In response to the uncertainty surrounding the banking industry and stock prices on Monday, the chairman and CEO of Northrim Bank reached out to account holders on Monday with a letter describing the bank’s strong position.

“We have always been measured and balanced in how we approach our banking operations. Our conservative strategy includes strong liquidity and credit quality, exceeding the regulatory requirements of a well-capitalized bank, a diversified investment portfolio and the ability to borrow if needed. We continue to monitor the environment and adjust our strategy as necessary,” wrote Joe Schierhorn on Monday afternoon.

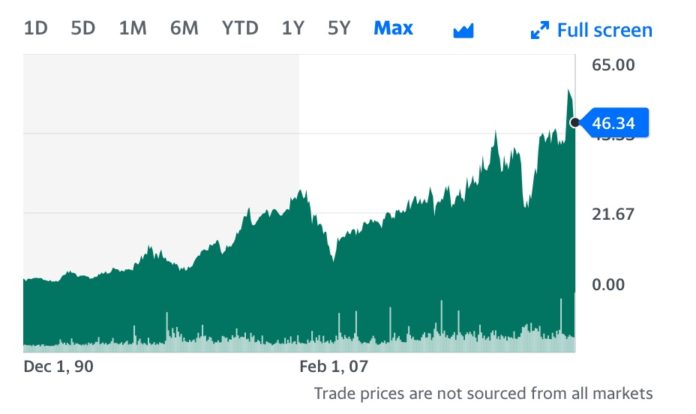

Northrim (NRIM) stocks took a dip in early morning trading but recovered most of their value by the end of the day. Friday’s closing price was 48.97, and Monday was $46.34, after a slightly bumpy ride through the trading day. Since it was established in 1990, the bank stock has continued to strengthen.

Northrim is no stranger to watching the bottom fall out from an economy. It was founded after the stock market crash of 1987, when oil prices dropped to single digits and 13 financial institutions failed across Alaska, displacing customers and opening the way for a group of investors to start Northrim — in a trailer in the middle of a parking lot. The founders raised $8 million to open the bank, which began accepting customers on Dec. 4, 1990.

It grew out of the ashes of a major recession in Alaska, staring with 21 employees, one branch, and its initial $8 million in assets. Today it is a statewide bank with more than $2 billion in assets, still considered small by global banking measures.

Just two weeks ago, Northrim’s board of directors approved a regular quarterly cash dividend of 60 cents per share, a jump of 20% from its prior payout. The dividend, to be paid, Mar 17 to shareholders of record as on Mar 9, is the 11th dividend increase in five years.

By comparison, Silicon Valley Bank, which was closed by regulators on Friday, was among the top 20 American commercial banks, with $209 billion in total assets and $175.4 billion in total deposits at the end of 2022. It was focused on financing more than half of U.S. venture-backed technology, green energy, and bio-tech companies.

Silicon Valley Bank was the nation’s 18th largest, but as account holders rushed to remove their funds, the bank was unable to meet the demand for what became a run on the bank.

Other regional banks folded last week, including Silvergate, Signature Bank of New York, and First Republic.