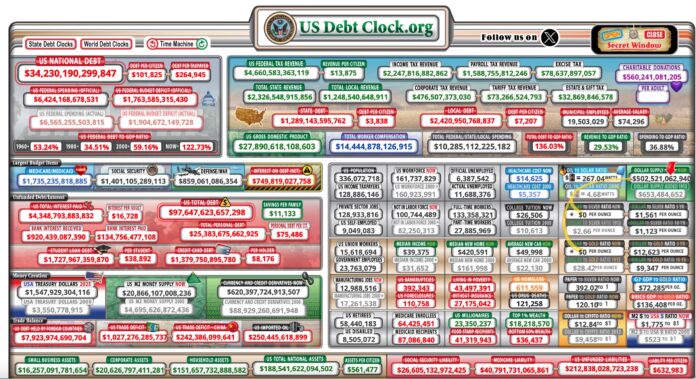

Worried about government spending? The debt that the nation owes due to government borrowing and spending reached over $34 trillion on Jan. 2, according to the U.S. National Debt Clock.

Six weeks later, it has reached $34.2 trillion. On this trajectory, the national debt will reach about $35 trillion before the end of summer and $36 trillion when the next president is sworn in in January of 2025, some 343 days from this report.

Debt is different from deficit spending. Last year, the Biden Administration ran a spending deficit of about $2 trillion. Compare that to the end of 2020, when the government’s budget deficit was $3.1 trillion, due in part to the Covid pandemic response. Prior to the pandemic, in 2019, the budget deficit under the Trump Administration was $1 trillion.

Driving the deficit higher was $659 billion in interest payments on borrowing, which has blasted through the Congressional Budget Office’s forecast by 137%.

Treasury notes are now 4%, rather than the 1.6% estimated by the CBO, and the federal debt is $2.5 trillion higher than CBO projections before Biden took office and Congress started passing big spending packages, like the Inflation Reduction Act, about $515 billion in borrowed money, referred to as the largest piece of federal legislation ever to address climate change.

The debt that the federal government has incurred on behalf of citizens now amounts to $265,000 per taxpayer. That’s about $19,000 more per taxpayer than one year ago.

The nation’s fiscal and economic outlook has deteriorated substantially since the last Congressional Budget Office (CBO) baseline in May, when CBO projected debt would reach a record 110 percent of Gross Domestic Product (GDP) by 2032. Under an updated current law baseline, we now project debt in 2032 will reach 116 percent of GDP, deficits will reach 6.6 percent of GDP, and interest will reach a record 3.4 percent of GDP. Under a more pessimistic (and in many ways realistic) scenario, debt in 2032 would reach 138 percent of GDP, deficits would reach 10.1 percent, and interest would total 4.4 percent of GDP. These projections suggest an unsustainable fiscal trajectory,” wrote the Committee for a Responsible Federal Budget in 2022.

The CBO was off by a few years. It only took two years for the debt-to-GDP ratio to reach 122.7% and for the Treasury notes to reach 4%.

View the U.S. Debt Clock at this website.

“A study by the World Bank found that countries whose debt-to-GDP ratios exceed 77% for prolonged periods experience significant slowdowns in economic growth. Pointedly, every percentage point of debt above this level costs countries 0.017 percentage points in economic growth,” according to Investopedia.

The U.S. has scored over 77 since 2009, but recently exploded into the “fiscal cliff” category. Only Japan, Greece, Singapore, and Italy are higher in the world’s advanced economics, according to Visual Capitalist.

The Biden White House predicted that in 2024, the national debt would be $28 trillion, and would reach $33 trillion in 2027.

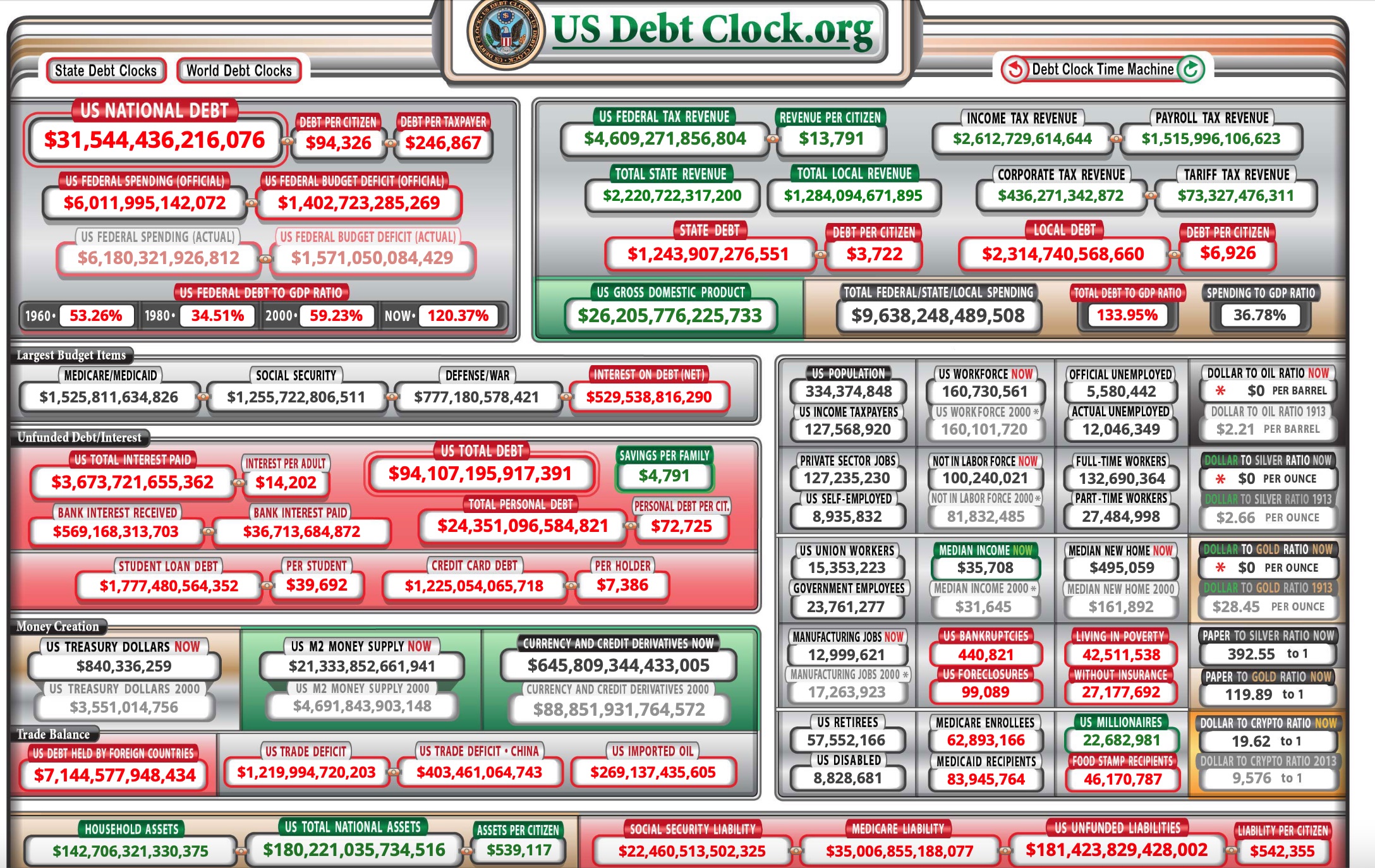

Here’s what the U.S. debt clock looked like one year ago, on Feb. 9, 2023, when the debt was $31.5 trillion:

What would it take to get the federal debt back into its box?

According to the Committee for a Responsible Federal Budget, it would take about $8 trillion of 10-year savings to stabilize debt as a share of the economy and about $15 trillion to balance the budget under the Congressional Budget Office’s February 2024 baseline.

“Under current law, CBO projects that federal debt held by the public will rise from roughly 97 percent of Gross Domestic Product (GDP) today to a record 106.3 percent by the end of Fiscal Year (FY) 2028 and grow further to 116 percent of GDP by the end of FY 2034. With this in mind, policymakers should set a fiscal goal to stabilize or reduce the debt and prevent substantial risks and threats to the budget and economy,” the watchdog group says.

“While there isn’t one ideal fiscal goal, there are several that represent a significant improvement to the current fiscal outlook. For example, policymakers could aim to stabilize debt or reduce debt to a target level of GDP over five or ten years. Stabilizing debt at its current level of roughly 97 percent of GDP would require $3.6 trillion of deficit reduction (including interest) over five years or $7.9 trillion of savings over ten years. Reducing debt to 80 percent of GDP, which would be in line with the pre-pandemic level, would require $9.4 trillion of five-year savings or $15.0 trillion of ten-year savings,” the group says. Read more here.

For consumer borrowers, on Feb. 14, 2024, the current average 30-year fixed mortgage interest rate is 7.25%, according to Bankrate.com. The rate has risen 15 basis points over the last seven days.

Some are predicting a fiscal crisis in 2025, with the expiration of the 2017 Tax Cuts and Jobs Act coming at the same time the national debt continues to soar.

Here are some of the effects of the sunsetting of the TCJA, according to Howard Gleckman of the Brookings Institute, who writes that all of the individual tax provisions of the 2017 legislation expire at the end of 2025. Among the changes:

- Individual income tax rates will revert to their 2017 levels.

- The standard deduction will be cut roughly in half, the personal exemption will return while the child tax credit (CTC) will be cut.

- The estate tax exemption will be reduced.

- The special 20 percent tax deduction for many pass-through businesses will end.

- The cap on the state and local income Tax (SALT) deduction will end.

Gleckman says taxes will likely increase for most US households. Read his report at this link.