Robin Brena speaks at Gov. Bill Walker’s “Tax Camp” in the spring of 2015. Brena is leading the charge to raise taxes on oil production with an initiative that could go before voters.

Feel that chill?

It’s not winter coming. It’s a posse of experienced Alaska politicos with a voter initiative application for a major tax hike on oil production in Alaska. The group filed its application with the Division of Elections near the close of business on Friday.

The Office of the Lieutenant Governor has 60 days to review it before Lt. Gov. Kevin Meyer must decide whether to approve the petition for signature gathering, and then it could go to the voters at the next all-state election, which could even be during a specially called recall election. Meyer will likely consult with Commissioner of Revenue Bruce Tangeman and Attorney General Kevin Clarkson before making his decision.

The three-member initiative committee is headed up by well-known foes of oil producers: Attorney Robin Brena, who bought the law office of Gov. Bill Walker when Walker became governor, but who now has Walker as his business partner; Sen. Bill Wielechowski, an Anchorage Democrat and Big Union lawyer; and Merrick Peirce, who was a Bill Walker colleague at the defunct Alaska Gasline Port Authority, where he was chief executive officer when Walker was lead counsel.

Gov. Walker is in the background, and both he and Brena represent oil interests that may or may not benefit from this voter initiative effort.

The committee also contains more of the usual suspects: Jane Angvik, whose husband Vic Fischer is a chairman of the Recall Dunleavy campaign; Joe Paskvan, a Gov. Walker acolyte and former state senator; Ken Alper, former Tax Division director for Gov. Walker; Kay Brown, former executive director of the Alaska Democratic Party and former legislator; and former House Rep. Harry Crawford.

If certified, the Division of Elections will prepare signature petition booklets, after which the initiative committee has 365 days to collect signatures. Signatures must be equal in number to 10 percent of those who voted in the 2018 general election. That’s about 29,000 signatures.

The group is recycling some of the parts of the Alaska’s Clear and Equitable Share tax policy that put the industry to sleep in Alaska. It’s also cribbing from the nomenclature of Our Fair Share, a phrase used by many anti-industry groups including Cook Inletkeeper. Calling the petition the Fair Share Act. Our Fair Share continues the drumbeat that Brena has been pounding on for several years. It’s catchy, and it has appeal.

[Read: Brena’s ‘Our Fair Share’ drumbeat]

“Alaskans should receive their fair share from the sale of our oil,” Brena said in the group’s press release. “We are currently giving away $1-$2 billion per year in tax breaks for oil produced from some of our largest and most profitable fields. Alaskans need to get a better deal for our oil from these fields.”

Kara Moriarty of the Alaska Oil and Gas Association saw it differently:

“Today’s news is no surprise,” Moriarty said. “But the proposed ballot measure would dramatically increase taxes on the heart of Alaska’s oil patch. No industry in Alaska can sustain an increase of this magnitude without causing a disaster for our state’s economy.”

She described it as an extreme policy shift that would have an impact on industry.

“This initiative raises taxes on over 90% of Alaska’s current production. The sponsors are proposing this at a time when Alaska is just barely crawling out of a recession. According to the Anchorage Economic Development Corporation the oil industry is one of the few bright spots for the economy, yet the proposed initiative puts any potential recovery at risk and job growth in the industry will be sacrificed.”

“While the sponsors are trying to portray that new fields will be held harmless, any successful production, such as production from ANWR or large new discoveries will eventually be under this new system. Make no mistake, the entire industry is at jeopardy with this initiative.”

Moriarty said the effects of such a major policy proposal has not been evaluated and is a bad way to make policy.

The petition would change the tax rates for the largest and more profitable fields, and take at least $1 billion out of the private economy every year for government.

The petition requires producers on the North Slope to make all their documents concerning revenue from the North Slope open to the public.

Additionally. the proposed act would “permit commonsense solutions for funding essential services, capital projects, and our PFDs.” In other words, it’s a tax to keep government flush with money.

[Read: The petition language here.]

The petitioners know that the public is anti-oil, and that their chances are good. The last time a group formed up to jack up oil taxes was in 2014, when Democrats tried to overturn SB 21, Alaska’s oil tax reform, by taking it to the ballot via referendum. That effort failed because a consortium of energy companies banded together to fight it. Alaskans decided to give oil companies a chance, and since 2014, the investment in Alaska returned. Last year and this year the investment in North Slope prospects have been between $1 billion and $1.2 billion a year in Alaska.

The rewards from that investment include taxes and royalties that will come when some of the big fields come on line in 2022.

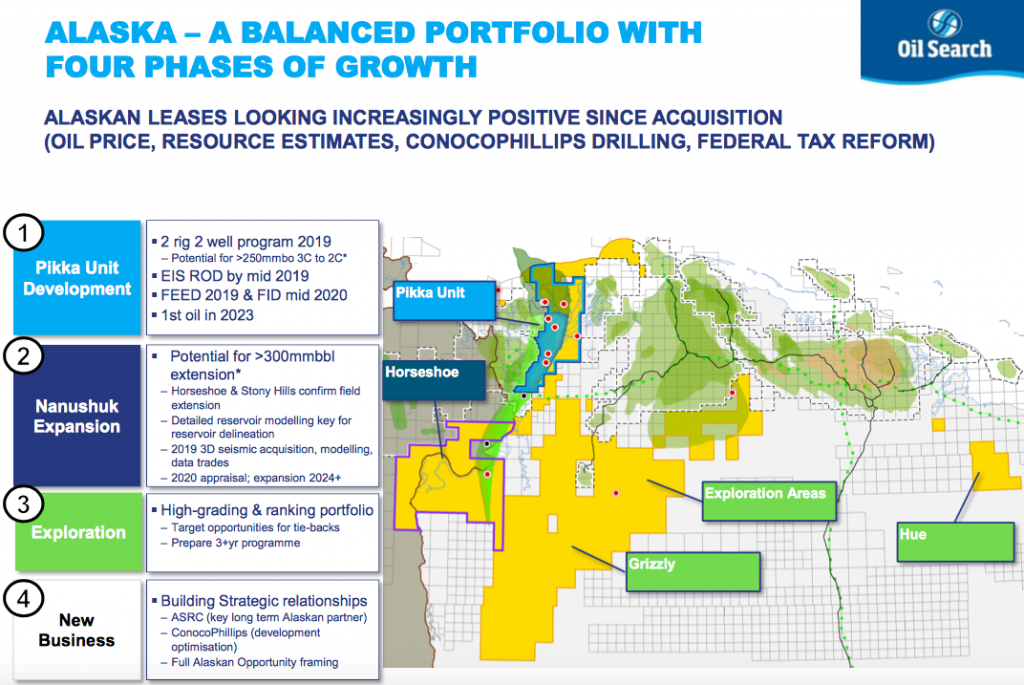

But companies like Oil Search could balk at bringing fields online if they think a new tax is coming. Oil Search the Willow and Pikka Units and board room decisions still need to be made about whether to continue investing.

The petition is somewhat vague, but it adds a concept called “progressively” back into the calculation of oil taxes, for some producers, but not others. It targets the larger companies, but doesn’t spare companies like Hilcorp or Oil Search, that could emerge as bigger players on the North Slope.

The threat of a new tax could, in fact, jeopardize investments during the coming year, and slow down the promised renaissance on the North Slope that SB 21 had set into motion.

By targeting per-barrel credits for some oil fields but not others, the initiative seems to pick winners and losers in Alaska’s oil patch.

For now, expect the Department of Law to get involved, and modeling will be needed by the Department of Revenue to determine if what the Fair Share Act is promising is what it can deliver.

Opponents of the zig-zagging of Alaska’s oil tax structure may take comfort in knowing that the repeal of SB 21 failed in 2014. But back then, there was a consortium of companies that spent millions of dollars to make the case to Alaskans that they should allow SB 21 to see if it could draw investment to the state.

Oil companies today will no doubt feel uneasy about yet another attempt to attack their profitability. Will they have the ability to come together as they did last time? Some of the new players haven’t been through this before.

Alaska is pulling out of a recession. The renaissance on the North Slope is underway. Right now when things are getting good, a punitive tax could actually stop all of this economic recovery.