The sectional analysis of the Walker Payroll Tax shows that the Revenue Department believes that “Adding a broad based tax would be a significant challenge to the Tax Division,” and would require a budget of $10 million and a staff of 40.

The tax, which Gov. Bill Walker has asked the Alaska Legislature to consider in the fourth special session of the year, would bring in $320 million a year in revenue to the State in 2020.

Here is HB 4001’s sectional analysis in full, as prepared by Ken Alper, director of the Tax Division, and approved by Commissioner Sheldon Fisher:

BILL ANALYSIS

The bill establishes a payroll tax on both wages and self‐employment income earned in Alaska. It applies equally to both residents and non‐residents.

The amount of tax is equal to one and one half percent (1 1/2%), with a maximum tax “cap” equal to two times the permanent fund dividend distributed in the previous calendar year. If the dividend is less than $1,100 as adjusted for inflation, the maximum cap is $2,200 instead.

The tax will be withheld by employers and remitted to the state. Employers of contract employees who are required to report this to the federal government, will be required to send comparable information to the state. Self‐employed individuals shall report and pay directly to the state.

The Department of Revenue is given broad powers to administer the tax, including drafting regulations, determining what business income is from a source in the state and thus subject to the tax, collecting withholding taxes, and paying tax refunds. Portions of the Internal Revenue Code are adopted by reference.

REVENUE IMPACT

The Tax Division has modified their existing income tax revenue model to estimate the approximate number of taxpayers and their associated tax burden. The bill would take effect on January 1, 2019, meaning that the tax for calendar year 2019 would be due in early 2020.

At full implementation in FY2020, revenue will be about $320 million / year. Revenue in FY2019 will be half that number, $160 million, based on the tax taking effect in the middle of the fiscal year. Impact could be partially mitigated because this will likely qualify as a state income tax for federal tax purposes, meaning it would be deductible on Schedule A of form 1040. Therefore, Alaskans who itemize could be able to reduce their federal taxable income by the amount of their state tax.

IMPLEMENTATION COST

Adding a broad based tax would be a significant challenge to the Tax Division. We have recently completed implementation of Tax Revenue Management System (TRMS), an integrated online tax application used by both taxpayers and administrators for the 25 tax programs currently overseen by the Division. We expect to engage FAST Enterprises, the TRMS contractor, to build a new module for this tax into TRMS.

Among the supplemental funds requested for FY2018, the Department intends to use about $300.0 to begin the implementation process. With this, we will engage a contractor with experience building a statewide tax structure impacting individual workers. An essential deliverable of the outside contract will be an implementation plan that includes staffing, infrastructure, and additional outreach needs. We will also contract for more advanced data servicesin order to more accurately forecast future revenues.

The $10,000.0 capital request reflects an estimate for our contract with FAST to add the new tax module as well as the Department’s other short term implementation costs. This is a multi‐year process and much of the actual spending will not occur until after we begin collecting revenues. In addition to the software development, this will require integration with national accounting and tax software vendors in order to update programssuch as TurboTax and QuickBooks to incorporate Alaska. In addition to the tax return filing and examination modules, the contractor will have to provide for the associated databases, forms, communications, and integration with our existing imaging, accounting, and collections systems.

Currently, the Department of Labor administers the Employment Security Tax, which establishes a relationship for data and tax collection with most employersin Alaska. It is possible that some efficiencies could be achieved by linking these databases. However, the proposed legislation adds at least three major functions that do not exist within the Employment Security Tax. These are: receiving and processing individual (rather than employer aggregated) tax returns, receiving direct payment from self‐employed individuals, and providing refunds in the event of overpayment.

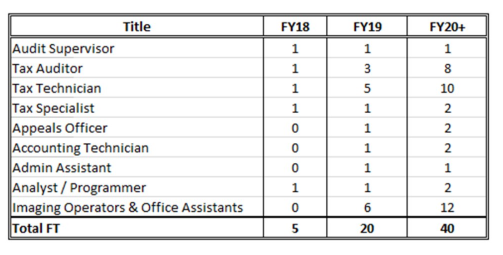

The department envisions a gradual ramping up of the staff needed to collect and administer the tax.

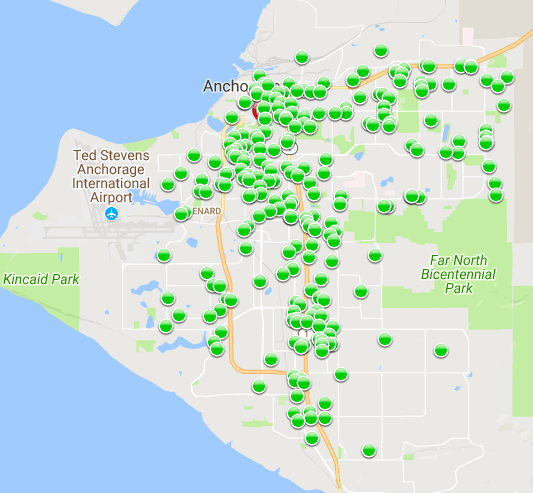

At full implementation, we will have about 40 additional staff. We expect the new staff to be roughly split between our Juneau and Anchorage offices. The staffing need is substantially less than what would be expected for a full income tax for two major reasons. First, the complex task of apportioning income among multiple states is greatly simplified by the bill structure. And second, the size of the tax cap reducesthe expected need for complex audits of high income individuals.

Additional travel is largely for public education efforts, as well as the need to train new staff on the tax management system. Cost for Servicesreflects primarily internal “core services” paid to other state agencies, due to the substantial growth in the overall size of the tax division staff. Commodities are primarily subscription data services; the Tax Division anticipates needing to procure additional data to better forecast revenue from individual Alaskan and nonresident worker taxpayers.

The department anticipates that taxpayers will file online at approximately the rate currently achieved by the Permanent Fund Dividend Division. If a substantially larger portion choose to submit paper returns, the staffing needs would increase accordingly. Throughout the six‐year period covered by this fiscal note, we anticipate total implementation costs, operating plus capital, to be less than 2.5 percent of additional state revenue.

An initial analysis of the staff needs within the Tax Division to implement a personal income tax is as follows: