By DAVID BOYLE

Many parents in Alaska’s public schools have removed their children due to the shutting down of the schools, masking of the students, and the teaching of Critical Race Theory and other Marxist ideals. Parents have sacrificed jobs and finances to either homeschool their children or send them to a private school.

These parents could use some help in paying for their child’s education. Fortunately, there is help in the form of a State of Alaska Education Tax Credit program.

Most parents don’t know about this great way to finance their child’s education. But Alaska’s Education Tax Credit program has been in existence since 1987. It was expanded in 2014 to include private nonprofit elementary and secondary Alaska schools.

Unfortunately, it has been below the radar of most families.

The tax credits are also available for cash contributions for STEM programs by a nonprofit agency and certain qualified childhood early learning programs.

If a company pays certain taxes to the State of Alaska, it may be able to claim an Education Tax Credit. If you work for a company that pays taxes (corporate income tax, fisheries landing tax, mining license tax, etc.) your company may qualify.

This tax credit can also be used to support Alaska universities and accredited nonprofit Alaska two/four-year colleges. It covers the entire range of education from kindergarten through college.

Here’s how St. Mary’s School in Kodiak implemented the tax credit program: It went to the local Chamber of Commerce and got the names of 200 companies/persons that could qualify for the credit. It sent these companies information regarding the program. Then it worked with these companies to get them to participate.

The program was set to end in 2018 but the Legislature extended it to Dec. 31, 2024. There was bipartisan, almost unanimous, support for this extension.

In 2019 the credit was changed to allow for equipment contributions as well as cash.

The credit has been reduced as of January 2021. It is set at 50% of all contributions and a business can claim up to $1 million in education credits annually. For example, if a company contributes $100,000 it can offset its corporate taxes by $50,000. A win for the company and for education.

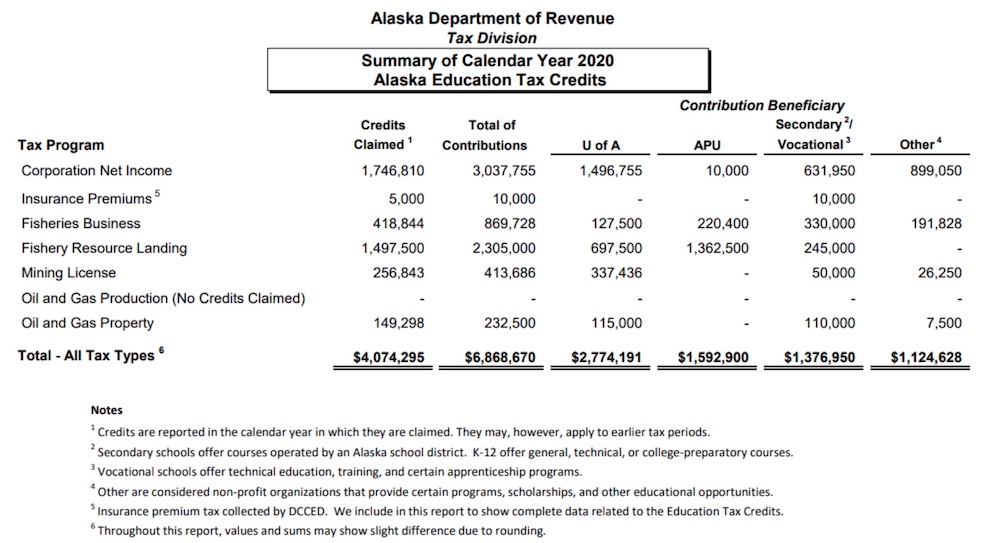

From 2018-2020 the credits totaled nearly $17 million. This chart shows the calendar year 2020 credits (taxes saved by the contributors) and the various beneficiaries. The University of Alaska benefited the most.

The Education Tax Credit program is an excellent way to help those parents who want the best education for their children. Corporations win by reducing their taxes and improving the education of the citizenry. Parents win by getting help to fund their child’s education. And the State of Alaska wins by improving educational options for students.

For more information on the Education Tax Credit program, go to http://tax.alaska.gov/programs/programs/credits/index.aspx for a description of the program.

Click here for a copy of the form.

David Boyle writes about education for Must Read Alaska.

Critical Race Theory is not part of the ASD K-12 curriculum. Marxism is part of some history curriculums as is capitalism and conspiracy theories.

May be not a part of the curriculum per se but it is integrated into the lesson plans. Ask to see the entire curriculum, K-12 and see what you get. Then ask to look at the various lesson plans. The ASD party line is that CRT is not taught. Ask about the “whiteness” training that ASD teachers just signed up to take at UAA.

Thanks for clarifying your CRT BS

Thank you for showing your true colors. Cuba much..?

Or, according to you, Frank, “Nothing to see here – move along”. Instead, parents SHOULD be involved in the school system, boards, curriculum and lesson plans. If there’s nothing to object to, then there should be no resistance to this engagement. Especially after decades of teachers and staff complaining about this very problem with parents NOT being involved in classroom education.

That’s not very civil! Suzanne will be disappointed.

Just because it is not taught as a subject does not mean it isn’t taught. “Social engineering” has been woven into textbooks and curriculum for decades. Teachers are being encouraged to take classes also that teach them how to incorporate ideas, ideology, into instruction.

Excellent information. Deeds instead of words.

This is how you do it people. Push back instead of whining.

So this program is just another government subsidy to educate children? As if the State government and local taxpayers don’t pay enough for the monopolistic and hugely bureaucratic school systems? We could save a lot of taxpayer money by contracting with Walmart to run the school system. Double the test results for half the price!

I also propose a “Pampers tax” on every diaper sold.

No tax on “Depends” though – us old folks are already paying for your children!

One could look at it as a government subsidy but look, the various taxed entities (fishery landing tax, corporate tax, mining tax, etc) would send this money to the State coffers that the State could use as it pleases. With this Education Tax Credit parents can benefit to send their kids to either a private school or augment their homeschool stipend the State gives them. Regardless, kids win!

Well, since we pay no income tax to fund State government, you kind of have a point.

I’m not totally up to speed on this, how much is the homeschool stipend these days? the BSA is around $6000?

It depends on the specific school district. If you mean the stipend a parent gets to homeschool using a charter school, then the parent gets about $4,000 of the $5,930 (BSA).That would be for the Family Partnership Charter School in Anchorage which gets the remainder. My daughter lives in King Salmon and home schools her daughter and she only gets $2,000, the district gets the remainder.

Depends heavily on which school system you use. We get a paltry 2500 a year per child. Very very few strings attached.

Chris: Far right conservatives hate hate hate taxes in all shapes except when it benefits their special interest. Hypocrisy is the structural framework of conservatives!

This is a way to reduce taxes paid to the state. I don’t hate, hate, hate, taxes of any sort. I hate, hate, hate, waste and paying my government for working against me.

The far left loves taxes.. Until they run out of tax money. Then they demand more taxes. After those resources are exhausted, they confiscate “for the greater good”. When that doesn’t work, they start stealing at gun point.

You’re sure a greedy bunch.

Nonsense. No evidence of gunpoint. You embarrass yourself.

Hypocrisy of conservatives, like the left works any differently. Pot meet the kettle much Evan.

No Mr. Singh we hate government waste and overstep. Hence when taxes are used for such, I suppose they may fall under the hate category.

As a self described constitutional expert you know that Article VII calls for public education free from sectarian control. Capitalism meets the definition of a sect.

Sectarian.. Like communism..? I agree. Communism (socialism) is a sect and a cult.

Railing against capitalism now?

You have to be the most woke “Republican” ever!

(F)Rank Rast, a Republican? That is a hoot!

.

I have read Frank’s tiresomely consistent radical leftist comments online for years, and the one thing that I can conclusively say about Frank is that he is NOT a Republican. Not unless the Republican Party, even as corrupt and co-opted as it mostly is, now has an official Marxist wing.

And the US Supreme Court decided that a government employee does NOT have to belong to a union to keep a job. Why haven’t the school districts put this in their contracts? Why hasn’t the state legislature implemented this in state law? They are not following the law.

Your Marxism has failed everywhere it is practiced and turns into oppression and poverty. Capitalism has proven successful and provides employment, industry, opportunity.

School vouchers.

Give educators and parents freedom! I know plenty of outstanding educators that cringe at the injected politics of the public school system. They despise the NEA and AEA but under the current rules they have to belong to an association. It is massively frustrating to them. School vouchers enable these great teachers a separate pathway to impart knowledge and use their skills/talents.

Vouchers provide parents with the ability to focus on the needs and natural abilities of their children. No student gets left behind and no student gets held back.

Parents who want the public school option simply hand over their voucher.

Parents with a child who is musically talented has the ability to determine the child’s path to learn how to play instruments or write music. Students who excel at problem solving can tackle STEM challenges.

A win-win.

It’s time to think outside the box the two politic parties have placed upon us and vote Libertarian. Neither party has solutions just status quo to maintain power. Give them the boot and let’s run this show for Freedom and Liberty.

Comments are closed.