The public comments on Senate Bill 92, sponsored by Sen. Rob Yundt, were less than favorable on Monday in the Senate Resources Committee in Juneau, where the income tax bill was being heard.

After a brief introduction by Yundt of Wasilla of only perhaps 80 words, the committee opened up meeting to public comment.

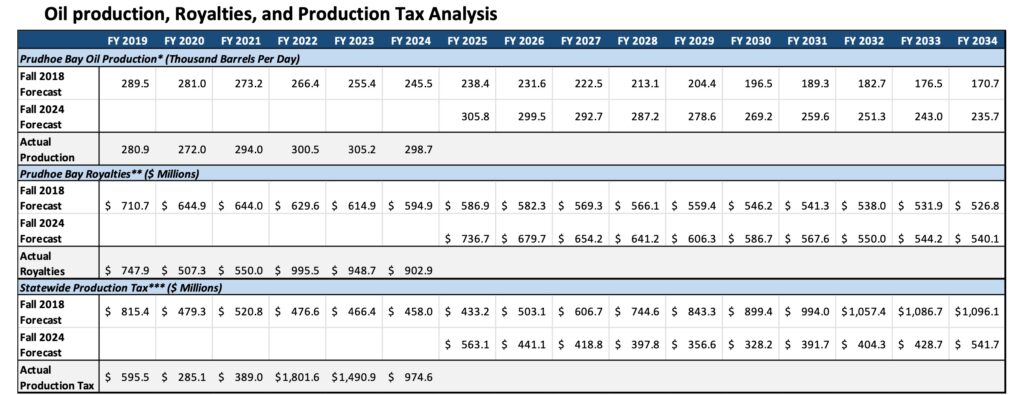

Yundt had not arranged for any favorable invited testimony. The lawmakers did not ask Yundt a single question about his impactful bill. And the committee members did not ask about the chart provided by the Department of Revenue that showed how in 2021 when Hilcorp came into the state and took over from BP, oil production went up, as did royalties and production tax to the state. Revenues took off immediately in 2022.

Kara Moriarty, president of the Alaska Oil and Gas Association, testified that AOGA strongly opposes targeted taxes (SB 92 is a targeted tax), and that the AOGA position comes with 100% support of the organization, which is made up of the oil and gas producers in Alaska, most of whom would not be affected by the Yundt Tax.

The tax was designed to target Hilcorp, because it is an S corporation that is not taxed in the same way that C corporations are taxed.

Moriarty called it a new discriminatory and also a retroactive tax income tax on a “limited number of firms.”

In 1980, the Alaska Legislature eliminated the income tax on individuals and pass-through entities, such as privately owned S corporations, she reminded the committee.

“Senate Bill 92 seeks to reinstate an income tax, but only on pass-through entities and only pass-through entities in the oil and gas sector, and only those oil and gas businesses with incomes exceeding $5 million,” Moriarty said. Out of approximately 11,000 S corporations filing taxes in Alaska, this legislation appears to be aimed at one or two individual companies within that category.”

AOGA has long oppose any type of tax retroactivity, she said, as it it undermines stability, business confidence and investment climate. In addition, without proper modeling, the full impact on businesses is unclear, as there has not been any modeling of the Yundt Tax.

The tax also appears to impose double taxation on entities already subject to corporate income tax, she said.

Others who testified against the bill included Laila Kimbrell, president of the Alaska Resource Development Council; Jerry Webre of Little Red Services; Lester Black of the Alaska Support Industries Alliance; Kelly Droop of Anchorage; Kati Capozzi, president of the Alaska Chamber of Commerce; and Tom Walsh of Petrotechnical Resource of Alaska.

Only one person testified in favor of the bill. That was Caroline Storm, executive director of the Coalition for Education Equity, a group that litigates against the state for not providing the desired funding to schools. Storm, a Democrat, ran for State House in 2022, losing to then-Rep. Craig Johnson of south Anchorage.

Although the committee received responses from the Department of Revenue to its questions, and even though Dan Stickel, chief economist of the Tax Division of DOR was on the phone line during the hearing, the committee never once asked about the responses he had given to their questions.

That document from the Department of Revenue is here: