A LOOK UNDER THE HOOD OF THE JOINT DEVELOPMENT AGREEMENT

This won’t take long.

The six-page “joint development agreement” signed by the Walker Administration with China will be part of Monday evening’s agenda of the Alaska House Natural Resources Committee. It will be television worth watching because the governor has signed a pact with China on behalf of all Alaskans.

The meeting starts at 6 pm at the Anchorage Legislative Information Office in Anchorage, and Alaska Gasline Development Corporation President Keith Meyer will be the lead presenter.

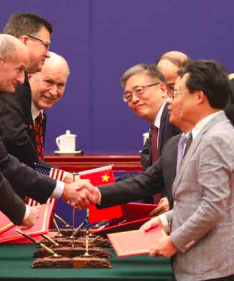

Meyer has spent much of the year in China forging relationships. On Nov. 9, he and Gov. Bill Walker signed an agreement with the Chinese to build the AK-LNG project.

BUT IT’S A TWO PAGE AGREEMENT

Take out the cover page, and the signature page, and there are four pages left, and half is written in Chinese. Once the Chinese characters are removed, it’s a two-page agreement, and a quarter of that is made up of the “Whereas” clauses. It’s less substance than Alaska signed in an MOU with Korea earlier this year.

WHAT IT GIVES CHINA

The joint development agreement is a a nonbinding agreement to develop a binding agreement.

The agreement gives China 75 percent of the LNG coming out of the gasline that would run from the North Slope to Nikiski on the Kenai Peninsula for export, “on a cost-based and stable price utilizing the benefits of strategic financing and investment.” The other 25 percent would go to Asia.

Page 4 of the agreement gives the Chinese hope for even more: a real role in the manufacturing of the gasline.

Item 4 on the page describes “Potential for Sinopec’s involvement in engineering, procurement, construction, and project management opportunities and in the overall development of the Alaska LNG System (including, but not limited to, progressing detailed engineering and design work, procurement of equipment and facilities, modular fabrication, construction activities, project management).

By May, 2018, the agreement says that Alaska and China will have identified the ability for Sinopec to engage in aspects of engineering and construction.

Sinopec, owned by the Chinese government, has never actually built a pipeline. China has no ability to roll this type of steel needed for a pipeline. Currently, Korea, Germany, India, and Japan do have that capacity. But that’s a hurdle that can be overcome.

There is no mention of a project labor agreement, Alaska hire, or use of local manufacturers. Alaska’s labor unions have remained silent on the issue. Joey Merrick, President of the Laborers Union, sits on the board of the AGDC. Project labor agreements in a union-dominated state like Alaska is a essential: No gasline will be built without one.

QUESTIONS FOR AGDC’S KEITH MEYER

BUSINESS MODEL: What is the AK LNG business model? This is the largest project in North American history, to cost at least $40 billion, or as high as $60 billion, some say. The previous project had a business model, but there is none evident now. The state has simply gone from country to country and signed similar agreements to build the gasline.

Is it a tolling model, where state owns infrastructure and gets money from gas coming through it?

Is it a joint venture with a national company owned by another nation?

How does it make money for Alaska? Under what price scenarios?

AK LNG originally had state of Alaska owning 25 percent of the proceeds of a project that involved selling gas to world markets with three other companies, which own the molecules of gas. There were clear and proportional shares of the costs.

The answer is not that “It is a classic integrated project.” That is the project design. That is not what the question is.

It’s a banker’s question: What are the investments? Where do the funds come from? What is the cost of the money? How does it make money? What are the operating costs? Who are the owners? Who are the customers? Who owns the risk?

STATE OF ALASKA’S ROLE: What part does the State of Alaska play in this project? Are we a regulatory authority? Owner of gas molecule? Owner of ultimate infrastructure? Are we a debtor? What is our role in the partnership? To get the tax exempt status, will we have to retain ownership during the construction, but do we then turn over ownership to the Chinese?

MEASURING SUCCESS: What is the measurement of success for the State of Alaska? If you have a business model and you know what Alaska’s role is, you may be able to be answer this question.

LOCAL COMMUNITIES: Is the option of getting gas to Alaska’s communities even viable considering the expense of fitting the offtake points?

RISK: What is the scope of the risk? How much risk is too much risk? How much risk are is Alaska willing to take on? In the original AK LNG project, everything went back to the question of risk. The plan was to stage-gate the project to prevent politicians from getting the State too far out over its skis, and prevent us from being in a “no going back” position in a world where the markets were awash in cheap gas. Are we still using a stage-gated approach?

PERMANENT FUND EXPOSURE: Is the Alaska Permanent Fund being exposed, and does the governor still intend to use it as collateral?

TRANSPARENCY: Legislators who have asked to see the finances of AGDC are now being required to sign a confidentiality agreement. Why is the appropriating body of the people of Alaska not able to see the finances?

Candidate Walker was outraged at the confidentiality agreements of the previous AK LNG project. But it is more secretive than ever under his management.

Even in the signed agreement, the actual Chinese who signed the document are kept secret, their names redacted by black bars.

PRICE: The leaseholders have said they will sell gas to the project at the wellhead at a commercially feasible price. What does that price profile look like? Wood-MacKenzie said this is the least competitive project in the world. It appears in order for this project to pencil, the gas will need to be practically free. Is it the governor’s plan to offer a low-ball price and then sue the producers for the gas, since the state does not actually own the molecules?

LAWSUITS: Speaking of lawsuits, the agreement says the project will start in 2019 for a window of selling gas in the mid-2020s. But it’s likely to draw a lawsuit from the Sierra Club or World Wildlife Fund. Does the project still work in five or 10 years after the lawsuit is settled?

NONBINDING FOUNDATION CUSTOMER: Regarding the sole foundation customer agreement AGDC got in September, is that binding? What is the level of commitment? Does that customer have gas, or are they going to be a shipper? Who is it? What amount?

GOVERNOR’S CAMPAIGN BROCHURE: This week, Alaska Gasline Development Corporation published a glossy insert in newspapers around the state. The brochure is a result of AGDC polling Alaskans earlier this fall to find out what they needed to hear to support the project,. The brochure now attempts to address those resistence points and persuade Alaskans that the project indeed answers their questions and concerns.

In the brochure, Alaskans are urged to learn more from the Dept. of Labor “about opportunities and what role you can fill.” Where does an Alaskan find such information?

The glossy brochure is found here.