If the legislature were to appropriate the Department of Revenue’s FY19 projection of $206 million to purchase oil and gas tax credits, the increase in UGF spending would be over $430 million. – Legislative Finance Division analysis

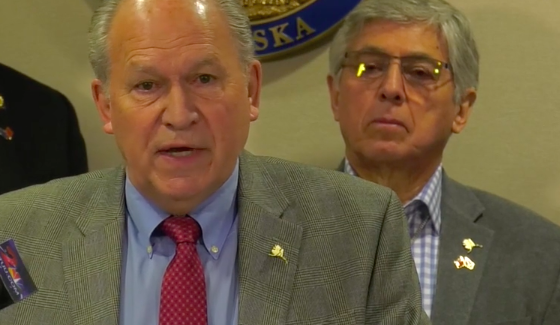

More from the Legislative Finance Division analysis of Gov. Bill Walker’s proposed 2019 budget:

“The Governor recognized the budgetary holes (and that some non-replenishing funds were no longer available), understood the conflict between submitting a straightforward budget and taking heat for increasing apparent spending, and appeared to be committed to presenting the budget in a more transparent way. The Legislative Finance Division was, quite naturally, interested to see how the Governor addressed the situation.

“The Governor released a “transparent” budget that shows a reduction of $150 million from the FY18 budget (unrestricted general funds, with dividends and transfers excluded). Does this mean the Governor found a way to fill the holes and reduce spending by an additional $150 million? Not exactly. The Governor’s budget misses the mark on transparency; proposed UGF spending in FY19 exceeds UGF spending in FY18.

“Transparency” is in the eye of the beholder, but perhaps all can agree on a few simple goals. The public and the legislature should know

1. how much money is available on a cash flow basis,

2. how much of that available cash is spent (and how much money is added to—or taken from—various savings/reserve/special accounts) and

3. the amount of surplus or deficit, both on a cash flow basis and after transfers to or from reserve accounts.

Is spending up or down?

“The Governor posed this question and answered it by reporting that the methodology proposed in his Budget Transparency Report shows the FY19 budget is $4.68 billion, down $150 million from FY18’s $4.83 billion budget. The Governor’s fiscal summary apparently does not follow the rules of the Budget Transparency Report; it shows a $316 million reduction (from $4.50 billion to $4.18 billion). Considering the $300+ million in budget holes left after the FY17 legislative session, a $316 million reduction would be nothing short of amazing.

“The Legislative Finance Division’s version of the fiscal summary (page 8) shows that proposed unrestricted general fund (UGF) spending (before accounting for dividends and transfers) is up $228 million—from $4.35 billion in FY18 to $4.58 billion in FY19 (line 36).

“If the legislature were to appropriate the Department of Revenue’s FY19 projection of $206 million to purchase oil and gas tax credits, the increase in UGF spending would be over $430 million. That number is far more in line with expectations regarding a $300+ million hole plus a Public Safety Action Plan that increases spending by $16 million (plus $18 million as a FY18 supplemental appropriation).