By Greg Sarber

The price of precious metals has gyrated wildly this year, and one reason is China’s acquisition of physical gold and silver. They are taking physical delivery, which removes supply from the world market, creating shortages and price instability. To make these purchases, China is selling its holdings of US Treasury debt. These moves should be alarming to politicians in both Juneau and in Washington, DC.

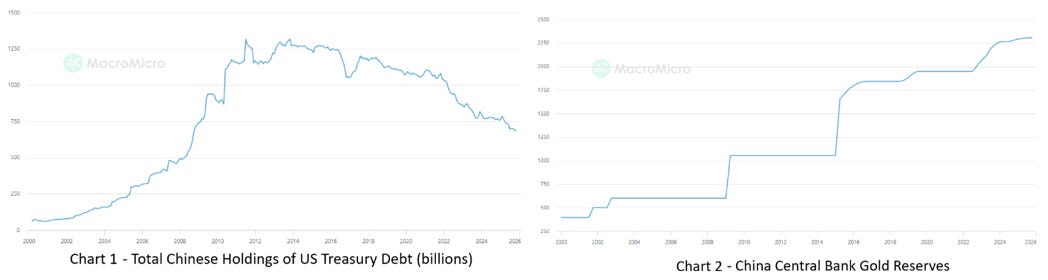

It shouldn’t be this way. For the last 40 years, as trade between the United States and China has increased, the trade imbalance between the two countries has forced China to purchase US Treasury debt with its excess dollars. There are valid financial reasons for China to hold treasuries. They receive interest payments, and these holdings stabilize their currency against the US dollar. However, in 2012, something happened, and China began selling its US debt holdings to purchase gold. They have continued this practice every year for the past 13 years, and even as gold has tripled in price, they continue to buy it. Since 2012, China has cut its holdings of US debt in half and doubled its gold reserves. (See Charts 1 and 2).

Despite the stability US Treasuries bring to its economy, China doesn’t want them anymore. One explanation for this policy change might be that they fear what might happen if there were ever a dispute between our two countries. We could refuse to honor any US Treasuries China holds, which could render them worthless, turning them from an asset into a potential weapon our government could use against them.

Politicians in China understand how we used these tactics in Southeast Asia once before. This was how the US attempted to rein in Japanese imperialism in the lead-up to World War II. In the ten years before the Japanese attack at Pearl Harbor, there was a series of escalating economic sanctions imposed on Japan, followed by a US-led oil embargo in 1941. When this embargo was imposed, Japan considered it an act of war and, in response, they attacked our fleet at Pearl Harbor.

Today, China finds itself in a similar situation to that of Japan in 1941. The US has imposed new tariffs on Chinese exports in an attempt to control China. At the same time, China is vulnerable because they import 70% of the oil it needs to run its economy. Two of the countries supplying this oil are Venezuela and Iran. President Trump just took Venezuela’s oil away from the Chinese, and now he is threatening their Iranian oil supplies by saying any country doing business with Iran will face an additional 25% tariff. This sanction on Iran was actually directed at China, which is the major purchaser of Iranian oil. If China’s oil imports are severely restricted, it would bring the Chinese economy to a standstill, possibly causing civil unrest similar to the Tiananmen Square riots. As a consequence, China might consider the tariffs and restrictions on oil imports to be an act of war, just as Japan did 85 years ago.

Alaskans who think these disputes don’t involve us might want to reconsider. Two important issues make China very important to our state.

You may not be aware, but China is Alaska’s number one trading partner. China buys 25% of the products our state produces, valued at 1.5 billion dollars in 2024, the last year for which data was available. Thousands of Alaskans have jobs because of what we export to China. If China stops buying Alaska products, those Alaskan jobs are at risk of disappearing, which would create havoc in our local economy. Tariff wars between the US and China could have a huge impact on our state.

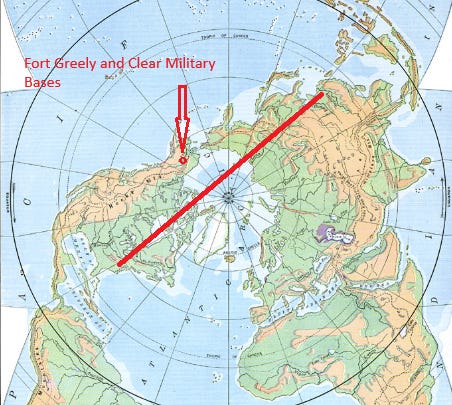

As bad as that would be, the bigger issue is Alaska’s strategic military importance. Alaska is home to a sophisticated missile defense system intended to protect the US mainland from a missile attack by Russia or China. There are two missile defense bases in Alaska, including a modern long-range radar at Clear Space Base near Fairbanks, and the missile intercept systems at Fort Greely, near Delta Junction. In a Chinese attack on the lower 48, Chinese missiles would fly near Alaska, which explains why those defensive bases are located here. In any hot war with China, Alaska would be a critical defensive military asset, putting us on the front lines of the fighting and, at the same time, making us a military target.

There may be an easy explanation for why China is selling US bonds and purchasing gold. China may simply be trying to avoid the inflation that comes with an investment based on the US dollar, or they could be preparing for something more sinister. When you look at all the geopolitical moves China is making around the world, it should worry every Alaskan that China is selling its US Treasuries to purchase gold and silver. They are telling us something by doing so. I hope our political leadership is paying attention.

This story was reprinted with permission from the author. It was originally published 2/9/26 on “Seward’s Folly” the author’s Substack.

Greg Sarber is a lifelong Alaskan. He is a petroleum engineer who spent his career working on Alaska’s North Slope. Now retired, he lives with his family in Homer, Alaska. Greg is a former board member of Alaska Gold Communications, Inc., the publisher of Must Read Alaska.