It’s tax season and only seven days left to the federal tax filing deadline of April 15. Just in time for Rep. Louise Stutes of Kodiak to make it known she’s onboard with state income taxes.

Fed up with talks of cuts and efficiency, Rep. Stutes took a bold stance today, firmly supporting new income taxes in her response to a message from an Alaskan who says he is ready for a state income tax.

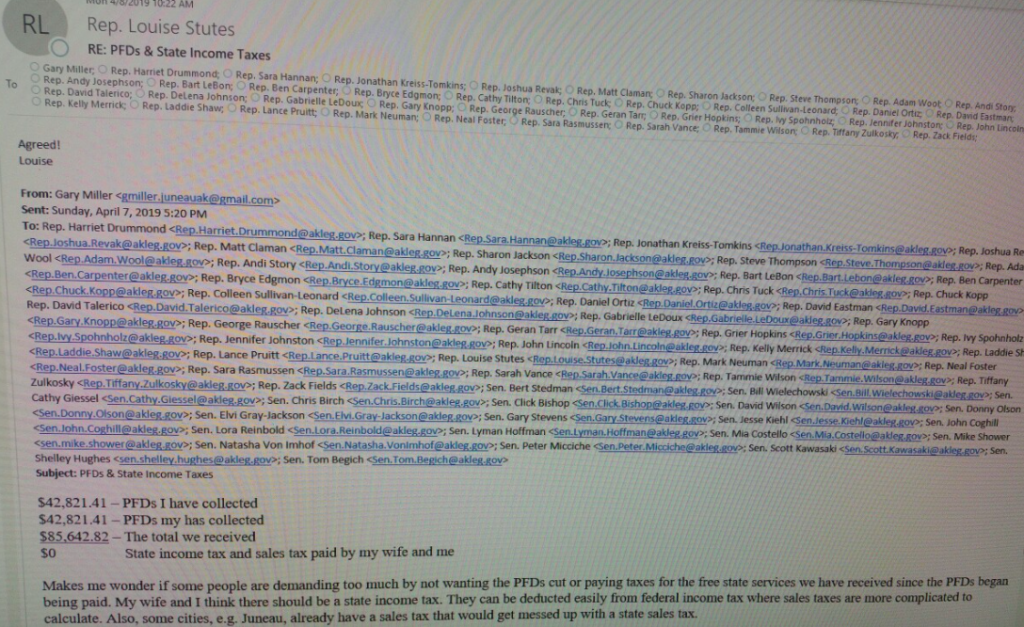

Stutes hit the “all reply” function with her one word answer: “Agreed!” That made sure that all of her colleagues in the Legislature know just where she stands.

It’s rare for a Republican to be so frank about wanting to institute an income tax on a conservative population that doesn’t have one on the books, but Stutes often writes in her constituent newsletter about the need for such a tax. Her Kodiak residents have a per-capita income of $32,600, not counting the $3,000 Permanent Fund dividend that the Dunleavy Administration wants to return to each Alaskan.