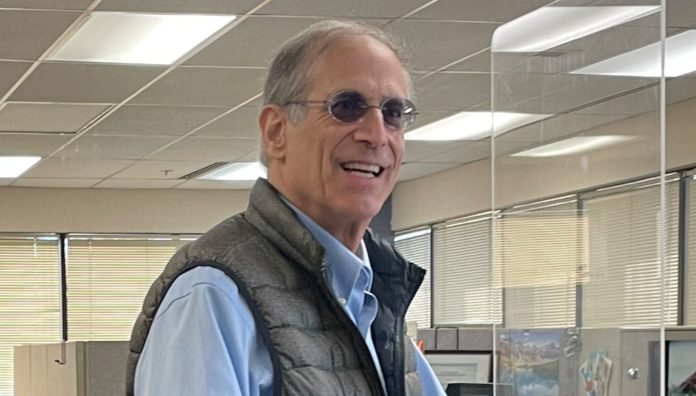

Congressional candidate Jeff Lowenfels says that without notice Wells Fargo bank has closed his campaign account, which had several thousand dollars in it. Lowenfels wants the bank to at least issue him a cashiers check immediately so he can pay campaign bills that are due to vendors, but so far has received no reasonable response from the bank, whose representative told him he will get a check in the mail.

Lowenfels thinks that the problem is that his campaign manager, Patrick Flynn, has a small interest in a cannabis company, and the bank is known for steering clear of any funds that could be sourced or commingled with dollars related to cannabis. Lowenfels said he waited for 45 minutes on the phone to speak with someone who could give him a straight answer — which he says he never got.

It has happened to candidates before. In 2018, Wells Fargo closed the account of Nikki Fried, who was a former medical marijuana lobbyist and a then-candidate for Florida commissioner of Agriculture and Consumer Services. Fried is now a candidate for governor in Florida.

In that case, Wells Fargo wrote Fried’s campaign, “As part of the onboarding of the client it was uncovered some information regarding the customers [sic] political platform and that they are advocating for expanding patient access to medical marijuana.” The bank asked, “Can you confirm the types of transactions expected for this customer & if any of the transactions will include funds received from lobbyists from the medical marijuana industry in any capacity?”

In the case of Lowenfels, he is a known advocate for legalization of marijuana and he writes and speaks publicly about the topic. He authored the book, “DIY Autoflowering Cannabis: An Easy Way to Grow Your Own,” available at Amazon.

But he runs his campaign by paying attention to detail, he said. He is a lawyer, has filed his paperwork properly with the Federal Elections Commission and his financial disclosures with the Clerk of the Congress. He has a compliance officer on contract.

“It is Wells Fargo’s policy not to knowingly bank or provide services to marijuana businesses or for activities related to those businesses, based on federal laws under which the sale and use of marijuana is illegal even if state laws differ,” spokeswoman Bridget Braxton told the New York Times in a statement in 2018. “We continually review our banking relationships to ensure we adhere to strict regulatory and risk guidelines.”

The late Congressman Don Young was not only a big advocate for legalized cannabis but was a founding member of the congressional Cannabis Caucus.

Lowenfels has said he would continue the Don Young tradition of promoting more sane federal policies in regards to the plant, which is legal in some states and not others.

He is not the only candidate with a cannabis business or advocacy connection. Andrew Halcro also was involved in the cannabis business, but it’s unclear if he is actually running for office, since he has not filed officially with the Federal Elections Commission, but is simply running social media ads that provide no campaign disclosure. Halcro may not even have an actual campaign account.

Must Read Alaska has reached out to Wells Fargo for comment.