all now — Social Security tax on every penny earned.