The federal budget is in worse shape than the government is admitting, according to an analysis from a federal budget watchdog group that downgrades the nation’s economic outlook.

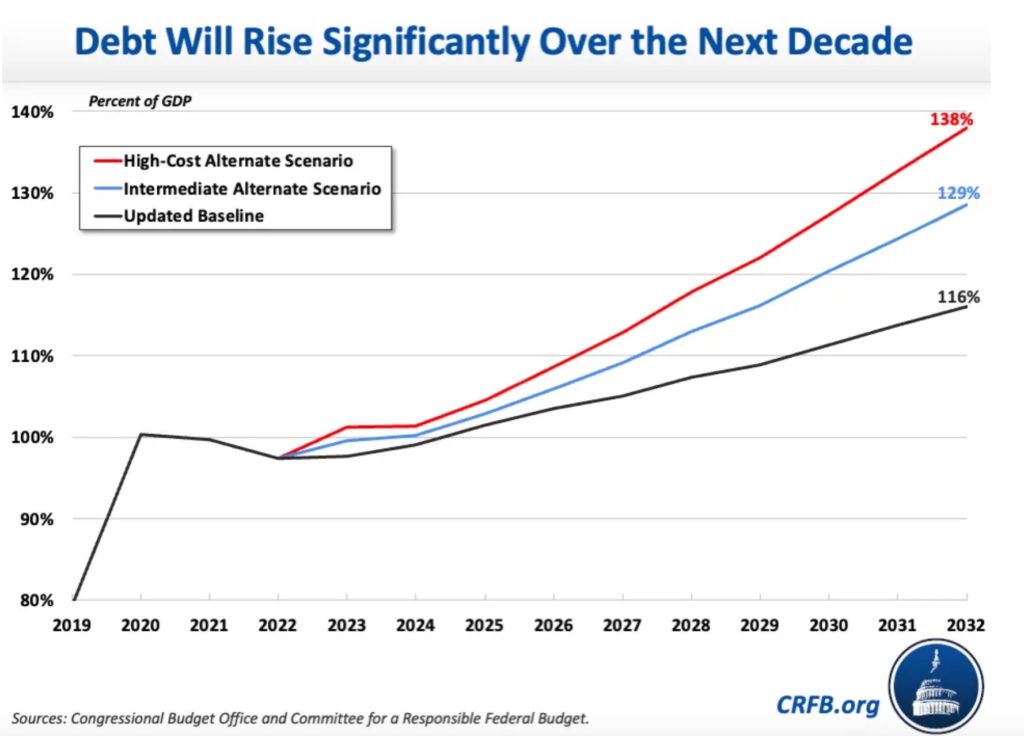

“The nation’s fiscal and economic outlook has deteriorated substantially since the last Congressional Budget Office (CBO) baseline in May, when CBO projected debt would reach a record 110 percent of Gross Domestic Product (GDP) by 2032. Under an updated current law baseline, we now project debt in 2032 will reach 116 percent of GDP, deficits will reach 6.6 percent of GDP, and interest will reach a record 3.4 percent of GDP. Under a more pessimistic (and in many ways realistic) scenario, debt in 2032 would reach 138 percent of GDP, deficits would reach 10.1 percent, and interest would total 4.4 percent of GDP. These projections suggest an unsustainable fiscal trajectory,” wrote the Committee for a Responsible Federal Budget.

“Under a more pessimistic (and in many ways realistic) scenario, debt in 2032 would reach 138 percent of GDP, deficits would reach 10.1 percent, and interest would total 4.4 percent of GDP,” the watchdog group said. “These projections suggest an unsustainable fiscal trajectory”

The U.S. national debt has exceeded $31 trillion this year and consumer prices are up 9.1 percent over the year ended June 2022, the largest increase in 40 years, according to the Bureau of Labor Statistics.

“At the same time as inflation is surging and interest rates are rising, our new projections show that the United States faces an unsustainable fiscal outlook. Policymakers should come together and act quickly to put forward a plan that would help the Federal Reserve fight inflation in the near term while putting deficits and debt on a more sustainable long-term path,” the policy group wrote. “The CRFB Fiscal Blueprint for Reducing Debt and Inflation provides a framework to tame inflation, reduce recession risk, address expiring policies, stabilize the national debt as a share of output, grow the economy, secure trust funds, and improve fairness and efficiency in the budget and tax code.”

View the report, recommendations, and more charts at this link.

Honk for demented joey!

Before the pandemic Congress generally required those seeking to spend money to show how the spending would be paid for. Along with the national debt limit, this limited spending. The pandemic broke this model. Just about everyone in Congress and many in the executive branch looked around the table and decided that the federal government would just PRINT all the money they wanted. (I say “print” but they didn’t even have to do that; some folks at Treasury and the Federal Reserve just add the necessary zeros.)

Once the linkage between revenues and expenditures is broken, the printing of money for domestic ends will never stop. Examples are Biden’s spending bills. Inflation is now deeply embedded. The debt-as-a-percentage-of-GNP will simply increase without end. And, eventually, we will be Argentina. Actually, we are already Argentina – it is just a matter of degree.

I’m thinking more Soviet Union. A nuclear power brought down by socialist finance policies.

But at the rate The Big Guy is going, Zimbabwe isn’t far off.

But, not to worry, the US Senate will now have John Fetterman working on the problem.

If you got it, spend it; if you don’t, spend it like you do! Fret about the details if it’ll ease your conscience; as for myself, I’ll see that the other guy pays!

But hey! Let’s keep spending. It’s not like the people in DC will ever pay the consequences.

Consequences are for little people. Like voters.

Churchill: the problem with socialism is eventually you run out of other people’s money.

The noted economist Herbert Stein (1916-99) left us Stein’s Law: “If something cannot go on forever, it will stop.” The big question for us, of course, is, what will be the manner and severity of the ‘stop?’ But who are we kidding; this unfathomable national debt, piled atop the government’s vast unfunded liabilities, will at some future event – big or small – surely push the nation’s tweaked economy right over a mile-high cliff. A disappeared supply of Costco toilet paper will then be the least of our worries.

What horse hockey. The national debt is completely sustainable at any level.

Remember that last time this country was debt free was 1837 and that the debt has been completely sustainable ever since then.

Wait a minute: Debt that was at a much lower level per GDP was a different story. It would just take a small increase to inflate your way to a, yet again, manageable level. Debt per GDP at what is being projected is WAY beyond that and will result in the currency being devalued to a point you cannot inflate your way out anymore. It’s called insolvency–but that is EXACTLY what our elitist globalist oligarchs want. Then, they get to rebuild us. We WILL hit the wall. Good and hard.

Really? That’s your rebuttal? It always has been?

Besides an argument for fiscal irresponsibility, you miss some basic points.

-the debt has never been this high.

-the debt is primarily held by countries who don’t like us.

-full faith and credit requires us to pay said debt. If China called it tomorrow we are obligated to pay in full. No one has that cash.

-the Biden spending orgy is why inflation is at a 40 year high. Keep pumping it up, our economy crashes in hyperinflation.

-civilization does not survive hyperinflation. Besides bankrupting everything, it historically paved the way for totalitarian governments who bring unspeakable atrocities with them.

-and on and on and on.

1-Modern Monetary Theory does not work.

2-The debt is obscenely high.

3-Like all good liberals, you live in the past while somehow being oblivious to history.

In case you missed the main point, the last time we made a serious attempt at paying the national debt was 1837. In the ensuing years the sky did not fall……In fact, in 1971 we went so far as to leave the gold standard in order to prevent any serious attempt by creditors to redeem their paper…..The sky STILL did not fall.

You might be on to something: national debt being a meaningless number.

We are entering an economic phase where government printing money up to a certain point doesn’t cause inflation. Inflation the last couple years is entirely due to idiotic anti-oil / natural gas government policies.

The proof of this was quantitative easing following the 2008 crash. The fed printed a LOT of money for years afterwards. No inflation until Biden and his greens took over. We may be entering a time where the fed needs to print money in an exponentially increasing amount yearly. Reason? Tech penetration into the economy, today at about 3%. Tech is profoundly deflationary, which is a really Bad thing. Cheers –

“The national debt is completely sustainable at any level.”

Nope.

.

Not a chance.

.

Reality. The US Federal Budget is comprised of two major parts. Discretionary spending, and non-discretionary spending. The non-discretionary spending includes things like Social Security, Medicare, and servicing the Federal Debt. Discretionary spending includes stuff like the Parks, RRs, the Military, etc…

.

Realize that if tax revenues remain constant, and servicing the debt increases, those payments have to come from somewhere. What programs, departments, or agencies will you pull funding from to service the debt? Or would you increase taxes instead?

Which of the two options will improve the economy? HINT: Neither will.

.

Let’s also add that the Federal Reserve is increasing rates. What happens when the cost to service your debt increases? Yep, you have to get the money to pay for it from somewhere, like discretionary spending.

.

Also, let’s talk about the money. The interest payments alone on the debt are going up higher than we are able to pay it. At the 2021 average annual interest rate, the interest alone on $32T of debt is $650B. That is the simple interest calc, not compounded, so add a few billion to that number. Let’s compare that to several high profile agencies. How many agencies would have to have their budgets zero’d out in order to pay the interest on the debt? Do you want to see the FAA go away? Would not make a dent. How about we get rid of the entire US military? Well, that would cover the interest, but who would care if you do not speak Chinese?

.

Anyone who thinks this level of debt is sustainable is clueless, and should spend their time suing their school district for the education they deserved, instead of posting comments on MRAK.

Of course you’ve harped on this during the Trump years, right CB? This only comes up when the Democrats are in power and immediately goes away when Republicans go on their spending sprees. Heheh!

I did.

Didn’t you?

Talk is cheap!

Agree, talk is cheap.

The question is… does the talk contain any substance? Please copy and paste anything you have posted on MRAK that is anything more than trolling in response to this comment.

Thanks!

Right after you paste anything suggesting that you, in fact, did harp on this during the Trump years CB. Heheh!

You are right on

I sure hope it’s foreigners buying those bonds and not my financial officer. I’d hate to be the fool who gets stiffed.

Let’s borrow and spend more asap so I can see the crash. It will be 3rd world and the rich will run leaving the rest of us to figure it out. Can’t wait to see a bunch of libs waking up and saying what happened. Silly fools

They need to have Biden pay it off, he’s got all the money from everywhere, Russians, all over the world he’s received billions..etc..

Welcome to the United States of Argentina.

.

Look south to see your future. It will be livable, but squalid.

In my circle at home and at work there is constant talk about all the “free money” out there. When I dare say that the “free money” ain’t free, I get met with the rebuttal that you have to get it while you can just to keep up with everyone else. There are entire careers made by getting “free money”, these people do not produce anything they simply exist to consume. It’s a house of cards folks and very few of us are producing the cards.

2 billion a year to indigenous communities.

Bury Biden and his band of merry idiots and the US won’t have a problem… but of course we have to now fix everything they have destroyed.

Comments are closed.