CONOCOPHILLIPS EXECUTIVE DESCRIBES PROGRESS SPARKED BY SB 21

In an upbeat report to a legislative committee this week, ConocoPhillips says its production in Alaska may grow by as much as 100,000 barrels per day in the near future.

Much of that increase is due to a more competitive tax structure known as SB 21, the More Alaska Production Act, passed in 2013.

The predicted increased will add to the 500,000 to 530,000 barrels a day flowing through the Trans Alaska Pipeline System.

Scott Jepsen, Vice President for External Affairs for ConocoPhillips, told a joint House and Senate Natural Resources Committee on Monday that new developments, technology, and exploration successes across the North Slope are leading to significant new production, revenues, and future job growth.

He added that keeping the current tax structure stable is critical to keeping Alaska competitive with the Lower 48.

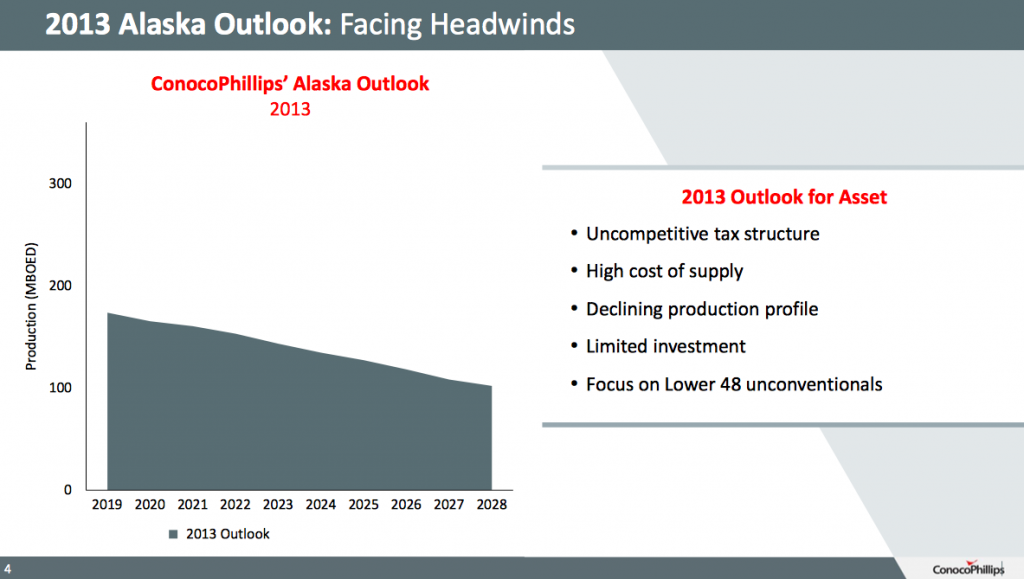

Jepsen shared a slide showing what the company’s outlook was in 2013, with a downward trajectory.

“Basically we had an uncompetitive tax structure and a high cost of supply and we were investing our monies elsewhere. We had a big focus on the Lower 48 unconventionals and our production profile here in Alaska was a 6- to 8-percent decline profile,” he told the committee.

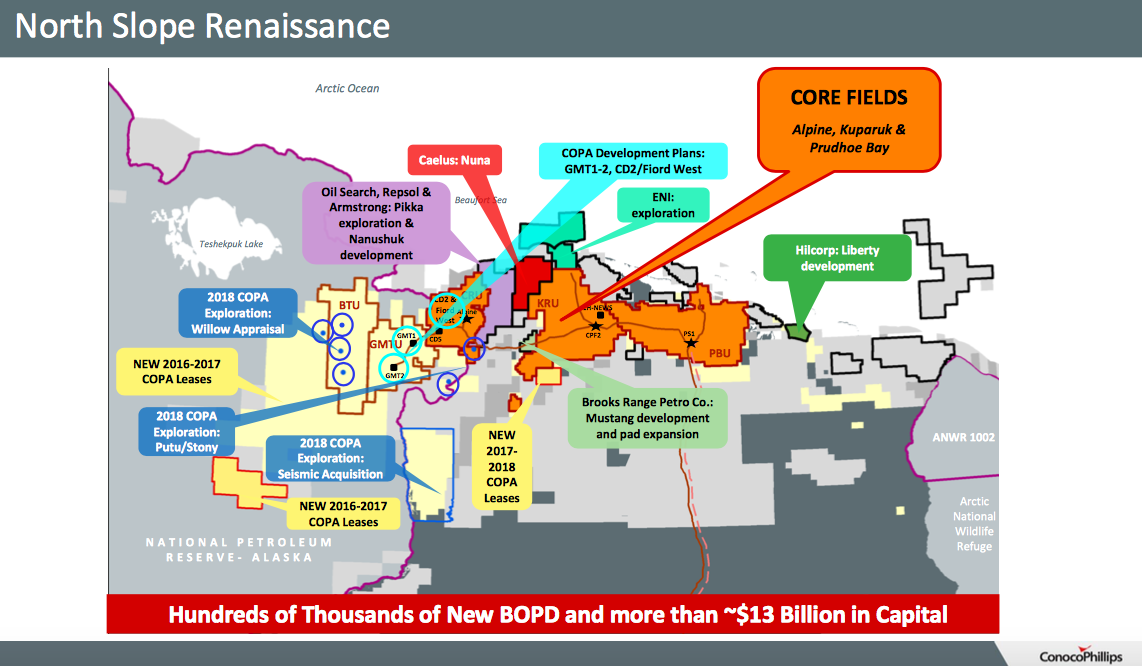

To drive the point home, Jepsen then showed the committee what the outlook is today, compared to the bleak outlook of 2013. It is decidedly more optimistic:

Jepsen suggested there will now be higher production in 10 years from the company’s efforts on the North Slope and the National Petroleum Reserve Alaska; Alaska will see 200,000 more barrels a day of oil flowing through the pipeline than the company had estimated prior to 2013.

What changed? What happened?

“Well, one of the things that changed is we ended up with a different tax structure in SB 21, which has helped basically keep Alaska in the game. It’s a more competitive fiscal tax structure,” he said.

Gov. Sean Parnell championed SB 21 and it passed in 2013, but Democrats in the House and Senate opposed the flattening of the tax structure, and a group of tax promoters who wanted the previous structure back took it to the voters in a referendum in 2014.

But voters decided to give SB 21 a chance. Even so, it was an issue that divided Alaskans — should oil be taxed higher as it reaches higher prices, or should the tax flatten out as the price of oil increases? Gov. Bill Walker was among those who opposed SB 21, wanting a progressive tax structure that the old ACES structure offered. But he also promised he would honor the choice voters had made on the SB 21 ballot referendum.

The House Democrats that control the majority have wanted to double the effective tax rate at the current price, and wanted to triple it if prices reached $70 a barrel, which is where prices have been since November. The House Natural Resources Committee is co-chaired by two of those tax promoters — Andy Josephson and Geran Tarr.

Jepsen told the committee that technological improvements and cost reductions are also making Alaska more competitive with other company projects around the country.

In Alaska this year, the company had drilled the longest lateral stretch on land that has ever been drilled in North America — 21,000 feet — a result of improved technology.

“That’s a huge game-changer,” Jepsen said. The company recently contracted with Doyon to drill an extended reach well with a bigger drilling machine that will allow lateral drilling to 37,000 feet. The company can explore 154 square miles from a 14-acre drill site.

For comparison, in early Prudhoe Bay exploration in the 1970s, the drilling pads were 65 acres and the drilling reach was three square miles.

As for projects happening right now, Jepsen said Greater Mooses Tooth 1 will have first oil in the final months of this year and produce around 30,000 barrels a day during peak production. Greater Mooses Tooth 2’s production will be higher than originally estimated, at more than 30,000 barrels a day, but will be more expensive to build out due to the increased number of wells planned.

During the two winter construction seasons, GMT 1 provided 700 construction jobs, and GMT 2 is expected to be the same.

The Fiord West site will be drilled from CD2, with extended reach drilling, and first oil is planned for August, 2020.

For the Bear Tooth Unit, where the Willow discovery is, there will be thousands of construction jobs, and the development will be similar in scope to the Alpine field, where ConocoPhillips has a stake.

In the Putu 2, Putu 2A, and Stony Hill areas, the company has found 100-350 million barrels of resource.

With the Willow discovery, with an estimated 400-470 million barrels of oil, a final investment decision won’t be ready until 2021.

ConocoPhillips is Alaska’s largest crude oil producer and one of the largest holders of state, federal and fee exploration leases in Alaska, with approximately one million undeveloped acres.