Friday, Jan 23, the Senate Labor and Commerce Committee discussed HB 78: “An Act relating to the public employees’ retirement system and the teachers’ retirement system; and providing certain employees an opportunity to choose between the defined benefit and defined contribution plans of the public employees’ retirement system and the teachers’ retirement system.”

The bill is sponsored by the House Finance Committee. Representative Chuck Kopp (R-Anchorage) presented the bill on behalf of the committee.

Why Was HB 78 Written?

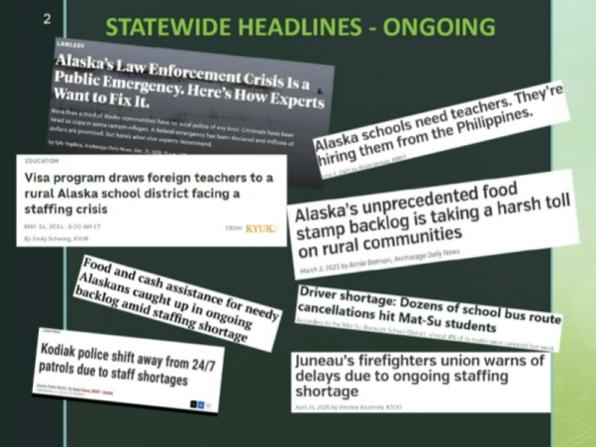

Rep. Kopp began his presentation with acknowledging the headlines resulting from the State’s current retirement system. According to Kopp, Governor Dunleavy’s budget “highlights critical struggle of recruitment and retention in most public service agencies.” The State Auditor says errors are going up exponentially, causing the State to incur expensive fines. Plus, high turnover in public employment has forced many agencies to be stuck in training mode, costing the State and local governments millions. HB 78 addresses those issues.

HB 78 Is Not the Old Legacy Plan

Rep. Kopp emphasized that HB 78 is “completely divorced” from the State’s failed Legacy defined benefits system. The State of Alaska is currently paying off debt accrued by the system which was discontinued decades ago. Debt from the Legacy system is expected to be fully paid by 2039. Kopp says the actuaries assure that the new defined benefits plan will not lead to increased liability.

What If We Keep the Current System?

Addressing “the cost of doing nothing,” Rep. Kopp stated that the current retirement system is not incentivizing people to stay in public service positions. Due to a high turnover rate, the State is experiencing service disruptions that are expensive and impactful to Alaskans. 50% of the workforce in the public sector stays only 1-4 years. Many people are cashing out their benefits after 5 years and leaving public service. Some leave Alaska altogether. Rep. Kopp also shared some numbers on which agencies have the highest rate of vacant positions. DOT&PF has the highest rate at 24.5% vacant positions.

The question, according to Rep. Kopp, is: “Do we want Alaska to be competitive again?” Rep. Kopp emphasized that people used to move to Alaska for competitive jobs in the public sector, but now Alaska is struggling to fill critical workforce positions. “We have to compete on a national scale,” he stated.

Why Adopt the New Plan?

The new proposed defined benefits plan will use a variable employee contribution rate that responds to the market, meaning employees will contribute between 8-12% of their income depending on the market. Rep. Kopp stated that the variable contribution rate sets the plan apart, creates shared risk that enhances sustainability of the plan, and works well in other states that have implemented it.

He also highlighted the plan’s inflation protection as another reason this plan will work better than the current system or past systems.

Under HB 78, employees enrolled in the Teachers’ Retirement System (TRS) or the Public Employees’ Retirement System (PERS) if not in a public safety position will be able to receive their benefits at 60 years of age with 5 years of service or at any age with 30 years of service.

Employees enrolled in PERS who hold a public safety position will be able to receive their benefits at 50 years of age with 25 years of service or 55 with 20 years of service.

Committee Discussion

Following Rep. Kopp’s presentation of HB 78, the Senate Labor and Commerce Committee launched into a discussion revolving around the bill’s tenability and advantage for the State.

Senator Jesse Bjorkman (R-Nikisiki) asked if there is any state with a similarly structured plan that is experiencing trouble financing the plan. Rep. Kopp answered that he has not found any such state during his work on this bill, which he has been working on since 2016. States with similar defined benefits plans have funded their plans 80-100%. He also emphasized that the State’s actuaries and a third-party actuary say they do not foresee any unfunded liability with this plan.

Senator Rob Yundt (R-Wasilla) asked what happens if a person works a certain amount of time in the public sector but does not work the required years for the full pension payout. According to Rep. Kopp, that person would be able to collect the accrued percentage of their base pay, but they will have to wait longer to collect than someone who served the full pension years.

Additionally, Rep. Kopp highlighted that employees would have 180 days to decide whether to stay in their current defined contribution (DC) plan or switch to the new defined benefits (DB) plan. New employees will be default enrolled in DB, but they can opt out of DB and into the DC plan if they wish. After 5 years, the plan will be locked in and employees can no longer switch.

Sen. Yundt then asked if there has been any discussion regarding not offering an option between DC and DB and just offering DB. Rep. Kopp replied that there has been discussion about that. The option was retained because engineers and other technical professions would likely prefer a DC plan and excluding that option may negatively impact the State’s ability to attract those professionals. Sen. Yundt agreed that allowing the choice is a good idea and will help attract talent. However, Sen. Bjorkman expressed concern, stating that the DC plan allows 100s of million dollars to flow out of the state because people can cash out and leave after a few years. Whereas DB stays in the State of Alaska until the pensioner reaches a certain age or years of service.

Rep. Kopp wrapped up the conversation by highlighting that the defined benefits plan proposed by HB 78 will improve Alaska’s economy by lowering training costs, lowering turnover rates, and increasing the quality of services. According to economist Dr. Teresa Ghilarducci, the plan will save the State a minimum of $76 million. Kopp also emphasized that the plan has been carefully reviewed by three actuaries that act as independent checks without invested interest.

The bill was set aside for future consideration. The Senate Labor and Commerce Committee will hear public testimony regarding HB 78 today at 1:30pm. The meeting will be livestreamed at AKL.tv.