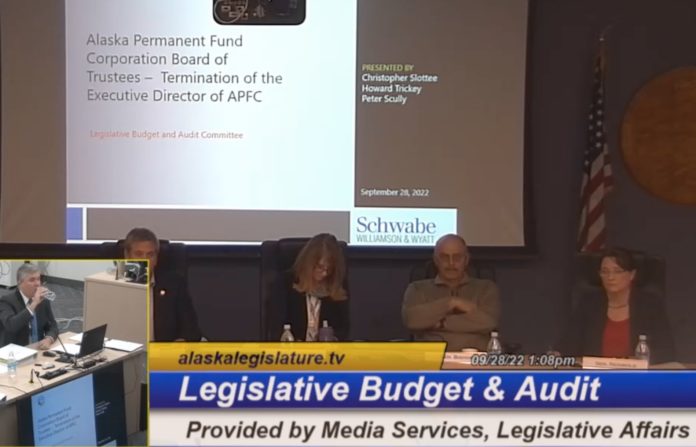

For several hours on Wednesday, lawyers hired by the Alaska Legislative Budget and Audit Committee attempted to get through their presentation of their final report to the committee, which had hired them to dig into why Angela Rodell was fired last December by the Alaska Permanent Fund Board of Trustees.

But the investigators were interrupted repeatedly by the lawmakers.

Rodell, when she was fired, threatened political retribution against the Permanent Fund trustees, a point that was brought up Wednesday by attorneys for Schwabe, Williamson & Wyatt, the law firm hired by the committee for $100,000 to investigate whether Rodell herself had been targeted by the Dunleavy Administration.

The partisan lawmakers on the committee completely ignored the fact that Rodell had made a political threat. And they ignored the fact that attorneys found no such involvement by Gov. Dunleavy, as Rodell had alleged to the committee last winter.

The $150,000 of public funds got the committee a 65-page report — costing the state over $1,700 per page. The most damaging finding was that the trustees could have had a better process for firing Rodell, but that finding was softened by the statement that when a board loses confidence in a CEO, the board members don’t have to produce any specific one incident that leads them to fire the CEO. The board’s loss of confidence is legally sufficient. Members of the Permanent Fund Board of Trustees had different reasons, but all but one of them shared a loss of confidence in Rodell. The presentation showed that Rodell had simply not managed the relationship between herself and her bosses.

The conclusions were not making Rep. Andy Josephson happy. A trial attorney himself, he kept interrupting and badgering the presenting attorneys to agree with him that Rodell could easily sue the state for damages for being fired. He kept trying to figure out a way to make the trustees appear they’d done something illegal. The attorneys were not going along with Josephson, however. After all, anyone can sue for being fired.

A few of the committee members — Josephson, Rep. Ivy Spohnholz, and Sen. Natasha von Imhof, especially — felt it was more important that they make extensive and interruptive comments than that the presentation could continue in an organized fashion. This constant interruption appeared to be because they were not getting the answers they wanted.

Attorneys Howard Trickey and Chris Slottee, sitting before the committee and attempting to get through their presentation, were repeatedly quizzed by the legislators who usually also vociferously oppose the governor and who were eager to put words in the attorneys’ mouths and recharacterize their comments for the record.

At times, the presenting attorneys reminded the committee that the specific concerns the Permanent Fund trustees raised about Rodell’s firing would come later in their presentation. If they could get to it.

In one instance that illustrates the willful disregard of facts being presented to them, Committee Chairwoman von Imhof stated on the record that the trustees “only” used the negative comments made by staff members, and had ignored all the positive comments.

That was not what the investigating attorneys had repeatedly told the committee. They said that Permanent Fund Board trustees relied more heavily on the negative comments by the fund’s investment staff than on positive comments made during Rodell’s evaluation.

The attorneys showed professional patience with the committee but were not able to advance through the presentation, as the interrogations and comments by committee members ended up dominating the committee hearing, which lasted several hours.

Takeaways from the official report to the committee:

- Nothing in the official report paid for by the committee contradicts anything in the independent review paid for by the trustees themselves.

- The investment staff of the Permanent Fund Corporation were increasingly critical of Rodell’s management, as evidenced by the “360” review that the trustees conducted.

- Rodell interfered with the board’s own election of its officers, discouraging them from electing Lucinda Mahoney as vice chair.

- The board could have used a more consistent form of performance measurements throughout the years that Rodell was at the helm and could have provided more clear standards for management performance.

- There is no credible evidence supporting Rodell’s claim to the Legislature that she was fired by the governor or that he was involved in any way in her performance review or firing.

Rodell was executive director of the fund from 2015 until December 2021. She had been appointed by former Gov. Bill Walker, who had actually wanted to hire his political ally Brian Rogers of Fairbanks, who was then the chancellor of University of Alaska Fairbanks. Rodell had been part of the Parnell Administration as commissioner of Revenue. But Walker was pressured to hire someone with actual investment experience, which Rodell, former commissioner of Revenue has. Her performance reviews were relatively positive until about 2018, when they began to deteriorate and her scores on her evaluations fell year after year.

The Permanent Fund trustees tried to maintain Rodell’s privacy during the process of announcing her firing last December, but she chose to make it a political firestorm, having warned them that she would do so.

When former board Chairman Craig Richards, who was first appointed by Walker to the board in 2015, and has been reappointed by Dunleavy, was called up in front of the Legislative Budget and Audit Committee last winter to describe why Rodell was fired, he demurred out of respect for employment privacy concerns. But the ensuing investigation has shown the board was justified, as it no longer trusted Rodell, and felt she was manipulating the board and pursuing her own political agenda.

All the committee was left with on Wednesday was an idea that Jospheson, von Imhof, and Spohnholz advanced: They want the Legislature to take control of who is appointed to the Permanent Fund Board of Trustees and remove the ability of the governor to appoint members of his cabinet to the board.

The Schwabe, Williamson & Wyatt report and presentation is at this legislative link.

The trustees’ report, conducted simultaneously, was released on Tuesday to Must Read Alaska, as a result of a public records request, and is in this earlier story: