Moody’s Investors Service has put the State of Alaska on a “negative” outlook and downgraded the Alaska Industrial Development and Export Authority.

Alaska’s rating for State General Obligation was affirmed at AA3, but the outlook has been revised from “stable” to “negative. The State’s moral obligation is now A2. It’s the agency’s way of telling the Alaska politicians to stop spending more than they are taking in in revenue.

“At the same time, we have affirmed ratings of the Alaska Municipal Bond Bank at A1; the State of Alaska Lease Revenue Bonds, Series 2008 and Lease Revenue Refunding Bonds Series 2015 bonds for the Goose Creek Correctional Center Project both at A1, and the Certificates of Participation, Series 2014 (Alaska Native Tribal Health Consortium Housing Facility Project) also at A1. The rating on moral obligation-supported bonds issued by the Alaska Energy Authority was affirmed at A2. The outlook on all of these bonds is now negative,” the ratings company wrote.

A negative or downgraded bond rating makes it more expensive to sell bonds for not only the State but for governmental units like Municipalities.

RATINGS RATIONALE

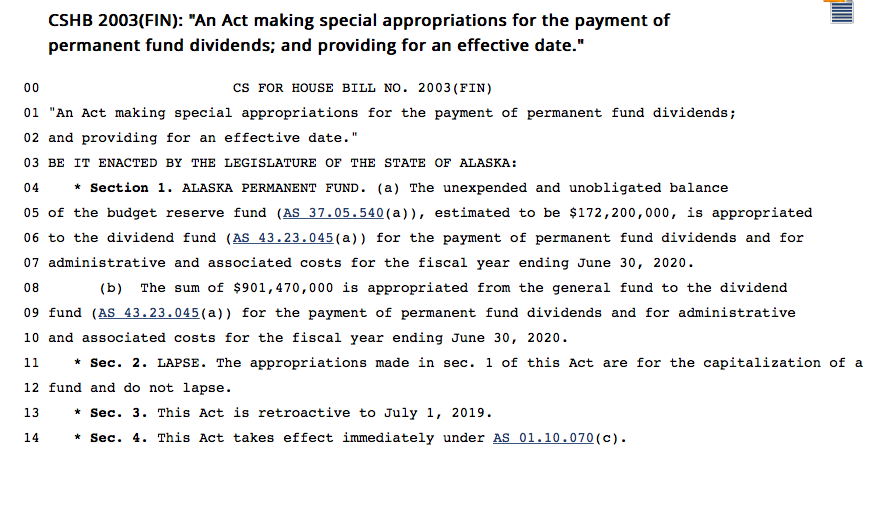

“Alaska’s credit position benefits from an ability to fund operations partly from earnings derived from the Alaska Permanent Fund. Credit challenges, such as a narrow economy, comparatively large net pension liability, elevated exposure to climate change and high reliance on the state’s oil production industry, have been largely offset by sizable budgetary reserves. A new focus on distributing increased shares of Permanent Fund earnings to residents, combined with political paralysis or other factors that prevent a return to budget balance, may make the current fiscal approach unsustainable over time, particularly in the event of financial market downturns or the inability to sufficiently contain spending growth.

“Alaska’s appropriation bonds are a notch below the state’s Aa3 GO rating, to capture the risk that a future legislature could fail to enact timely legislation authorizing payment. This rationale applies to both the debt issued by the state for two specific projects and to bonds issued by the state’s Municipal Bond Bank to finance projects of certain local governments. The two state project financings both involve more essential projects – a prison as well as a facility to assist in the delivery of healthcare to the state’s native population. For the bond bank’s debt, the state’s established practice of appropriating in advance to provide for debt service reserve replenishment transformed a moral obligation credit into one that is essentially an appropriation bond. Also, the bond bank’s a very strong legal provisions – including the state’s ability to intercept state aid payable to borrowers – offset the potentially mixed nature of facilities financed.”

RATING OUTLOOK

The negative outlook reflects the risk of deterioration of financial metrics or governance practices particularly if political paralysis impedes policymakers from agreeing on effective approaches to the state’s key credit challenges.

FACTORS THAT COULD LEAD TO AN UPGRADE

– Demonstration of ability to fund operations from recurring resources through economic cycles

– Reduction in unfunded pension liabilities

FACTORS THAT COULD LEAD TO A DOWNGRADE

– Persistent operating imbalances that threaten to deplete financial reserves or other evidence of liquidity strain

– Significant worsening of unfunded pension liabilities

ALASKA INDUSTRIAL DEVELOPMENT AND EXPORT AUTHORITY

As for AIDEA, the ratings dropped two levels from an AA3 to an A2. The justification given was that the State keeps eyeing the AIDEA funds, while an impasse persists over fiscal policies and the use of earnings from oil.

Moody’s Investors Service has downgraded the Alaska Industrial Development and Export Authority’s (AIDEA) Revolving Fund bonds to A2 from Aa3. The outlook has been revised to negative from stable. The rationale from the ratings agency follows:

“AIDEA’s revolving fund bonds are payable from revenue of the Revolving Fund, the authority’s operating fund. Despite very high debt-service coverage and large amounts of liquidity relative to debt currently outstanding, a rating below the State of Alaska’s (Aa3, negative) general obligation rating is warranted because of AIDEA’s relationship to the state. Alaska’s current impasse over fiscal policies – particularly the priorities for revenues generated from earnings of the Alaska Permanent Fund – underscores the Revolving Fund bonds’ exposure to actions the state may take as it seeks to adopt a revenue model less dependent on North Slope oil production. The state collects annual dividends from AIDEA and also has the capacity to push funding burdens onto it, although to date it has not done so. Additionally, the downgrade better aligns AIDEA’s Revolving Fund bond rating with the fact that AIDEA provides very limited information on its loan program participants, apart from broad factors such as collective loan delinquency rates (which have averaged less 1% since 2008).

RATING OUTLOOK FOR AIDEA

“The negative outlook reflects the risk that the state’s financial pressures will encourage actions that undermine AIDEA’s credit position by reducing the authority’s liquidity or shifting burdens to the authority,” the ratings company wrote.

FACTORS THAT COULD LEAD TO A DOWNGRADE FOR AIDEA

– Downgrade of the state’s rating

– Actions by state that increasing amounts of cash from AIDEA or force it to absorb financial burdens

LEGAL SECURITY

“AIDEA’s bonds are backed by the revenue of the authority’s Revolving Fund, which has three sources: Principal and interest payments on commercial loans, income from development projects owned outright and returns on a portfolio of investments. The authority covenants to refrain from actions that would drive debt service coverage below 1.5 times, and issuance of new bonds is subject to a test that revenue will cover maximum annual debt service by the same amount. In addition, the authority is required to maintain large substantial cash in connection with its debt: unrestricted surplus must equal the lesser of debt outstanding or $200 million (and in any case at least $100 million). A share of the authority’s financial reserves – the lesser of $50 million or 25% of outstanding debt – must be maintained as cash, money market funds or other highly liquid investments. Annual dividend payments from AIDEA to the state, provided for in state law, cannot run afoul of these provisions.”