By Michael Tavoliero

Modern Alaska “neo-feudalism” is not chainmail and castles. It is a thicket of agencies, boards, state corporations, grant pipelines, and licensed guilds wedged between Alaskans and Alaska’s wealth. Citizens don’t receive ownership; they file paperwork. A political class and its contractor class dole out permissions, exemptions, and program money while protecting captive markets. In that system, the Legislature’s priority is not direct, universal household benefit; it is keeping the gatekeepers funded, and the public stuck at the tollbooths of a neo-feudal bureaucracy.

The 2025 cleanest and one of two real “tells” of the Alaska Legislature’s organization and enforcement of Alaska’s neo-feudal bureaucracy is the PFD gap. The Governor pointed to a statutory dividend of about $3,892, and the Legislature delivered $1,000, because money works better when it is circulating through “programs” in Juneau than when it is sitting in Alaskans’ wallets. That is the neo-feudal trick: tighten households, then sell them relief through managed help complete with paperwork, overhead, and gatekeepers.

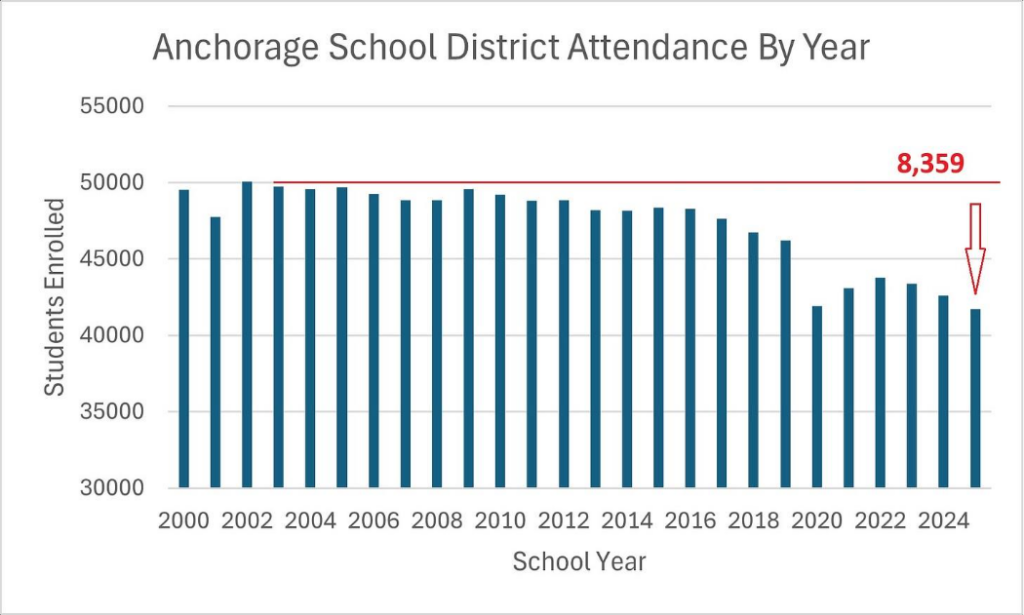

Education is the other “tell.” We have got too many dunces masquerading as political brainiacs insisting Alaska’s education problem is solved by pouring in “just a little more money.” HB 57 turned the “just add money” myth into law, boosting the BSA by $700 and adding requirements, then getting vetoed by Gov. Dunleavy for lacking real reforms to improve outcomes. The Legislature overrode him anyway, underscoring the structural problem: when “help” is routed through the existing system, new dollars are typically absorbed by fixed costs, administration, bargaining, and compliance long before families see measurable gains in reading, graduation, or classroom quality.

When lawmakers say, “we helped Alaskans,” the neo-feudal read is simple: they sell outputs while protecting the machine, help routed through budgets, boards, regulations, administrators, and symbolism, while the one co-owner trust mechanism that treats every eligible Alaskan the same, the PFD, gets minimized. Whether you call it “lying” is moral; the provable point is that the public story of universal trust benefit rarely matches the way the money and power flow.

Taken together, the 2025 bills were not random, they reflect a governing style: thin direct household benefit, “improvement” mostly as expanded state capacity, and plenty of symbolic signaling, while the one universal, non-bureaucratic trust benefit, the dividend, is minimized. That is neo-feudal mechanics: wealth circulates through intermediaries who control access and dependency, while the public narrative calls it “help” even as the system feeds itself first.

In Alaska’s payroll-and-vendor state, the budget is the “benefit” engine: HB 53 (PFD), HB 55 (Alaska’s mental health budget bill), and SB 57 (Alaska’s 2025-2026 capital budget/capital appropriations bill) move money first to agencies, payrolls, vendors, and contractors, and only secondarily, if at all, to households. HB 53 is the lone direct household lever because it contains the PFD; HB 55 and SB 57 mainly fund institutional activity and delayed, indirect outcomes. The pattern is predictable: agencies and vendors get paid, rules control access, families rely on administrative gateways, and universal cash benefits get crowded out under the banner of “protecting services, jobs, or projects.”

In the gatekeeper-and-guild state, government grows through permission layers, boards, licensing, compliance, and prior-authorization rules that decide who may work, offer services, or even receive care. Alaska’s 2025 maintenance bills (SB 80, SB 137, HB 121, SB 132, SB 133, government-operations and regulated-industry maintenance bills) keep gatekeepers entrenched and expand the administrative glue, regulated professionals, compliance staff, and consultants who live off the rules. Competition gives way to “approved pathways,” citizens and small businesses rely on intermediaries, and universal relief gets crowded out because complexity always comes with a payroll and a permanent excuse.

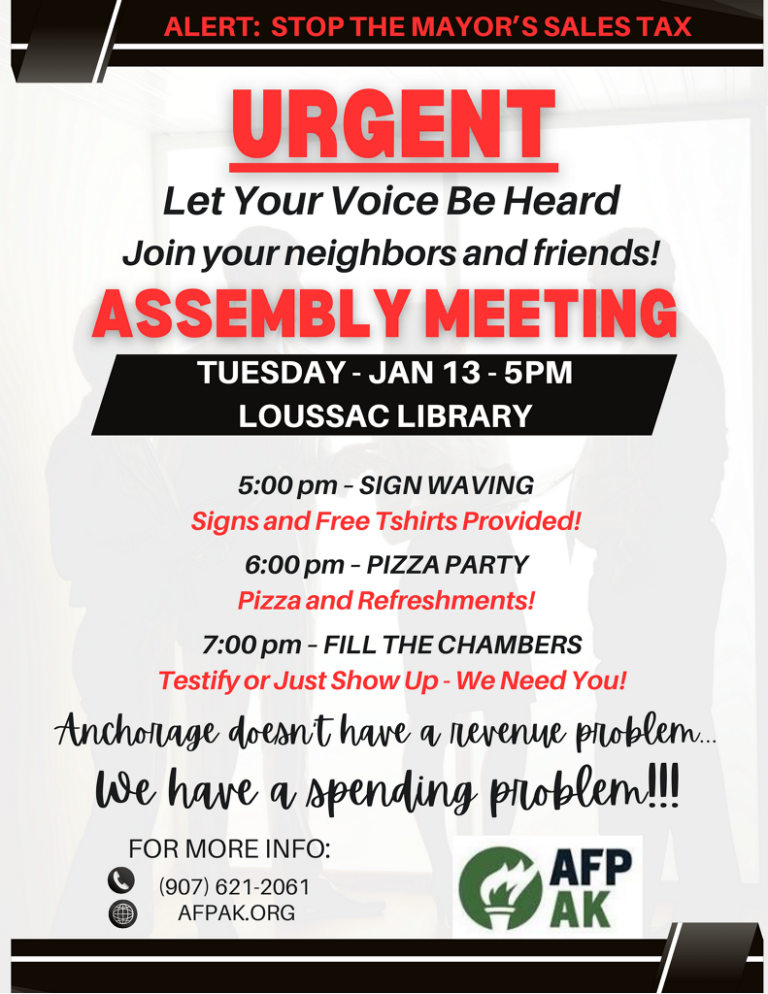

In the constituency state, policy becomes targeted deals, childcare aid and credits (SB 95, SB 96), fishing supports (HB 116), guide permits (SB 97), even directed-loan ideas (SB 156, vetoed). The benefits may be real, but they come through eligibility gates, permits, and administrators, so someone must be approved, processed, and renewed. Institutions get paid, access is controlled, recipients become dependent on legislative continuation, and universal relief like the dividend gets crowded out by concentrated stakeholders fighting for their slice while the public stays diffuse.

In the legitimation state, symbolic bills, like SB 43 (Women’s History Month), SB 60 (May 12 as Myalgic Encephalomyelitis/Chronic Fatigue Syndrome Day of Recognition), and SB 152 (renaming Ruby Airport), let lawmakers say “we acted” without changing outcomes. They are politically cheap, but they buy moral signaling and institutional legitimacy while consuming attention that could go to real reforms, cost drivers, performance accountability, dividend policy, and regulatory pruning, dulling pressure for anything that actually improves household conditions.

HB 57 is the template for institutional capture: “help” is defined as more money routed through school systems, even when outcomes are contested and household value is uncertain because the underlying drivers of performance remain untouched. District payrolls and fixed costs get paid first; education bureaucracy and compliance rules control how funds flow; and families stay dependent on institutional performance rather than gaining portable purchasing power. The result is that the case for direct household control, letting families allocate more of their own share of Alaska’s wealth, gets crowded out by the system’s preferred answer: fund the institution and call it help.

Alaska’s wealth could flow straight to households, but Juneau keeps rerouting it through a tollbooth maze, agencies, boards, contractors, grants, compliance systems, and “approved” providers, each skimming overhead, tightening paperwork, and converting owners into applicants. Cut the dividend and families do not just lose cash; they are shoved onto the longer road, charged more tolls, and thanked for their patience while being told the detour is “help.”

In 2026, expect the same soft tyranny with better branding: the universal benefit treated as optional, the routed spending sold as compassion, and bureaucracy claimed as a substitute for household prosperity.