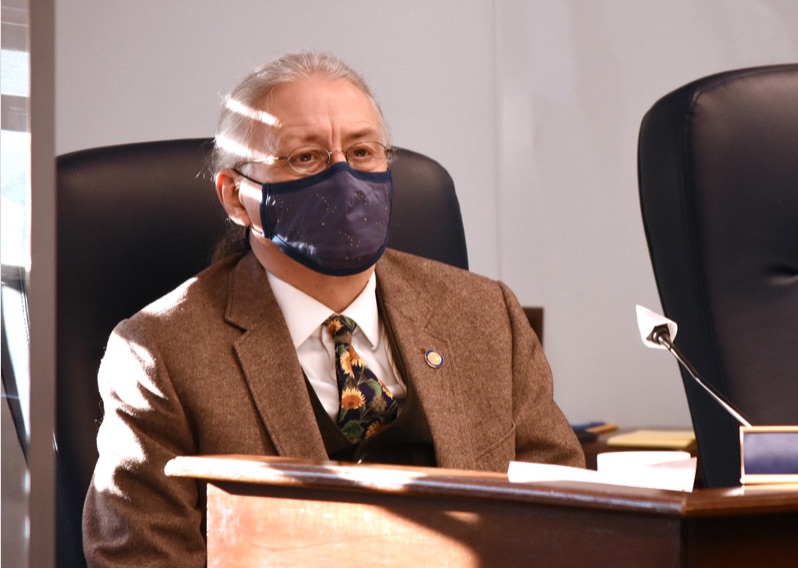

Sen. Tom Begich of Anchorage has introduced SB 100, a 5 percent state income tax. The tax would be based on the federal tax rate.

“… the road Alaska is on has finally arrived at the edge of the fiscal cliff. Alaskans realize we need a balanced fiscal plan — a plan that relies on a balance of revenue sources and other solutions, not just on one or two major sources like oil and the Permanent Fund. We need a plan where we all play a part – where Alaskans and those who make their profit or their living here invest directly in the services we all use. That commitment will, in turn, increase taxpayer scrutiny of the budgets we produce,” he said.

The bill was referred to the State Affairs Committee and Finance Committee. State Affairs is chaired by Sen. Mike Shower, and Finance is co-chaired by Sens. Bert Stedman and Click Bishop. All three are Republicans.

At this point the bill has no cosponsors.