The Senate Majority held a press conference today at 12:50pm. The conference featured comments by the Senators regarding the Rural Health Transformation Program, winter road maintenance, funding for the Department of Transportation, the Permanent Fund draw, and Governor Dunleavy’s proposed statewide sales tax.

Rural Health Transformation Program

Senator Forrest Dunbar (D-Anchorage) spoke on the Rural Health Transformation Program (RHTP), highlighting the program’s context as part of H.R.1, which led to some Alaskans losing Medicaid and SNAP benefits. “The consolation prize was this thing called the Rural Health Transformation Fund.” Despite framing the RHTP in the context of H.R.1’s Medicaid and SNAP impacts, the program has little to do with either. Sen. Dunbar stated that the program funds cannot be used to backfill Medicaid. Sen. Dunbar identified renovation projects and equipment as examples of how the funds can be used.

According to Sen. Dunbar, the bill enacting RHTP identifies all of Alaska as “rural,” allowing both bush communities and urban locations such as Anchorage to benefit from the funds. He stated that the Legislature has been working closely with the Department of Health, trying to understand the funding access rules. “Rules about accessing the money and continuing to access the money are quite opaque,” he stated. Sen. Dunbar also expressed concern that the funding is controlled by the Commissioner of Health and lacks what he perceives as necessary legislative oversight. Senator Bill Wielechowski (D-Anchorage) echoed this concern.

Winter Road Conditions

Senator Jesse Bjorkman (R-Nikisiki) spoke regarding the Department of Transportation’s efforts to maintain the roads during this year’s difficult winter. According to Bjorkman, freeze-thaw cycles plus a high rate of vacant DOT positions contribute to the difficult road conditions. “DOT is out there working as hard as they can to mitigate hazards,” he stated. However, he admitted that roads often go uncleared due to an inadequate workforce, claiming DOT “is running at 60% capacity.”

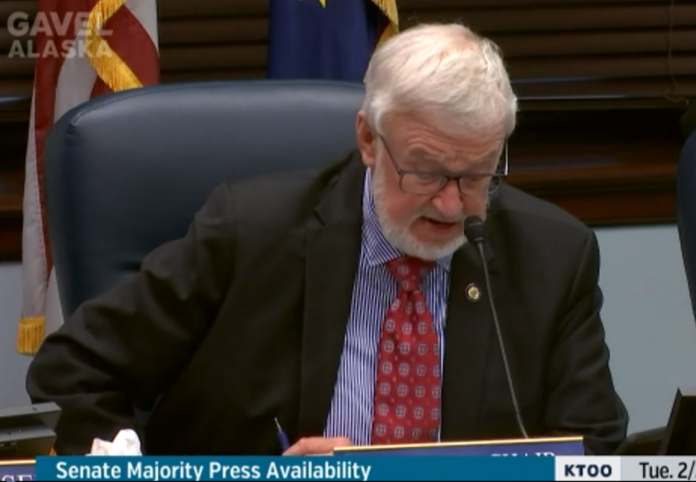

According to Senator Bert Stedman (R-Sitka), the Senate Finance Committee will be looking to fast track the supplemental budget bill that will give needed funds to DOT. “The Senate Finance Committee won’t let any moths grow under it… It can’t get done fast enough,” he stated.

Permanent Fund Draw

Sen. Stedman also addressed the Permanent Fund draw. He stated: “We are talking about a 5% draw. I personally think that is a bit high. I would personally like to see it at 4.5% or 4.25%.” He also expressed strong opposition to a full Permanent Fund Dividend as well as opposition to the dividend being in the Constitution. “The dividend should not be in the Constitution,” he stated forthrightly.

Senator Cathy Giessel (R-Anchorage) also commented on the Permanent Fund draw, saying the proposed amendment says, “up to 5%,” meaning the Legislature will get to decide each year what the actual number will be with a cap set at 5%.

Proposed Sales Tax

Wrapping up the press conference, Senators Stevens, Wielechowski, and Giessel commented on the Governor’s proposed statewide sales tax (SB 227). The Senators expressed a positive response to SB 227, especially the part of the bill that levies a tax specifically targeting oil and gas corporations. “What impacts Alaskans most is lowering the Permanent Fund Dividend,” stated Wielechowski. “What impacts Alaskans the least is corporate taxes… We should seek revenue from our natural resources.” Giessel echoed Wielechowski, stating, “Corporate taxes are the least impactful on the average Alaskan family.”