There’s something cooking over at the Alaska Gasline Development Corporation and it’s Chinese. Alaskans can expect a big announcement in the next few days.

With AGDC President Keith Meyer in China for the past many weeks, word is out that AGDC is one of 40 corporations taking part in President Donald Trump’s trade mission to China.

This is a critical month for the gasline project. After head fakes from the Japanese and Korean governments and utilities, the AK-LNG’s eggs are all in the China basket now, as Alaska looks for a customer and a funder for what would be the mega project of the century.

- Maybe they’ll buy the gas.

- Maybe they’ll finance the project.

- Maybe they’ll be in charge of construction.

The public doesn’t know the details, and the public doesn’t even know some of the most critical questions that should be asked.

Some of the unknowns are involved in a rumored deal with Sinopec, which may have committed $45 billion for the project in the past few days.

The role of the Alaska Permanent Fund is another question: Will it pony up the rest of the money? And who among the players will take the risk if costs go through the roof or the financials are not solid?

There are two tracks to this project: Federal and State.

FEDERAL: The federal government has made a lot of progress for the gasline in a relatively short period of time:

- AGDC received tax-exempt status from the IRS.

- Getting the Trump Administration’s support for the project is “bigly.” He’s a big-project guy.

- Getting an introduction to Chinese Premier Xi Jinping was key. Trump wired that for Gov. Walker.

- All of this happened in 2017, even while the world was awash in natural gas.

- The U.S. Department of Energy issued a license to the North Slope producers to export up to 20 million tons of LNG yearly. That was before the State took over the entire project.

STATE

At the state level, there is a lot of noise and a governor who has an obsession. The window for getting a customer is closing. AGDC is burning through $3 million a month. Alaskans are doubtful the gasline will be built. And the agency is not in good stead with its funder, the Alaska Legislature. Keith Meyers has been in China for weeks on end, and he’s got a lot riding on Trump’s trip.

But there is progress:

- AGDC has signed 23 confidentiality agreements to date involving entities from different countries across the Asia-Pacific region. The agreements enable the companies to review technical information in the AGDC data room and AGDC sees that as a critical step toward reaching definitive long-term commercial agreements. [Note: The governor has not been transparent and released who he has signed confidentiality agreement with.]

- In addition to the Korea Gas Corporation (KOGAS) memorandum of understanding, AGDC concluded six letters of intent that establish the foundation for terms and negotiation parameters for definitive agreements. The letters are non-binding but contain indicative agreement terms. AGDC signed the three most recent letters of intent in Asia in October.

- AGDC continues to work with KOGAS to advance the memorandum signed in Washington, D.C., on June 28, 2017.

- AGDC participated in the LNG Producer Consumer Conference and held meetings with potential LNG buyers in Tokyo, Japan on Oct. 18, 2017.

- AGDC concluded the capacity solicitation process for foundation customer capacity and one producer expressed interest in subscribing to space in the pipeline. In addition to one “conforming intent,” each of the three major producers expressed “interest” in selling gas to AGDC for future sale to global markets.

It’s all very fragile however. When AGDC Chairman Dave Cruz told the Legislature earlier this month that he wants lawmakers and the media to stop badmouthing the project, because it could cost AGDC credibility with the Feds, and that it could deflate any deal that is being advanced in China, he was sending a signal: “There’s something in the works, so don’t mess it up.”

WHAT ABOUT PRICE AND SUPPLY? Today, the AK-LNG line would deliver LNG to Asia for about $12 per million British thermal units, and would cost $45 billion or more to build, according to a Wood Mackenzie study.

Because the IRS has granted tax-exempt status to the AK-LNG project, with the government in the driver’s seat and no taxes, the project could put Alaska LNG into a more competitive range, maybe down to $8 a btu.

And China is a viable customer, whether or not Alaskans like the idea of bedding down with a despotic communist government. The International Energy Agency says that China will account for 40 percent of the global annual growth in natural gas demand over the next five years.

Beyond that, the U.S. will account for 40 percent of the world’s extra gas production to 2022, when production will stand at more than a fifth of global gas output.

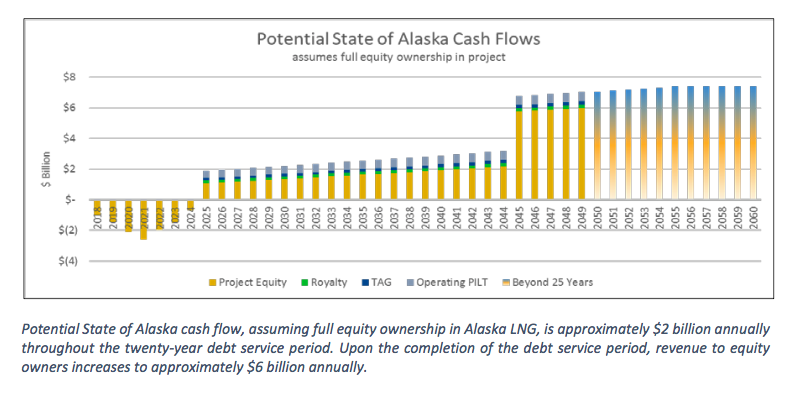

WHAT ABOUT RISK? There is a great deal of risk for construction cost overruns in a project this size. AGDC has given out a lot of speculative information about revenue and benefits from the project, as shown in the chart above that was released by AGDC today, but has said nothing about the risks associated with construction. In a deal with China and a nonprofit gasline owned by the people of Alaska, who will be on the hook if the cost of the project is over by billions?

It’s the elephant in the room.