By PEDRO GONZALEZ

The Alaska LNG Project moved closer toward becoming a reality this week. It’s a big step for Gov. Mike Dunleavy, who has just two years left in office.

During a press conference hosted by Dunleavy, Frank Richards, the president of the Alaska Gasline Development Corporation, announced that the state-owned energy corporation was in private talks with an unnamed entity—later revealed to be the Glenfarne Group—to lead development. “The terms of the framework agreement are being negotiated or have been negotiated; the next step is for both parties to create a legally binding development agreement that will move the project forward,” Richards said.

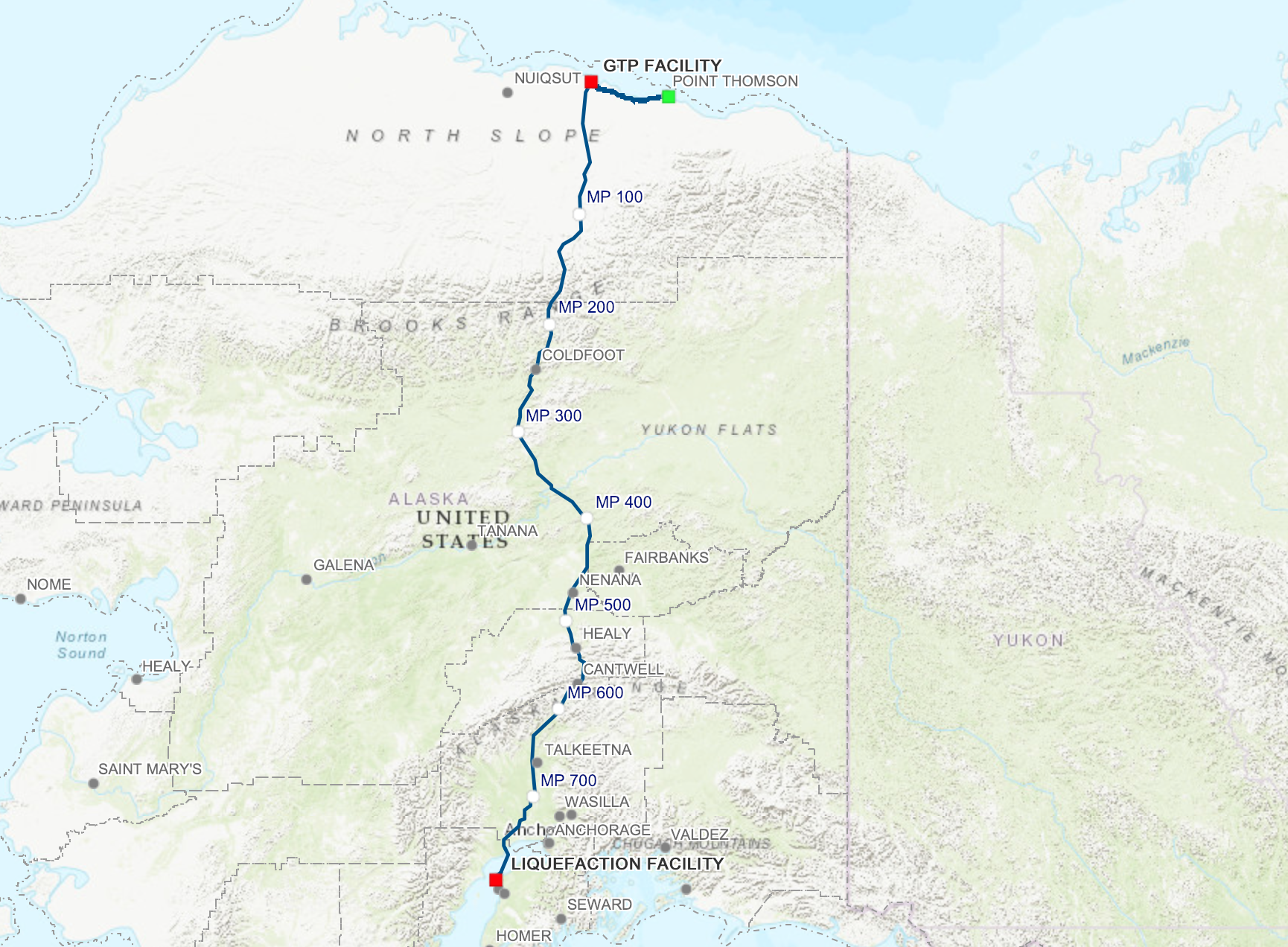

The announcement raises a few questions about the nature and funding of the pipeline, which would transport gas out of the North Slope to be shipped abroad, primarily to Asian markets.

John Boyle, the commissioner of the Alaska Department of Natural Resources, said during the press conference that the Cook Inlet is a “mature oil and gas basin” where, over the last 70 years, all the “easy to reach, low-cost economic oil and gas has already been produced and developed.” A period of renewed investment in the inlet has yielded some fruit but also cultivated a sense of complacency, Boyle said. He framed the Alaska LNG Project as a way to drive more activity.

In December, the Alaska Industrial Development and Export Authority approved a $50 million backstop for the project. Richards said that the money might not be needed but that it would serve as a way to minimize risk for Glenfarne.

“They would like to make sure that there is a backstop, meaning that they would be paid should the project not take the next logical step, which is final investment decision,” he told KDLL.

What protects Alaskan taxpayers from cost overruns or even failure?

Last summer, AGDC entered into a gas sales precedent agreement with London-based Pantheon Resources, which both parties say will lower the cost of the project. Pat Galvin, a senior executive at Pantheon and the husband of Rep. Alyse Galvin (I-Anchorage), told Alaska Public Media that the economics “look extremely positive.”

That outlook seems at least as optimistic as the AGDC’s forecast that the project could provide gas to Southcentral Alaska by 2029.

More critically, questions about transparency and process linger.

In a press release, Pantheon executive chairman of resources David Hobbs welcomed the news that AGDC had reached an “exclusive Framework Agreement with a private company” to lead and fund the development of the project. But what criteria did this Glenfarne meet? The Alaska Landmine news organization initially received a tip that Glenfarne was the then-unnamed private company. Shortly after that, the AGDC confirmed it with a public statement “in the interest of transparency.” However, it seemed to only come after the group’s identity leaked. Why the secrecy in the first place? It’s unclear.

An ambitious firm, Glenfarne took control of Texas LNG in 2019 through its subsidiary, Alder Midstream, and is also the owner of Magnolia LNG in Louisiana.

Notably, both the Texas and Magnolia projects were highlighted by JiaQi Bao, who worked for the Chinese government’s National Development and Reform Commission, to Hunter Biden, President Joe Biden’s son, in 2017 as potential business opportunities with regard to LNG and China, according to leaked emails.

Bao, who was then an adviser to the Biden family, also pointed to a Bloomberg News story from the same year that named the AGDC as one of several “companies tentatively listed as working on China-related deals” amid Donald Trump’s first presidential trade mission to China.

This project has been in the conceptual stage for more than five decades. It is understandable that Dunleavy wants to finally get it done before his tenure comes to an end. Nevertheless, there are lingering questions that, if answered, would go a long way toward assuaging the concerns of Alaskans.

Pedro Gonzalez is writer at Must Read Alaska.