HARASSMENT IS UNACCEPTABLE

BY REP. MIKE CHENAULT

In the wake of the Harvey Weinstein revelation, it has been a painful time for all, especially for the many, many women harassed, abused and taken advantage of by a culture that has allowed and too often turned their heads to such injustices. For the women speaking out, I both applaud their courage and apologize for our society’s cultural and callous indifference to the challenges and abuse they have faced.

As a father who has raised four wonderful young women, I have always believed in the importance of gender equality, concerned about the opportunities that society would present them and the plights they would face from a less than perfect world. As a legislator, l supported many matters important to women and learned a lot about women’s issues and the inequalities they faced. I closely followed the Choose Respect campaigns and have wholeheartedly supported these efforts.

Yet nothing, absolutely nothing, has prepared me until now or made me understand the prevalence of sexual abuse and the dehumanizing behavior that women routinely face. In the wake of this scandal, I now see and understand the magnitude of this problem and how women have been taken advantage of, exploited and shamed with little if any consequence to the men taking these unwanted liberties.

Frankly, I am saddened and shocked that a country as enlightened and great as ours would tolerate and show such indifference to this cultural abhorrence.

As a father and a legislator, I had no idea of the extent or peril women regularly faced. I now understand that this issue is of epidemic proportion, that women have learned to live with. Society has too long tolerated this behavior. This is unacceptable and must change.

This isn’t just about rape and sexual harassment; rather, it is about holding ourselves to a higher standard toward a culture of respect. We have laws governing the most egregious acts such as rape and sexual harassment. We need to end not only the most egregious acts against women; but, also the insensitive and dehumanizing behavior they otherwise are sometimes forced to face as well.

Awareness is the first step to change. The many women speaking up on social media with the #MeToo campaign should be heralded for sharing their anguish and courage in speaking out.

These two simple words, #MeToo, cannot begin to describe the scars, emotional pain and torment that many of these women have faced. The names I see coming forward on Facebook are people we know – – our neighbors, relatives and friends – – and not just movie stars and Hollywood celebrities.

Hopefully, history will record this candor of courage and recognize it as a pivotal and important beginning point in a cultural shift that does not tolerate such unwanted advances and behavior that women have been routinely forced to live with. Let’s hope these dynamic women, like the suffragettes of 100 years before, will help lead change and make Alaska and America better.

As individuals and as a community, we need to come together, recognize that a woman’s body is not for the taking and show them the respect, dignity and courtesy they deserve. We must put an end to this cultural nightmare that our mothers, aunts, sisters, wives, daughters, friends and co-workers have suffered and been traumatized by.

Each of us, beginning now, needs to make a commitment to help insure that our communities, our work places and schools are safe for women.

Women need to know that we as individuals, communities and employers respect them and that we will not tolerate sexual harassment, dehumanizing and predatory behavior from anyone.

I will be sitting down with my colleagues in the legislature and explaining that we need to provide awareness and sensitivity training and that we should have a zero tolerance policy for such behavior. I hope employers across Alaska and America will follow suit. Each of us can play an important role and take responsibility to end the routine occurrences of this nightmare. Together, we can make a difference. Choosing respect is the answer.

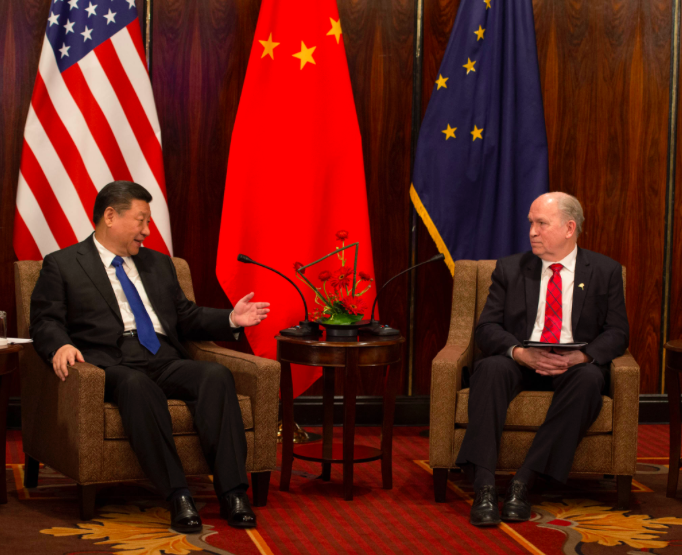

Mike Chenault is the former House Speaker, and is a Republican representing District 29, Nikiski. He was first elected to the chamber in 2000 and has filed a letter of intent to run for governor.