The federal government has spent $855 billion more than it has collected in fiscal year 2024, which began Oct. 1, resulting in a national deficit. The government has collected $2.96 trillion in revenue, according to the U.S. Department of Treasury.

In fiscal year 2023, the federal government collected $4.44 trillion in revenue, with primary source of revenue being individual income taxes.

In 2023 the federal government spent $6.13 trillion in government programs, with the majority spent on Social Security.

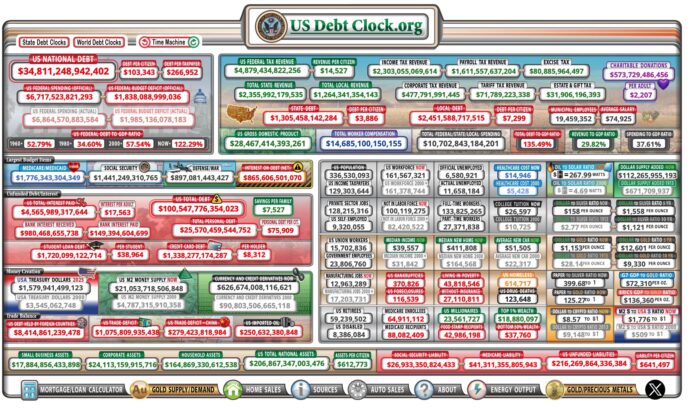

In this fiscal year, however, the majority of expenditures is on Medicaid/Medicare (socialized medicine), at over $1.7 trillion; Social Security at over $1.4 trillion; Defense at $900 billion; and interest on national debt at over $865 billion a year.

As far as what the U.S. government owes its lenders, it’s now more than $34.8 trillion. Four months ago, it was $34.2 trillion.

View the U.S. Debt Clock at this link.

The national debt obligation for each citizen — taxpaying and non-taxpaying alike — is now over $78,000 per citizen. Debt-to-GDP ratio, a measurement of fiscal soundness, exceeds 121%. Back in 1960, the debt-to-GDP ratio was less than 53%.

The debt-to-GDP ratio indicates the country’s ability to pay back its debts.

“A country with a high debt-to-GDP ratio typically has trouble paying off external debts (also called public debts), which are any balances owed to outside lenders. In such scenarios, creditors are apt to seek higher interest rates when lending,” Investopedia explains. “A study by the World Bank found that countries whose debt-to-GDP ratios exceed 77% for prolonged periods experience significant slowdowns in economic growth.” Every percentage point of debt above 77% costs countries 0.017 percentage points in economic growth.

The U.S. debt-to-GDP for Q4 2023 was almost double 2008 levels, the investor information website says.

The U.S. government finances deficit spending by issuing U.S. Treasuries, which are historically considered to be the safest bonds with the least amount of risk in the world.

The 10 largest holders of U.S. Treasuries (as of March 2024) are:

- Japan: $1.2 trillion

- China, Mainland: $767.4 billion

- United Kingdom: $728.1 billion

- Luxembourg: $399.3 billion

- Canada: $359.1 billion

- Ireland: $317.8 billion

- Belgium: $317.1 billion

- Cayman Islands: $302.9 billion

- France $283.1 billion

- Switzerland $262.9 billion