By KEITH DOBSON

Alaska’s Digital Opportunity

Alaska’s economy has long depended on extracting resources and tourism, with over 90% of our food arriving by barge and truck from thousands of miles away—a precarious balance leaving communities vulnerable to boom-and-bust cycles.

What if Alaska could develop a tech sector reaching beyond Anchorage into rural communities? What if our cold climate, abundant energy, and strategic location between Asia and North America became advantages in the AI revolution? This is already happening. In Cordova, a small AI datacenter is online, expected to create high-paying jobs, reduce energy bills, and advance technology education.

Understanding AI Datacenters

Artificial intelligence requires massive computing power to process enormous amounts of data, learn patterns, and make predictions. Whether diagnosing diseases, optimizing shipping routes, or translating languages, AI does real work requiring significant computational resources.

Datacenters are warehouses filled with powerful computers working 24/7 to process this information. AI datacenters specifically use specialized chips called GPUs (Graphics Processing Units) designed for the intense mathematical calculations AI demands.

When people think “datacenter,” they imagine football-field-sized buildings consuming electricity for a small city. Those are hyperscale facilities run by companies like Amazon, Google, and Microsoft. But there’s another category perfect for Alaska: micro-datacenters, consuming 250 kilowatts to 1 megawatt—roughly equivalent to 200-800 homes. These can fit into existing buildings like closed schools or underutilized government facilities, requiring renovation rather than new construction.

Alaska’s Competitive Advantages

Natural Cooling

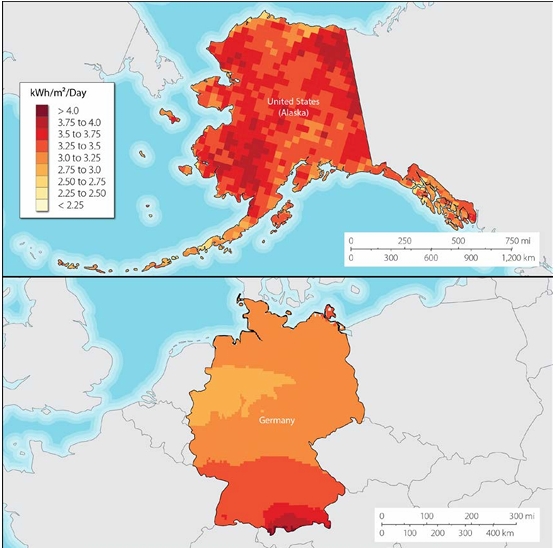

Cooling costs represent 10-40% of datacenter operational expenses. Alaska’s climate provides natural cooling most of the year. In Fairbanks at -40°F, you’re not paying for air conditioning—you simply open the door (so to speak). Even in summer, our temperatures offer fundamental economic advantages over most locations.

Strategic Geography

Looking at a globe, Alaska sits between Asia and North America with fiber optic connections in multiple directions. As Asian economies boom and AI demand grows, Alaska could serve as a strategic hub—a bridge between East and West. Iceland leveraged similar advantages years ago, hosting major datacenters despite being a tiny island nation. Alaska has even more diverse energy sources and better positioning for the Asia-Pacific market.

Energy Resources

Alaska offers surprising energy diversity: hydroelectric power in Southeast communities like Juneau and Sitka, geothermal potential along the Ring of Fire, world-class wind resources in coastal areas, and excess generation capacity sitting idle in many communities. Companies like Greensparc build their model around finding communities with excess power and deploying datacenters that generate revenue while helping reduce electricity rates by sharing infrastructure costs.

Essential Requirements

Communities exploring micro-datacenters need four key ingredients:

Reliable Power: 250kW to 1MW of consistent electricity, 24/7/365. This is like adding a medium-sized commercial building to the grid—significant but manageable for most established communities.

Fiber Connectivity: Major carriers including GCI, MTA, ACS, Quintillion, and Far North Fiber serve Alaska. Connected communities span from Southeast (Juneau, Ketchikan, Sitka, Cordova) to Southcentral (Seward, Kenai, Homer, Anchorage, Palmer, Wasilla) to Interior (Fairbanks) to the Arctic Coast (Utqiagvik and beyond).

Physical Space: Existing buildings work fine—closed schools, vacant warehouses, unused government facilities. Spaces need security, climate control, maintenance access, and power/fiber connections. Many companies offer pre-built modular units for relatively quick installation.

Skilled Workforce: A micro-datacenter needs 2-10 people with electrical knowledge, HVAC skills, IT basics, and security expertise. If your community maintains a power plant, water treatment facility, or modern school, you have baseline skills needed. Specialized AI work happens remotely. This creates good-paying technical jobs for reliable, technically-minded locals.

The Heat Opportunity

Datacenters generate tremendous heat, typically wasted by blowing it into the atmosphere. In Alaska, where food security concerns run deep and growing seasons are short, this “waste” heat becomes incredibly valuable.

Imagine a datacenter next to a greenhouse. Hot air and water from cooling computers keeps the greenhouse warm year-round, growing tomatoes, lettuce, and herbs in January. A community importing 90% of its food now grows its own, creating jobs, improving food security, and reducing shipping costs and environmental impact.

Other possibilities include fish hatcheries for Alaska’s critical fishing industry, lumber drying operations, district heating for municipal buildings, aquaculture facilities, and recreation centers with year-round swimming pools. The datacenter transforms from a technology project into an integrated community asset.

Economic Benefits

Direct Employment: A 250kW facility employs 2-5 full-time workers; a 1MW facility needs 5-10. These are year-round positions paying $60,000-$120,000+ in communities where good jobs are scarce—stable careers supporting families without forcing young people to leave for Anchorage or the Lower 48.

Infrastructure Benefits: Adding a large, stable customer to the power grid can reduce rates for everyone by spreading fixed costs across more kilowatt-hours sold. In communities with prohibitively high electricity costs, this makes real differences for residents and businesses.

Training and Education: Datacenters create educational opportunities, showing students that technology careers are realistic options and providing immediate local application for technical training programs.

Native Corporation Partnerships: Alaska Native Regional and village corporations are natural partners, providing land or buildings, co-investing in development, employing shareholders, and ensuring economic benefits flow to historically underserved communities.

Real Challenges

Alaska doesn’t need another overpromised economic scheme. Challenges include high electricity costs (requiring targeting communities with excess capacity or low-cost generation), incomplete fiber infrastructure and redundancy, the valid criticism that datacenters create relatively few jobs, and ensuring community fit and readiness. Success requires community engagement and leadership from local decision-makers—tribal councils, Native corporations, city councils, borough assemblies, and business leaders. This must be a community choice, not something imposed from outside.

Communities with Opportunity

Based on existing infrastructure, several Alaska communities are well-positioned: Southeast communities like Juneau, Ketchikan, Sitka, and Cordova have strong hydro power and fiber; Southcentral’s Palmer/Wasilla corridor offers road access and agricultural integration potential; Fairbanks provides university partnerships and technical workforce; and Utqiagvik offers extreme cold climate advantages and Arctic research opportunities.

Looking Forward

Alaska has built prosperity on bold vision: the gold rush, oil pipeline, and fishing industry. The datacenter opportunity follows this tradition. Our cold climate, strategic location, and energy resources position us to participate in the digital revolution.

Micro-datacenters won’t work everywhere or solve all challenges. But for communities with the right infrastructure and vision, they offer opportunities to create technical jobs, use excess energy productively, improve food security, upgrade infrastructure, partner with Native corporations, and diversify beyond boom-and-bust extraction.

The technology is proven. Companies are already investing. The question is whether Alaska communities will seize this opportunity—a chance to write Alaska’s future with fiber optics, AI, and year-round tomatoes grown with datacenter heat.

We’ve thrived on the edge of the world before. We can do it again.

Keith Dobson is an Alaska-based IT leader with nearly 40 years in consulting, engineering, sales and management. At INVITE Networks, he advances responsible AI to strengthen private and public services. A Big Lake resident and active volunteer, Keith focuses on helping Alaska communities use technology for practical solutions delivering better outcomes for all Alaskans.