SEEKS TO CALM CONCERNS ABOUT LNG PROJECT

Steel tariffs didn’t faze Alaska Gasline Development Corporation President Keith Meyer when they were announced by the Trump Administration this spring.

And energy tariffs proposed by the Chinese aren’t worrying Alaska’s governor, who this summer remains confident about the Alaska LNG project.

Gov. Bill Walker issued a brief statement on Friday about China’s tariffs:

“Alaska’s vast reserves of natural gas can satisfy market demand for nearly a century, and short-term trade tensions do not change this long-term value proposition,” Walker said.

“Alaska LNG would be the largest job-creating infrastructure project in the country, and would generate billions of dollars in revenue. My team and I will continue to work with the Trump administration to ensure that Chinese and U.S. officials strike a fair compromise so that Alaska’s natural gas reaches the market,” Walker reassured the public in his statement.

China’s threatened tariff against U.S. LNG is part of a raging trade war with the communist-run nation.

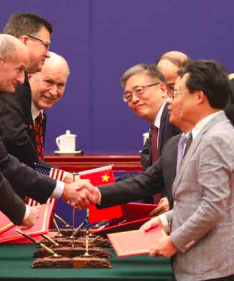

Walker did not revisit the overall feasibility of the project, the details of which the Alaska Gasline Development Corporation is still trying to nail down after the joint development agreements Walker signed with China last November.

According to the Alaska Journal of Commerce, Sinopec sent officials to Alaska to review plans, and then the company pulled out of the development phase. It is now only interested in the buying of natural gas, should the project come to fruition.

Meyer told the newspaper that Sinopec had expressed interest in being a major participant in construction of the 800-mile gasline, but after flying the route and studying it on the ground, decided the project was beyond its capability.

Few Alaskans even knew that Sinopec was planning to participate in building the gasline, since when the joint agreement was signed, Walker announced Sinopec as the buyer, not the builder. And, in public forums on the campaign trail, he has sought to downplay the role of Chinese entities in building and operating the line.

Regardless, Sinopec as builder is just one aspect of a less-than-transparent set of agreements that Walker has been trying to put together with China.

The Nov. 8 five-party joint development agreement included Alaska, AGDC, and Chinese entities Sinopec, Bank of China, and the China Investment Corporation.

In November, the governor explained that Sinopec would have the right to buy 75 percent of Alaska’s LNG, and the Bank of China and China Investment Group would finance 75 percent of the development.

“This agreement has all five necessary signatories—the buyer, the lender, the investor, the developer and the state,” Gov. Walker said in November. “This is a big project with big players and big benefits.”

STEEL TARIFFS A CONCERN – AT LEAST TO CONOCOPHILLIPS

While the tariff war with China could end before the Alaska gasline is built, tariffs on steel imports are perhaps more of an issue than the Governor’s Office and AGDC have acknowledged.

Al Hirshberg of ConocoPhillips said last month said that steel tariffs are turning into a significant expense item for the company, which spends $300 million a year on steel between its operations in Alaska and the Lower 48. That includes pipes, valves, and fittings, according to Petroleum News.

Hirschberg told analysts that hot-rolled steel prices in the U.S. are up 26 percent since the first of the year, although ConocoPhillips has been insulated somewhat due to its supply chain agreements. He expects the company’s cost increases to worsen next year, Petroleum News reported.

WHAT IS THE ALASKA GASLINE?

AGDC, a State-owned entity, plans to build and operate a gas treatment plant near Prudhoe Bay; a 1.0-mile-long, 60-inch-diameter Prudhoe Bay Unit Gas Transmission Line; a 62.5-mile-long, 32-inch-diameter Point Thomson Unit Gas Transmission Line; a 806.6-mile-long, 42-inch-diameter natural gas pipeline from the gas treatment plant to the LNG terminal in Nikiski; and an LNG terminal with a 20 million ton per annum liquefaction capacity. There will be numerous facilities associated with the project, which would have an annual average 3.9 billion standard cubic feet per day peak capacity of natural gas.

The State of Alaska is now the sole owner of the project after BP, Exxon, and ConocoPhillips pulled out as developers, with the encouragement of Gov. Walker, who wanted the project to be state-owned so it could capture tax breaks from the federal government. He also wanted to move the project along at a faster pace than the partners were willing, although in their absence project resources have shrunk.

The Federal Energy Regulatory Commission will issue a draft environmental impact statement next March, followed by a final EIS in December 2019.

In the meantime, broader market forces such as competing, lower cost energy supplies in the Pacific Basin and the raging trade war between the U.S. and China continue to blow strong headwinds against the Alaska LNG project, happy talk from Gov. Walker notwithstanding.