The Alaska Support Industry Alliance, which represents most of the major oil service and related contract companies in Alaska, is polling its membership to find out what they think of the tax that Sen. Bill Wielechowski inserted into the governor’s carbon credit bill, House Bill 50.

The bill seems likely to pass the Democrat-controlled Senate, which is a body where there are actually more Republicans than Democrats, but where all but three Republicans have given over the power to the Democrats. Taxes are the result.

“Please take one minute to complete our survey and let us know if your company is an S Corp and if you oppose the attempt by some legislators to circumvent the IRS Tax Code and impose the corporate tax rate of 9.4% on some S corps in Alaska. (This is meant to target Hilcorp but could have broader scope),” the Alliance wrote to its members.

Take the Alliance survey at this link.

House Bill 50, the carbon credit bill, was originally, “An Act relating to carbon storage on state land; relating to the powers and duties of the Alaska Oil and Gas Conservation Commission; relating to carbon storage exploration licenses; relating to carbon storage leases; relating to carbon storage operator permits; relating to enhanced oil or gas recovery; relating to long-term monitoring and maintenance of storage facilities; relating to carbon oxide sequestration tax credits; relating to the duties of the Department of Natural Resources; relating to carbon dioxide pipelines; and providing for an effective date.”

In plain language, the bill creates a framework for the Department of Natural Resources to lease State of Alaska lands for carbon storage projects, and for the Alaska Division of Oil and Gas to permit and regulate carbon storage facilities in Alaska.

Wielechowski inserted language from his earlier failed attempt in the past, SB 114 of 2022-23, which was also a tax aimed at Hilcorp.

The proposed tax could be expanded to include all private S corp. companies in a new 9.4% tax.

Critics warn that such a tax on Hilcorp, which took over operations on the North Slope when BP pulled out of Alaska, could dry up the company’s investments in the state, and the spin-off from that could leave many smaller companies without work.

A hearing in Senate Finance was set for Tuesday morning, then moved to Tuesday (May 7) afternoon at 1:30 p.m.

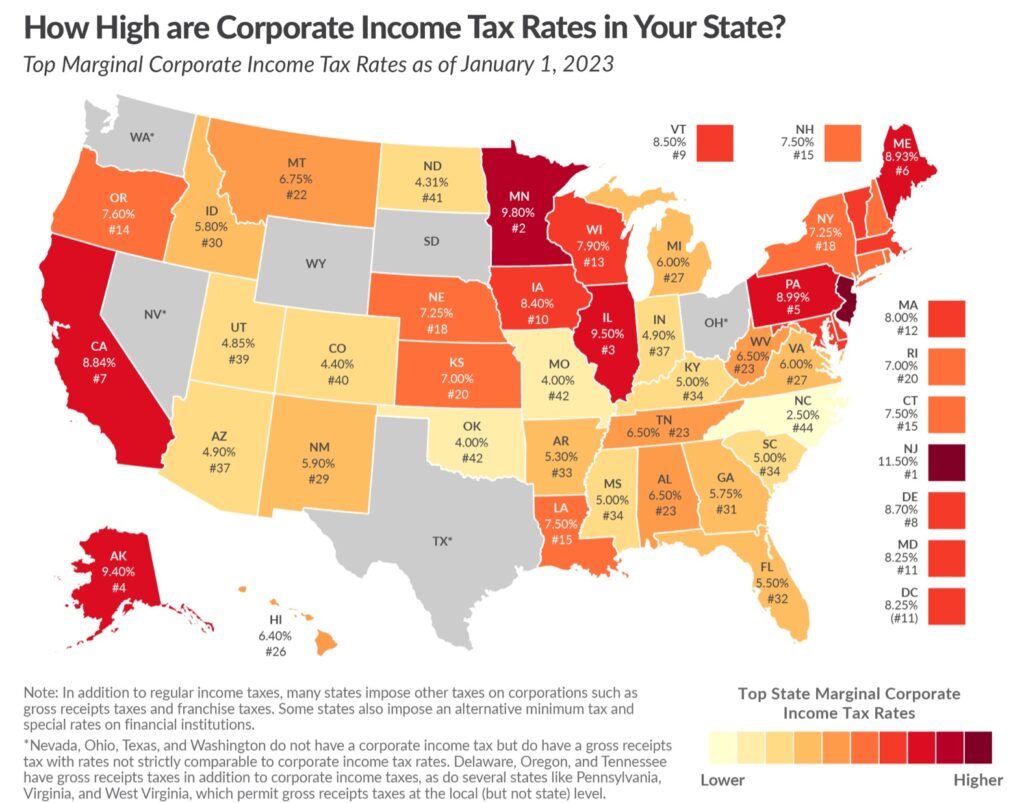

Alaska’s state taxes on C Corporations are among the highest in the nation, according to the Tax Foundation. “New Jersey levies the highest top statutory corporate tax rate at 11.5 percent, followed by Minnesota (9.8 percent) and Illinois (9.50 percent). Alaska and Pennsylvania levy top statutory corporate tax rates of 9.40 percent and 8.99 percent, respectively,” the foundation says.

Find documents and history of this SB 50 at this link.

Watch the Senate Finance Committee at this link at 1:30 p.m. on May 7.

Although the bill is likely to pass the Senate, due to the liberal makeup of the members, Must Read Alaska has learned that Gov. Mike Dunleavy may veto his own bill if it arrives on his desk with the Hilcorp tax.

The idiots in government just can’t get it through their heads that, sooner or later, they are going to run out of the private companies’ money and the printed crap won’t be wortht the paper it is pfinted on.

Any “scientist” or politician who supports the utterly backward idea of “carbon storage” is, unquestionably, an idiot or a thief. The entire concept is designed specifically to funnel government money to grifters. We need to start running conservatives as democrats, so that we actually have some representation in our legislature.

Our legislators, on both sides of the aisle, are largely mediocre – at best.

Unduly taxing companies that bring high wages to the State.

Breaking the law and stealing the citizens PFD – with no consequences.

Doing the bidding of the unions to the detriment of private sector.

And that’s just our state legislators.

Our federal legislators are even worse – Peltola is two faced, Murkowski is the beneficiary of nepotism, and Sullivan is a dyed in the wool RINO.

In the end, “We the People” get what we deserve for continually voting for these people.

The legislature shouldn’t have gone out of their way to aggravate the company that provides much of the heat and electricity to south central Alaska, especially when natural gas is in short supply with no relief for the near future. To quote Ron White, you can’t fix stupid.

And the voters still doesn’t get it they vote for these legislatures that steal their money lie to them for power over the voter.

Going to wake up one day and everything‘s gonna be way too expensive and you can’t do anything about it and you have no rights. Lazy Anchorage voters need to get involved.

Fairbanks, FNSB just shot down tax increase. Special election cost $125,000 according to .gov website.

They normally spring this ballot question in October, with regular elections.

Only 22% of eligible voters voted, supposedly. What’s scary, is 10% more voting YES would pass it.

Also on .gov website, original ballot question said it was general purpose tax increase. However, what we voted on was worded specifically for schools.

So is it a shell-game, move money from schools to other uses then claim schools are broke?