By JON FAULKNER

In 2023, Haines residents uncovered actions they perceived as unjust methods for assessing private property. As these actions came to light at a local level, a more widespread problem emerged within Alaska’s municipal taxation statutes that are supposed to protect individuals’ rights and the public interest from bad actors.

Subsequently, Alaskans become alarmed. Sen. Jesse Kiehl recently announced that he will be introducing a bill to improve Alaska’s property tax assessment procedure. Kiehl stated that “when the government takes money, it needs transparent, fair processes to do it … Many Alaska municipalities already follow all the best practices I’m drafting into a bill. For them nothing will change. But for others, a few additional guardrails are in order.”

The Real Deal with Kiehl, February 3, 2024

The senator’s announcement comes after months of public outcry, a citizen’s petition that resulted in the cancellation of the Haines assessor’s contract, the resignation of the state assessor, and the publication of a white paper on Restoring Public Trust in Alaska’s property tax assessment process.

Excessive property assessments in Alaska have become a source of bipartisan concern. Assessing property at its full and true market value is required by AS 29.45.110. However, Alaska statutes permit broad interpretations and subjectivity that invite unjust outcomes and undermine the guarantee of a fair, just, and equitable tax structure. This means some properties are assessed excessively, causing a detrimental effect on community investment by making homes and commercial property more unaffordable for both owners and tenants.

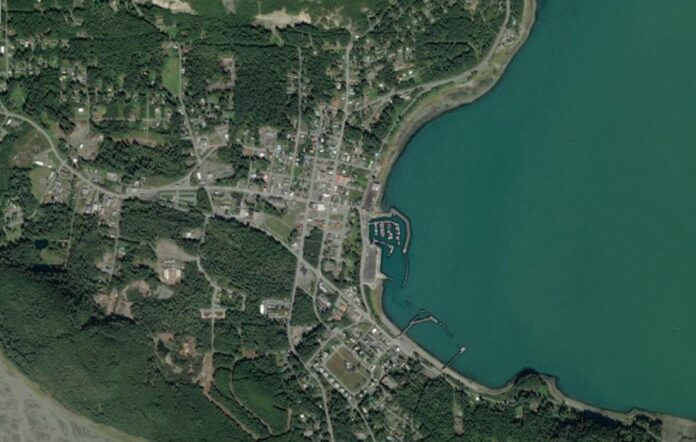

One outcome appears to be a loss of public trust in Alaska’s property tax assessment process. The Haines assembly voted unanimously to cancel an agreement for services with the community’s property tax assessor, Michael Dahle. Following months of public outcry and a citizens’ petition requesting the contract cancellation, the action quickly gained bipartisan support and signatures from borough residents.

Haines Borough Mayor Tom Morphet issued a formal apology to the public on the topic during last year’s Nov. 14 assembly meeting, noting the protracted time it took government to fully appreciate the problem and reassuring residents that “we are working as fast as we can to fix the property tax assessment system and make it right for both the Haines Borough and property tax payers.”

Charged with implementing the first phase of a new mass appraisal methodology for the borough’s 2023 property tax assessments, Dahle attempted to implement a new “replacement cost” hybrid methodology, which resulted in assessments in excess of full and true market value for some parcels.

According to former Assembly Member Brenda Josephson, when property owners appealed the excessive values, they received threats of increasing assessments if appeals were filed with the Board of Adjustment (BOA).

Dahle gained attention for his aggressive tactics, which included an assessment increase on appeal from $864,400 to $1.1 million on a modest property in the Haines Mosquito Lake area that was originally appraised at $620,000.

Citizen petitions to Alaska’s State Assessor’s Office resulted in a BOE retraining that occurred on September 21, 2023. During the retraining, State Assessor Joseph Caissie encouraged the BOE to support the municipality’s methodology. Caissie argued that “uniformity” is what matters, even if the model the assessor uses consistently results in assessments at 150% or even up to 200% of the full and true market. In Caissie’s words, the job of the assembly is not to reduce assessments to market value, but instead “the job of the assembly (is) to set the mill rate lower.”

Haines BOE State Assessor Retraining, September 21, 2023

According to Josephson, Dahle lacked credentials, as he did not have either an assessor’s certification with the Alaska Association of Assessing Officers or possess a license in Alaska as an appraiser. The lack of professional credentials was the basis of the petition to not renew Michael Dahle’s contract.

One resident, Dr. Mark Smith, expressed the need to codify safeguards against unjust actions, stating, “We’re pleased with the outcome, but the culture of inept government that allowed this to occur in the first place still exists. It’s like a tumor has been removed, but it will return unless we get the ‘whole body’ well holistically.”

Juneau appears to have suffered a similar experience under Dahle when he served in CBJ’s Assessor’s Office. Juneau commercial properties in 2021 received assessment increases of 50% across the board, regardless of the area they were in or how COVID-19 shutdowns affected their industry.

How to Make Juneau Less Affordable

There, as in Haines, the problem property owners faced was a mass appraisal methodology with a creative hybrid cost-based approach with some market data that ignored actual market sales conditions. The result is inflated assessment values in excess of their full and true value. Juneau appellants also cited the aggressive tactics of the assessor’s office.

Josephson believes that inherent flaws in Alaska’s property tax assessment process led directly to these problems. Her experience is that the process fails to protect individual rights through a board of equalization process that fails to provide for fair hearings, licensing and/or certification of assessors, and the upholding of assessments in excess of their full and true market value.

Haines, there ought to be a law

In December, Caissie announced his resignation as Alaska’s State Assessor, less than three months after he came under criticism for the training advice provided to the Haines BOE members.

Caisse stated in a farewell letter that he would be leaving in January for a full-time job managing a 501(c)(4) that advances Georgism. Georgism is a controversial policy that bases the land’s value on what the government thinks it should be used for rather than its existing one. Caissie stated that, in his new role with the NGO, he would be “pushing for more jurisdictions to adopt this policy.”

In a white paper titled Restoring Public Trust, Josephson and coauthor Greg Adler call attention to problems with Alaska’s assessment process and highlight instances of the negative effects of the existing approach. Arguing that every resident ultimately pays property tax either directly to the government or through rent and lease payments, Josephson asserts that this is a statewide issue.

She said, “The assessment process should never invite this level of confrontation; instead, statewide policies and statutes must be written to protect citizens from unintended consequences and bad actors.”

Jon Faulkner is president of Alaska Gold Communications Inc., which publishes Must Read Alaska.

That’s what happens when voters turn down property tax increases, they simply over evaluate your home.

Property tax is wrong. It’s difficult to collect. The only fair tax is sales tax and it’s easy to collect that’s why we don’t use that system. Tax attorneys and accountants would be left sucking wind.

Agreed Doug,

Sales Tax or maybe an all inclusive flat tax. That will never happen here though because once people realize how much tax they are actually paying, they would revolt. Also, people who don’t pay taxes wouldn’t be able to vote to increase other people’s taxes. There goes the whole Democratic platform…

Could this be part of what is driving our galloping inflation?

Even more egregious than what is offered in this somewhat too long article is the practice that allows most Alaska towns and villages to have no property tax at all – no local contribution to local government costs like education, public safety, fire protection, road maintenance, etc. Tok, Tenakee, Gustavus, Hoonah and many other well and long established municipalities contribute nothing to their local government spend.

There a few left-hand threaded wing-nuts in the Alaska Legislature, elected and appointed, that believe all roads lead to a state income tax. They actually believe that people in Kenai, Anchorage, Fairbanks, Juneau, Ketchikan, etc. will pay a property tax for local services and pay a state income tax so that most towns and villages need not collect a property tax.

I disagree. Many taxing authorities tax communities without providing any services or value for the taxation. That is government theft. Those that do tax their citizens, squander it. No community should be forced to collect property taxes.

The only reason they would need to pass a state income tax is because they mismanage the funds they already receive through corruption, misuse, and stupidity.

Boroughs without Taxes at all.

If you trust Kiehl, you deserve what comes next.

It’s not the tax assessment process which has failed us. It’s our government at every level.

And us for continually re electing these losers.

Senator Kiehl is moving to provide statewide protection similar to what Juneau enacted by forcing the assessors to abide by standard rules of assessment and respecting the work of professional appraisers. He should be applauded and thanked for his efforts. I have known him for quite sometime and while we often disagree he can always be trusted to be forthright. Once again you haven’t done your homework and have demonstrated your ignorance and incivility.

Spare us.

The same controversial policies have been used in Anchorage since Mark Begich was mayor. It not only increases your property taxes, but raises your insurance rates. Your insurance will not pay on these values if you suffer a total loss, regardless of what your agent tells you. Depreciation and salability must be factored in.

There should be no property tax. You should be able to pay off your property and have it free and clear without the government or some politician, telling you that you owe them money to live on your land.

Amen

Amen 100%

The Municipality of Anchorage just raised the valuation of my property by 10%? What friggin valuation in Anchorage increased values of properties by 10%? This is criminal theft by government edict.

You got off easy. My Anchorage home’s assessment went up 22.8%. Criminal.

14% here this year on my home in MoA. The appraisal jumped $58k last year and over $68k this year despite my home not having a visit since 2016. It’s straight out theft.

Pay attention. This is what happened to home owners in Hawaii. They drove property values up so high that families who’d lived there for generations and owned their homes couldn’t afford their property taxes. This is happening in Alaska as we speak

You still have time to file an appeal. And the appeal process is still worth the effort. The money saved is well worth the time, and and if enough people use it, maybe they will get the message. Any good realtor will tell you how far off the assessments are and how they are being used to increase tax revenue.

Property tax assessments are a miserable mess all across this state but that doesn’t mean we need the State to fix it.

Juneau will start by “fixing” the assessment problem. A few years later, they will “fix” something else and then, before you know it, every property tax decisions will be made by Juneau. Unless of course, Congress decides they need to “fix” it.

I know it sucks Haines, I feel for you and wish you the best, but please, go vote, or protest, or whatever, just don’t sell your soul to the next higher level of government…any gains will be short lived.

I have to agree with you. Giving added credence to your statements is that Senator Jesse Kiehl is believed to be working on this legislative “fix.” That has to mean that real working and productive Alaskans will be screwed somehow by the legislative “fix.”

Do your homework. While the Juneau Assembly didn’t have the courage to admit fault in allowing the prcess to continue for too long they did pass an ordinance to ensure that the assessors had to actually play by the rules. So they did “fix’ the main problem. Let’s hope this can be enacted statewide so the battle doesn’t have to be fought by every indidvidual city or borough.

Every municipality and the state is guilty of this wrong doing to the public and property in collusion with the real estate industry of Alaska by inflating every asset value to make more money for individuals and municipalities and entities. Look at the plans to expand boroughs and break away from boroughs. The asset loss to foreclosure and beyond is astronomical.

Jon,

Very well said. And as a Haines resident I want thank you for helping to keep this ball rolling. I truly hope we as a state can stop this injustice that is occuring all over the state of Alaska.

Kimberly Rosado

Inept government? Who wudda thought?

I’ve tried to understand this Georgism single taxation deal, it just doesn’t make any sense at all. If the value of raw land should be taxed, then why did the state assessor quit after telling local assessor that they should inflate the assessment value of the improvement on properties to make them more uniform? After reading about Georgism it sure sounds like communism where the state owns all property and the people who own the title to that property don’t actually own the property but the ability to pay rent on that property to the desired level of satisfaction that the government demands. If that is what Georgism is then I can only hope the former state assessor is the only assessor with that opinion, but I doubt it.

I was wondering about that Georgian concept: tax a property at the value the government thinks the property best suited for…. With current governments I wonder what the value of daisy covered fields and overgrown parks are. They certainly don’t envision industry and productivity.

Mr. Adams , wasn’t it Obama that said “if you’ve got a business, you didn’t build that.” the government did! Please add that to your thoughts I am interested in your response! Liberty Ed

Communism/Socialism is when the state owns the means of production (i.e. the factories, the trains, utilities, etc…). Georgism/Geoism is when the state owns the land, but not the means of production. So if you have 2 properties of 10 acres of land and one has a factory on it and the other is idle, they would be taxed the same. In this instance, the government should pay the same valuation for all the land they hold. State Government for state land and the Federal gov for Federal lands. They would be bankrupt as they hold 99% of Alaska so of course, they would be exempt from their own mandate -as always.

Seems to me that the land, the property, is the means of production. Unless of course communists…errr Georgists have figured out how to produce something out of nothing.

While fixing the property tax assessment process is a step in the right direction, it doesn’t address the root problem, which is gross overspending by government. More taxes, like sales tax or income tax, are not the solution. The solution is simply less government spending. In every municipality, every borough in Alaska, the elephant in that room is always, without exception, the school district. Tax payers deserve a clear, unambiguous, easy to understand account of how their tax dollars are spent by their school districts. Unfortunately, school district expenditures are always mixed with general budget statements, buried, obfuscated, purposely hidden from taxpayers. Those responsible for such practices are the very same people who support ideas like Georgism.

I have to say, the term “Georgism” is one of the funniest I’ve seen for a while.

It is such a boneheaded, unjust and grossly statist idea, one might just as well call it “Curious Georgism”.

Jon after reading the peanut galleries’ comments on taxation, let’s encourage many to write short assays in a new section called “Petition to Government” & when 100 comments support those assays send them off to the ” Representative Legislature with a voice of “WE THE PEOPLE”! Oh wait you may have to register as a Lobbyist of the Peanut Gallery.

A peanut gallery was, in the days of vaudeville, a nickname for the cheapest and ostensibly rowdiest seats in the theater, the occupants of which were often known to heckle the performers.[1] The least expensive snack served at the theatre would often be peanuts, which the patrons would sometimes throw at the performers on stage to convey their disapproval. Phrases such as “no comments from the peanut gallery” or “quiet in the peanut gallery” are extensions of the name.[1] According to Stuart Berg Flexner, the term owes its origin to the United States’ segregated South as a synonym with the back seats or upper balcony mostly reserved for Black people.[2] The racial element of the term’s origin is disputed, however, and absent from the Oxford English Dictionary and others

Now don’t anyone label me a racist, I am not, just providing a bit of history! Liberty Ed

Ed personal property and real property tax is 100% wrong. There is nothing intelligent about it. Can you imagine an inspection and appraisal on your house and belongings every yea.?

A sales tax is simple and simple to audit. My dad told me years ag0 the mat su was loosing $35 million a year in tourist dropped sales tax. The chamber actually came up with those numbers. Can you imagine how much sales tax anchorage would collect yearly from tourists.? I would never trust the government to create a sales tax without first canceling the property tax.

About to blow the lid off of this same situation in MO as well, ‘https://ago.mo.gov/attorney-general-bailey-files-suit-against-jackson-county-tax-assessor-for-illegal-property-assessments/

Comments are closed.