DEBATE RAGES AS TO THE ORIGINAL INTENT BEHIND ANNUAL CHECK

Alaskans have debated it for years, but even more so since the Permanent Fund dividend was politicized by Gov. Bill Walker in 2016, when he unceremoniously cut it in half, and put the unspent half into the Earnings Reserve Account for future government purposes.

- What was the purpose of the dividend itself?

- Why did Alaskans create a dividend, rather than just pour all of the oil money into the principal of the Permanent Fund?

It’s a debate that has all sides quoting the late Gov. Jay Hammond, who proposed that 50 percent of all mineral leases, bonuses, royalties, and severance taxes be deposited into an investment account. Then, each year one-half of the account’s earnings would be dispersed among Alaska residents, each of whom would receive one share of dividend-earning stock. The other half of the earnings could be used for essential government services.

Hammond’s rationale? He wrote about that in “Diapering the Devil: How Alaska Helped Staunch Befouling by Mismanaged Oil Wealth: A Lesson for Other Oil Rich Nations”:

“My rationale for creating such an investment account and making shareholders of Alaskans was many fold:

1. I wanted to encourage contributions into the investment account and to protect against its invasion by politicians by creating a militant ring of dividend recipients who would resist any such usage if it affected their dividends.

2. I wanted to transform oil wells pumping oil for a finite period into money wells pumping money for infinity. It was apparent that unless we did so, politicians would spend every windfall to satisfy insatiable short-term needs and demands, only to find themselves in a world-of-hurt when oil wealth declined. Such had been the experience of virtually every oil-rich state and nation. Not only Pérez Alfonso’s Venezuela had been defiled by the devil s excrement.

3. To put it crudely, I wanted to pit collective greed against selective greed. In the past, those who knew how to play the game were able to secure subsidies for their pet projects, many times at the collective expense of all other Alaskans. One example of this was a program granting loans not based on need at an interest rate far less than what that money could have earned in an investment account such as proposed in Alaska, Inc. In one year alone, more money had been lost to the state through subsidized loans not based on need than was paid out that year in dividends, and those loans went to but 6 percent of the people.

4. I wanted to remove a number of Alaskans from welfare. (The legislature subsequently frustrated this effort by exempting dividends from consideration as income when determining one’s eligibility for welfare.)

5. By issuing shares of dividend-earning stock annually and allowing Alaskans to accumulate them over time, I hoped to eliminate the magnetic attraction for others from elsewhere who might otherwise be inclined to flock to Alaska in order to receive dividends. Few would do so for the mere $50 dividend per share we initially set arbitrarily, but many might if everyone received a few thousand.

6. I wanted to install a sense of ownership in all Alaskans that would incline them to support healthy resource development and resist unhealthy versions.”

[Read “Diapering the Devil at this link]

At the Permanent Fund’s inception, the dividend was not part of the equation, however. The fund itself was to grow and eventually be used to help fund State government in times of budget shortfalls. But the details of how it would be used were not clearly detailed in the original constitutional amendment passed by voters in 1976.

In 1980, the Alaska Legislature enacted the dividend program by statute and Hammond signed it into law. The Legislature laid out the lawmakers’ purpose of the fund itself:

- The fund should provide a means of conserving a portion of the state’s revenue from mineral resources to benefit all generations of Alaskans;

- The fund’s goal should be to maintain safety of principal while maximizing total return;

- The fund should be used as a savings device managed to allow the maximum use of disposable income from the fund for purposes designated by law.

The plan, at the time, was to give every adult Alaskan $50 for every year of residency since statehood. That was litigated as a violation of the 14th Amendment to the U.S. Constitution by Ron and Penny Zobel, who had moved to Alaska in 1978. It went to the U.S. Supreme Court and was ruled unconstitutional. Every Alaskan would get the same amount, regardless of how many years they had called Alaska home. A one-year residency was set.

The first check, cut in 1982, was for $1,000, and was not from investments but from surplus oil revenues.

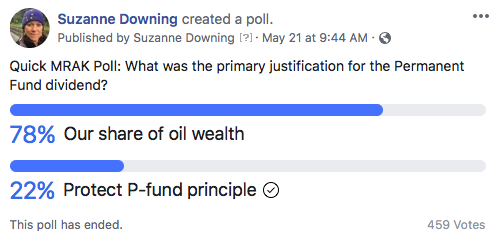

A poll run by Must Read Alaska on Facebook last week asked participants what they believed was the greater driving factor in the creation of the Permanent Fund dividend: Was it meant to be Alaskans’ share of the oil wealth (owner state concept), or was it to give Alaskans a stake in the Permanent Fund so they’d never let their legislators drain the principal?

Those responding favored the first answer:

A Facebook poll is unscientific, but this one shows a strongly held belief that the dividend does not actually belong to the government, which then distributes it through an appropriation as it sees fit, but that it is the average citizen’s share of the sale of Alaska’s oil. For these respondents, the government is merely the holding company of that money, which is then distributed based on a set calculation.

The other 22 percent feel the dividend is in place to ensure that Alaskans are always holding their lawmakers accountable, and will vote them out of office if they dip into the money that belongs to the people.

In September of 1999, Alaska lawmakers put an advisory question on the ballot asking Alaskans if the state should spend some of the earnings of the Permanent Fund for government. The overwhelming vote was 84 percent against that concept, even though the “vote yes” side had spent heavily to sway public opinion.

The way the question was worded on that advisory 1999 ballot gives a clue to how Alaskans perceived the dividend 20 years ago:

“Permanent Fund Dividends: Guarantee a dividend to eligible Alaskan residents at a minimum of $1,700 in 1999 and $1,700 in 2000. Thereafter, the dividend will be approximately $1,340 and will continue to grow with the value of the permanent fund. After accounting for inflation-proofing, the dividend will be based on 50 percent of the annual earnings payment.

“Funding for Essential Public Services: After payment of permanent fund dividends and inflation-proofing the fund, prioritize the annual investment earnings payment for essential public services.”

[Read the entire ballot language here]

Two decades later, the earnings are, in fact, finally being used to patch the budget gap. Alaskans still seem to resent the idea that the government should take their dividends away.

After a lengthy debate, SB 26 (dubbed by Gov. Walker “The Permanent Fund Protection Act”) passed in 2018. It was a plan to draw from Permanent Fund earnings — not principal — to pay for state government. It was the first time in Permanent Fund history that state government would draw on the fund’s earnings for budgetary shortfalls.

The plan was to take 5.25 percent of the Permanent Fund’s value each year. For the 2019 budget cycle ending July 1 of this year, that amount is $2.7 billion. It was known as a “structured draw.” Fifty percent of that structured draw was to go to the Permanent Fund Dividend fund.

But SB 26 did not clearly specify how dividends would be calculated. Language in SB 26 describes a “transfer” under AS 37.13.145(b) from the earnings reserve account to the dividend fund. Former Attorney General Jahna Lindemuth said it requires an annual appropriation in order to accomplish the transfer of permanent fund income.

During the debate over SB 26, critics warned that the “structured draw” would allow lawmakers to spend more on general government, and divert cash from the dividend program.

Indeed, last year’s dividend was set at $1,600, half of what it would have been under the previous formula the state used, based on return on investments.

This year, Gov. Michael Dunleavy is in office, elected in large part by people who want a full dividend. Even his primary opponent Mark Begich promised a full dividend during his campaign. Only former Gov. Bill Walker, who was a vestigial remnant on the November General Election ballot, wanted to stay with the half-a-dividend program; he won 2 percent of the vote.

The full dividend under the traditional calculation would be $3,000 for this year, in a check or deposit issued in October.

Today, lawmakers are debating HB 1005 in special session, which would again revisit how the dividend is calculated. It would take the 50 percent of the 5.25 percent that goes into the dividend program, and cut that in half. Alaskans would get 25 percent of oil revenue instead of 50 percent; government would take 75 percent for services.

[Read: HB 1005 gets pounded by public testimony]

With HB 1005, Alaskans would get a $3,000 dividend, but in subsequent years, they’d get half of whatever the original 50 percent formula would have given them, and the rest would go toward government.

This scenario is playing out just as critics of SB 26 said it would.

HB 1005, offered by Reps. Tammie Wilson and Neal Foster, is back on the calendar for House Finance for 8 am Tuesday, after taking a beating in public testimony last week. The meeting will be televised at 360North.org.