Collapsed cryptocurrency exchange FTX was under “the control of a small group of inexperienced and unsophisticated individuals, and unfortunately, the evidence seems to indicate that some or all of them are also compromised individuals,” a lawyer for FTX told the Delaware Bankruptcy Court on Tuesday.

“A substantial amount of [FTX’s] assets have either been stolen or are missing,” said James Bromley, of Sullivan and Cromwell, hired by FTX to represent it in the bankruptcy. It’s been widely reported that during and after the Nov. 11 bankruptcy declaration, the FTX exchange was hacked and assets were transferred.

“You have witnessed probably one of the most abrupt and difficult collapses in the history of corporate America,” Bromley said during the first of what will be many bankruptcy hearings.

The company declared bankruptcy after a run on its deposits left it $8 billion short.

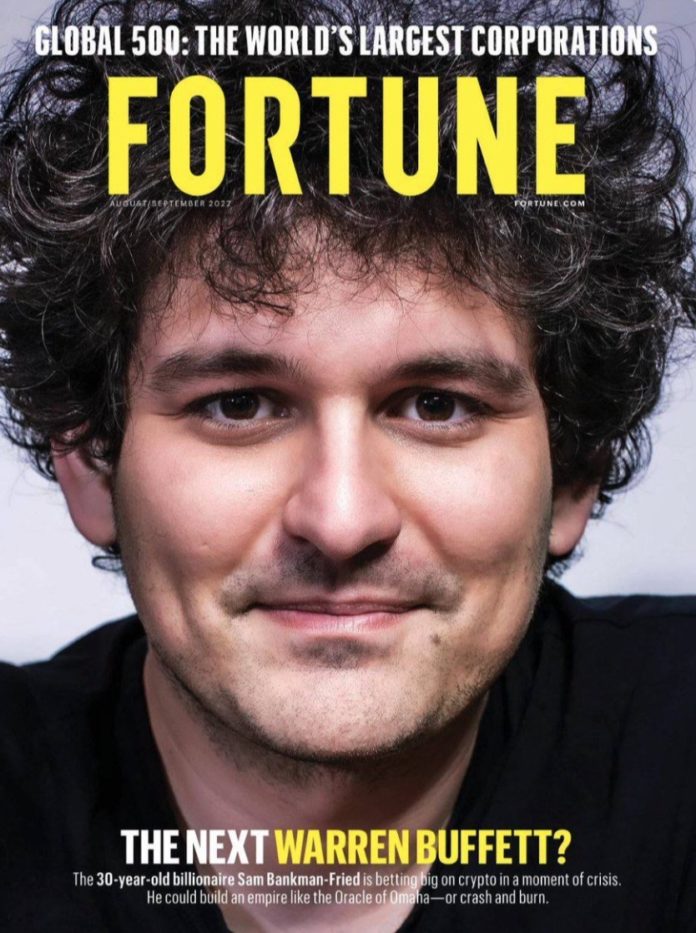

Former CEO Sam Bankman-Fried ran FTX and its sister companies like his own “personal fiefdom,” Bromley said, as he explained to the court how the company collapsed within two weeks of a report from CoinDesk showed that FTX subsidiary Alameda Research had an inexplicably large number of FTT tokens that were issued by FTX.

Read CoinDesk: Bankman-Fried apologizes to FTX in letter leaked to reporter

FTX CEO Bankman-Fried, with his ill-gotten gains, was the second-largest funder for the Democratic Party, and funded the Alaska Democratic Party and Republican Sen. Lisa Murkowski’s campaign for reelection in 2022. Bankman-Fried was second only to George Soros in funding liberal candidates and causes. Even Congresswoman Mary Peltola’s campaign benefited, through pass-through assistance from the Alaska Democratic Party and political action committees funded by Bankman-Fried.

Current CEO of FTX, John Jay Ray III, who was brought in to clean up the mess, is the former Enron scandal cleanup expert.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented,” Ray wrote in a declaration to the bankruptcy court.

“Since my appointment, I have worked around the clock with teams of professionals at Alvarez & Marsal, Sullivan & Cromwell, Nardello & Co., Chainalysis, Kroll and a confidential cybersecurity firm, to secure the assets of the Debtors wherever located, to identify reliable books and records, to assemble the information necessary to provide to this Court, and to respond to numerous inquiries from multiple regulators and government authorities including the U.S. Commodity Futures Trading Commission (“CFTC”), the U.S. Attorney’s Office for the Southern District of New York, the U.S. Securities and Exchange Commission (“SEC”), and the U.S. Congress, among others,” he wrote.

Ray has over 40 years of legal and restructuring experience and was the chief restructuring officer or chief executive officer in several of the largest corporate failures in history. He supervised situations involving allegations of criminal activity and malfeasance (Enron). He supervised situations involving novel financial structures (Enron and Residential Capital) and cross-border asset recovery and maximization (Nortel and Overseas Shipholding). “Nearly every situation in which I have been involved has been characterized by defects of some sort in internal controls, regulatory compliance, human resources and systems integrity,” Ray wrote.

“In the Bahamas, I understand that corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas,” Ray told the court.

FTX-related entities spent $300 million on real estate in the Bahamas for homes for the FTX executive team.

After Bankman-Fried left the company on Nov. 11, it was evident that “the emperor had no clothes,” legal counsel Bromley told the court.

Bankman-Fried hung onto power until the last hour, and didn’t decide to give up control of the firm until the morning of Nov. 11, after having consulted with his lawyers at the firm Paul Weiss, and with his father, Joe Bankman, who is a professor at Stanford Law School, Bromley said.

FTX has given the court redacted list of its top 50 creditors that are owed over $3.1 billion. The names of the creditors were redacted.

Read the Nov. 17 statement to the court by the current CEO of FTX, John Jay Ray III in support of the Chapter 11 bankruptcy filing:

Buying cyrpto is investing in nothing, Charlie Munger, July, 2022

Anchorage Assembly began their deceptive ” Downtown Takeover ” scheme last night… SPEND SPEND SPEND !

The mega donor to left wing politics is a psychopath? Impossible.

Everything done by the left is holy, innocent, and pure.

The Alaskan Democrat Party and Lisa Murkowski need to reimburse the Permanent Fund for the monies they received. We’ve come to realize it was stolen via the “Big Guy’s spending and money laundering. Build Back Better, Infrastructure, and Ukraine. Hard to trace trillions of dollars.

A cryptocurrency corporation run by purported geniuses, all – the most progressive wokesters, and graduates of the nation’s most reputable universities! What could go wrong?

Comments are closed.