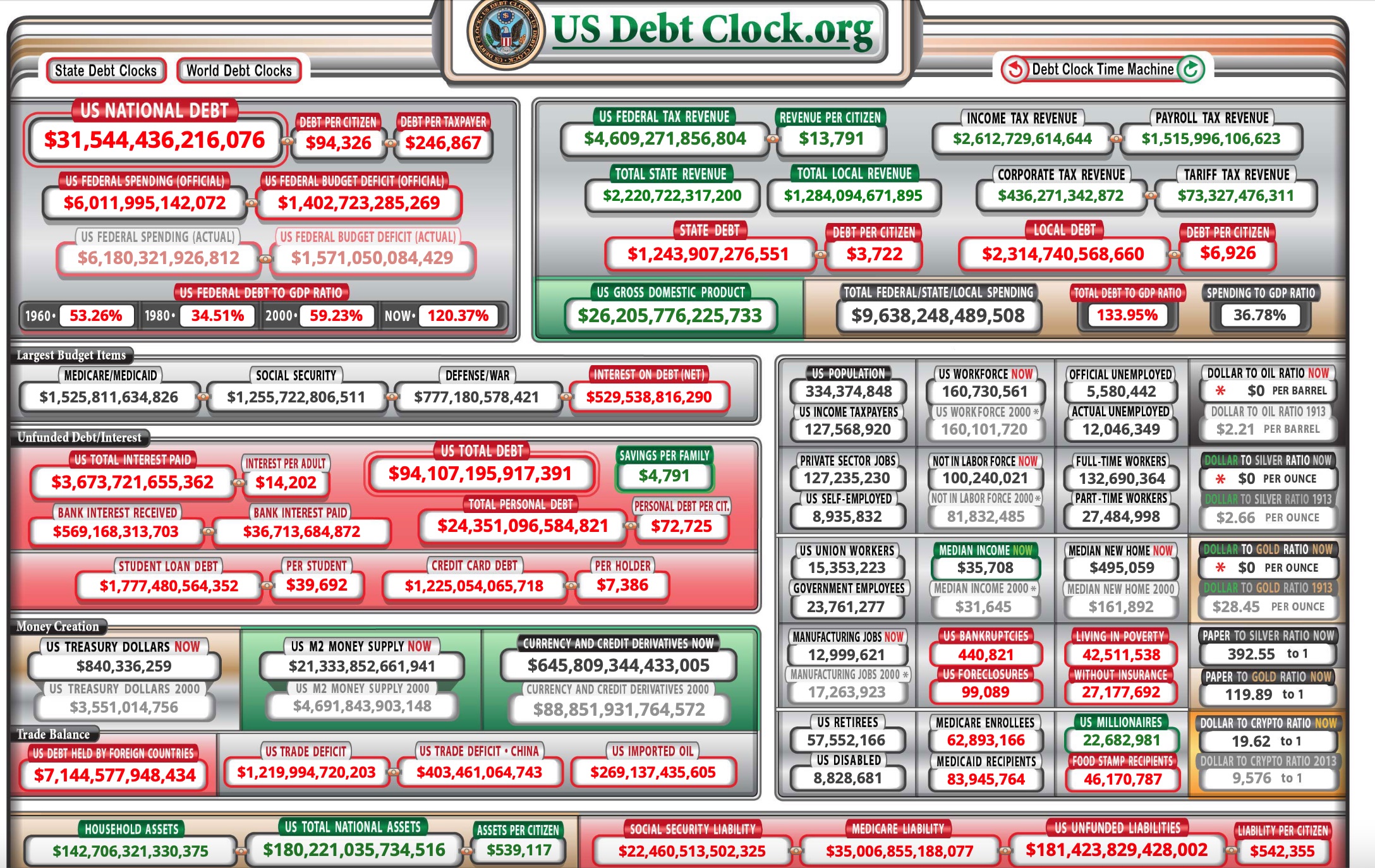

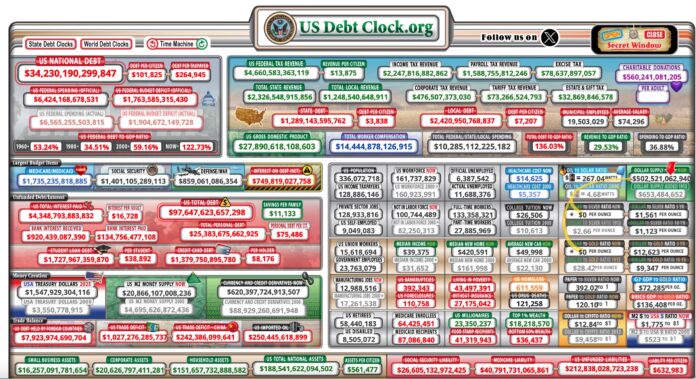

Worried about government spending? The debt that the nation owes due to government borrowing and spending reached over $34 trillion on Jan. 2, according to the U.S. National Debt Clock.

Six weeks later, it has reached $34.2 trillion. On this trajectory, the national debt will reach about $35 trillion before the end of summer and $36 trillion when the next president is sworn in in January of 2025, some 343 days from this report.

Debt is different from deficit spending. Last year, the Biden Administration ran a spending deficit of about $2 trillion. Compare that to the end of 2020, when the government’s budget deficit was $3.1 trillion, due in part to the Covid pandemic response. Prior to the pandemic, in 2019, the budget deficit under the Trump Administration was $1 trillion.

Driving the deficit higher was $659 billion in interest payments on borrowing, which has blasted through the Congressional Budget Office’s forecast by 137%.

Treasury notes are now 4%, rather than the 1.6% estimated by the CBO, and the federal debt is $2.5 trillion higher than CBO projections before Biden took office and Congress started passing big spending packages, like the Inflation Reduction Act, about $515 billion in borrowed money, referred to as the largest piece of federal legislation ever to address climate change.

The debt that the federal government has incurred on behalf of citizens now amounts to $265,000 per taxpayer. That’s about $19,000 more per taxpayer than one year ago.

The nation’s fiscal and economic outlook has deteriorated substantially since the last Congressional Budget Office (CBO) baseline in May, when CBO projected debt would reach a record 110 percent of Gross Domestic Product (GDP) by 2032. Under an updated current law baseline, we now project debt in 2032 will reach 116 percent of GDP, deficits will reach 6.6 percent of GDP, and interest will reach a record 3.4 percent of GDP. Under a more pessimistic (and in many ways realistic) scenario, debt in 2032 would reach 138 percent of GDP, deficits would reach 10.1 percent, and interest would total 4.4 percent of GDP. These projections suggest an unsustainable fiscal trajectory,” wrote the Committee for a Responsible Federal Budget in 2022.

The CBO was off by a few years. It only took two years for the debt-to-GDP ratio to reach 122.7% and for the Treasury notes to reach 4%.

View the U.S. Debt Clock at this website.

“A study by the World Bank found that countries whose debt-to-GDP ratios exceed 77% for prolonged periods experience significant slowdowns in economic growth. Pointedly, every percentage point of debt above this level costs countries 0.017 percentage points in economic growth,” according to Investopedia.

The U.S. has scored over 77 since 2009, but recently exploded into the “fiscal cliff” category. Only Japan, Greece, Singapore, and Italy are higher in the world’s advanced economics, according to Visual Capitalist.

The Biden White House predicted that in 2024, the national debt would be $28 trillion, and would reach $33 trillion in 2027.

Here’s what the U.S. debt clock looked like one year ago, on Feb. 9, 2023, when the debt was $31.5 trillion:

What would it take to get the federal debt back into its box?

According to the Committee for a Responsible Federal Budget, it would take about $8 trillion of 10-year savings to stabilize debt as a share of the economy and about $15 trillion to balance the budget under the Congressional Budget Office’s February 2024 baseline.

“Under current law, CBO projects that federal debt held by the public will rise from roughly 97 percent of Gross Domestic Product (GDP) today to a record 106.3 percent by the end of Fiscal Year (FY) 2028 and grow further to 116 percent of GDP by the end of FY 2034. With this in mind, policymakers should set a fiscal goal to stabilize or reduce the debt and prevent substantial risks and threats to the budget and economy,” the watchdog group says.

“While there isn’t one ideal fiscal goal, there are several that represent a significant improvement to the current fiscal outlook. For example, policymakers could aim to stabilize debt or reduce debt to a target level of GDP over five or ten years. Stabilizing debt at its current level of roughly 97 percent of GDP would require $3.6 trillion of deficit reduction (including interest) over five years or $7.9 trillion of savings over ten years. Reducing debt to 80 percent of GDP, which would be in line with the pre-pandemic level, would require $9.4 trillion of five-year savings or $15.0 trillion of ten-year savings,” the group says. Read more here.

For consumer borrowers, on Feb. 14, 2024, the current average 30-year fixed mortgage interest rate is 7.25%, according to Bankrate.com. The rate has risen 15 basis points over the last seven days.

Some are predicting a fiscal crisis in 2025, with the expiration of the 2017 Tax Cuts and Jobs Act coming at the same time the national debt continues to soar.

Here are some of the effects of the sunsetting of the TCJA, according to Howard Gleckman of the Brookings Institute, who writes that all of the individual tax provisions of the 2017 legislation expire at the end of 2025. Among the changes:

- Individual income tax rates will revert to their 2017 levels.

- The standard deduction will be cut roughly in half, the personal exemption will return while the child tax credit (CTC) will be cut.

- The estate tax exemption will be reduced.

- The special 20 percent tax deduction for many pass-through businesses will end.

- The cap on the state and local income Tax (SALT) deduction will end.

Gleckman says taxes will likely increase for most US households. Read his report at this link.

As the recent Facebook note says: We are the only country that taxes its citizens to give money to other countries, most of whom despise us! The Senate early Tuesday passed a $95.3 billion aid package for Ukraine, Israel and Taiwan!

Britain & France & Italy also have foreign aid programs paid for through taxes & debt. If so many despise us, why do they want to come here? What many despise is the unreliability of US foreign policy and politics.

Problem with Facebook post is easy. Most countries who dole out foreign aid don’t bother with taxation.

Your concept is flawed from conception. Another way to look at is we are the only nation who gives foreign aid where the taxpayers/

citizens have any hope of a voice in the matter

uh, dollars are the international reserve currency for the time being, so when the game of musical chairs stops, there will be plenty of foreign sheep sheared.

An additional aggravator is how GDP is calculated in the US. Just one example is massive subsidies and grants to industries inflate the “value” of products sold. If/when federal “funding” was eliminated in the Alaska economy, what small percentage of durable or valuable goods are left? The value of the US dollar for which all these calculations are based is headed for a massive loss due to world commerce increasingly moving into the BRICS system. Deindustrialization and forcibly destroying reliable and affordable energy systems is accelerating our decline. We are not as far gone as Germany, but we can see the effects of these policies. Educated and reliable skilled labor is disappearing, the most basic and essential factor for a healthy society and economy. And our senators are “working” hard to add $96 billion to the problem.

You raise a very good and important point, Brian.

GDP, as measured today, is a complete farce of an economic metric, as it includes ALL governmental expenditures, which by any logic it should exclude them, as government spending is a drag, not an addition. to the REAL, and actually productive, economy.

All that federal money Alaska craves and is addicted to at all levels of government that is supposedly free? That our federal reps so love to brag about big & small? Connect the dots. Just say’in.

As much as I would love to blame this on Grandpa Bloodstains, it’s not just him.

Not by a long shot.

For decades all parties have been gorging at the public trough. Our own Princess Lisa has pigged out so much I’m surprised she hadn’t exploded. Uncle Ted was just as bad.

The last POTUS to have a balanced budget was Bill Clinton .

We’re never gonna have fiscal stability in this nation until the economy collapses Soviet Union style.

We have never had fiscal conservatives in our Republican congressional party. Sullivan is the closest but he is in tune with the Industrial complex for the military. All the way back to the first ones to go to Congress. They are just Democrats who spend less than the true Democrats. At least Donleavey can say he tried it but everyone rebelled with his cuts in his first year. Alaska is not a conservative state.

I agree, Avenger. Old Woodenhead hasn’t the faintest clue what any of those numbers even mean, as they have nothing to do with ice cream. Jerry Powell and Janet the oompah loompah….. different story.

Avenger: I agree that Clinton was the last president to have a balanced budget but I’d like to clarify that he only had it because it was forced on him AND, most of that ‘balance’ was achieved through slight of hand and cheap parlor tricks.

Nobody has any right to complain about the debt. We have been warning of this for decades.

Ive gotten to the point where I dont care anymore. I personally keep over 30% of my total net worth in physical gold and silver. I have no debt. Im just kicking back and enjoying watching the decline. I pay the least amount in taxes as possible. Left the workforce in 2019.

Ive read the history of every country that has done this. None come out of this without a completely new currency and monetary system.

As inflation has grown and the value of nonferrous metals (particularly gold and silver) have remained relatively consistent you have lost a lot of money in recent years.

LOL!!! I was buying gold at $400 and silver at $6.00. Im sitting in 6160 ounces of silver and 210 ounces of gold. Trust me, Im way ahead. And you are forgetting that gold and silver cant bankrupt. Price is irrelevant. There is no counterparty risk. I own it. There isnt a promise to pay. Gold and silver is final payment. You dont hear about gold and silver asking for bailouts.

Hey skippy, when there is no GDP, you can own it but there will be noting to buy with it! Oh by the way what stops our government doing a Déjà vu again outlawing gold ownership? BTW they will take our guns first to ensure no viliance with you!

AMP that up scottie !

Trouser Bark, you seem confused by the concept of “value” as opposed to “price”.

Those are two VERY different things.

Oh WOW(!!!) … You punch that green button on the ‘Time Machine’ and select 2028 (4 years ahead), this Debt Calculator now totals … $46TRILLION (!!!)

.

Dan // Lisa // Mary (???)

You still think giving away Billions of Tax Payer $$$’s is still a worthy endeavor?

How exactly is this going to be rectified and by when … What is the Plan?

What sacrifices are you three going to expect // demand of us Tax Payers?

Oh, yeah, once politicians get their lips locked on to a nipple it’s hell to pry the suckers loose! Look at the bastards–the milk just runs off their chins. Something has to give: another dollar or two and we’ll be dealing with real debt!

Interest on this record debt is around $700 billion per year. The morons in DC want to add another $100 billion to the debt by giving it away to foreign countries.

On top of all this is the overlooked fact that your savings, wages and investments are valued in dollars that can buy 20% less than in 2020.

A 2 Trillion per year deficit is unfathomable. It seems impossible to cut spending by even 1 Trillion. So what is the path out of this trainwreck? Everyone will be taking a major haircut over the next 10-20 years.

I would ask Dr. Peter Navarro what to do but he is soon serving time for contempt of Congress. Steve Bannon somehow is free on bail after being convicted for the same thing. Frank Rast must be smiling.

There is no turning the ship at this point. the 2024-2026 commercial space vacancy rate is going to cause a banking implosion that will make 2008 look like a “nothing to see here” moment. In 2008, the FED turned up the presses but the debt is so high today, that will just cause a tidal wave of inflation, at this point. Prepare for your money to me worthless and all the “buy gold and silver” crap is going nowhere. You can’t peel of a sliver of silver to buy some food. Barter is going to be huge and the urban centers are screwed.

The average American does not have a clue what’s about to happen.

We are going to wake up to no banks open and marshal law because we are broke and the printing presses have ran out of ink.

People can’t see that a billion dollars is a thousand million so then a trillion dollars is a million billion.

Because the middle class and conservatives don’t start trouble we have a mess coming soon so all bets are off.

Just remember who’s responsible and where they live so we know who to arrest and take back all the stolen taxpayers money.

a trillion is a thousand billion or a million million.

Better way to state it would be to say 1 trillion seconds is 31,709 years. That puts it into better perspective.

Chris, Alaska is estimated to hatch 17 trillion mosquitoes every summer. If each bug was worth one dollar it would take two summers of bugs to equal the current national debt.

I hope this helps people understand the enormity of the situation.

A million million does not really convey the magnitude.

.

Put it into terms the average person can grasp. I think earning $100K a year is understandable to pretty much everyone drawing a paycheck. Let’s say it this way.

If you earned $100,000.00 a year, it would take you 10 years to earn a million.

It would take you ten thousand years (10,000 years) to earn a billion.

It would take ten million years to earn a Trillion.

.

Which means the US government owes 340,000,000 years worth of a person making $100K a year.

The USA needs to stop corporate welfare! We have the Democrats the “tax and spend” party, and the Republicans the “borrow and spend” party.

What percentage of the national debit is corporate related?

And, how much if it is unnecessary, and potentially unconstitutional government entitlement programs?

.

Unless you can tell us, your corporate welfare statement is just a demonstration of ignorance.

I am old enough to remember when $6B for a border wall was going to bankrupt the nation. Now, we are giving another country $60B+ and it is apparently not going to harm the bottom line at all.

It’s probably too late for USA to get rid of its debt. It’s not too late for individuals and families to reduce our own spending and consumption of government services. We can at least encourage our neighbors to do that much.

Our Alaska Democrat and Republican leadership really need to get serious in cutting the budget Donna Auduin way. I’m sorry we Alaskans didn’t give her much of a chance and that we Alaskans were so mean sported to her. She not from our state. still she was looking after us by her proposal of how the State can better spend money and save, so we are less federal dependent.

How about we just stop giving goods and services away to people who are not legally in the country, stop giving money to other countries and getting nothing in return, and stop forgiving student loans because a persons degree in hyphenated-American studies is worthless in the job market.

After we stop that bleeding, we can start fixing other problems.

Help me out here. I heard Alaska spends one hundred and fifteen thousand dollars a year per person. Is that true?

No. That is 100% false. Total spending in 2023 was 17.4 billion. Population about 730,000 people. Thats $23,835 per person.

Everyone in the beltway understands that those in power have no intention of ever paying off this debt. They will push it as hard and as far as they can, until CBDCs can be put into place, at which point “POOF” the gargantuan debt is magically gone. As a bonus, they will have full control over everyone’s money. Kinda cool, huh?

I for one cannot wait until I have to check my social credit score before I can buy groceries.

It’s not gonna be a long wait.

$34,230,190,299,847.00 is an incomprehensible amount. It’s like measuring how close the next nearest star is to us, which as it turns out is about 24,984,092,897,478.72 miles away and would take 4.3 years to get to if we were able to travel at the speed of light, which we aren’t.

In comparison, if you were to spend about $0.75 per mile to travel at the speed of light which is 186,000 miles per second it would take you 4.3 years to pay off our national debt at a cost of $139,500.00 per second.

Incomprehensible.

The “quiet part” That no conservative ever says aloud is that over the years the Republican party has been just as guilty as the Democrats of running up this atrocious debt. The other “quiet part” that Neither party will talk about is that at this point we have no option except to continue to borrow even more since it is not possible to ever repay this debt.

Members of Congress are acting like a degenerate gambler in Las Vegas, only they are betting our last dollars on Ukraine winning a war they have already lost, in the hope that we can raid the vast natural resources of Russia and pull our nation’s nuts out of the recessionary fire that is already upon us.

Our family owns our home, bought both our cars with cash and we pay off our credit card balances at the end of every month. This came about because for almost 10 years we never went on any expensive vacations, never bought anything we couldn’t pay for outright, didn’t borrow money from anyone, and operate on a written out and agreed upon budget. It’s long past time that the Federal government operate under the same principles. Fanny Mae and Freddie Mac, Social Security, farm subsidies, corporate bailouts; all these things need to be paid for in an ongoing manner. If Congress can’t even get its act together to make social security solvent (mostly because they all care more about getting re-elected than anything else) then none of us should expect anything to be done about the national debt.

Unfortunately, that won’t happen. I’ll let Thoms Sowell explain why:

“The first lesson of economics is scarcity: There is never enough of anything to satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.”

Lets talk about the National Credit the people create with our labors. What have they done with that?

Comments are closed.