JPMorgan Chase, one of the largest banks in the United States, finds itself at the center of two vastly different financial decisions that leave many scratching their heads.

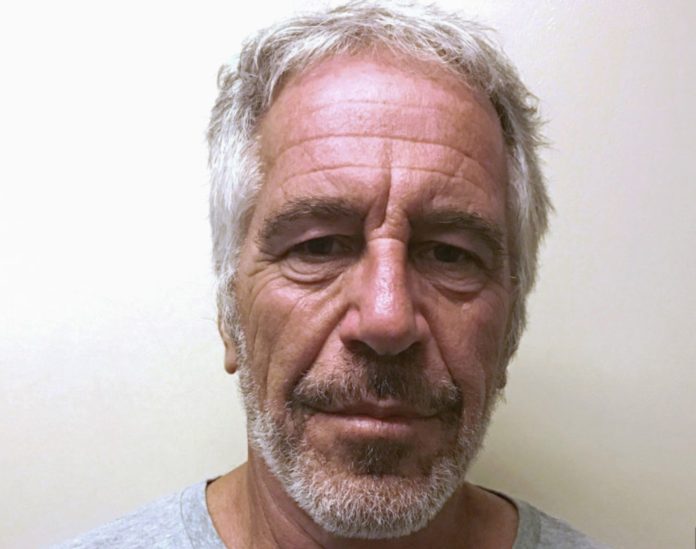

The first revolves around the bank’s commitment to environmental responsibility, while the second involves its unsettling ties to the notorious financier and convicted sex offender Jeffrey Epstein.

Back in 2020, JPMorgan Chase made headlines by announcing its decision to refuse to finance oil and gas extraction in the Arctic region, including the Arctic National Wildlife Refuge. Additionally, the bank vowed to discontinue financing several coal-related enterprises worldwide, including thermal coal mines and coal-fired power plants. This move came after relentless pressure from environmentalists like the Sierra Club, which urged the bank to distance itself from projects that groups say pose a threat to the climate.

Fast forward to 2023, and the bank’s reputation takes another strange twist. JPMorgan Chase recently agreed to pay a $290 million to settle a lawsuit tied to its association with Jeffrey Epstein, the convicted sex offender who allegedly killed himself in prison in 2019 after becoming exposed as sex trafficking young girls to his private island, where he flew in men clients, many of whom are quite famous, such as former President Bill Clinton. Donald Trump, Prince Andrew, and Bill Gates were also identified as a persons who flew to Esptein’s island. It’s unknown what activities they took part in there.

Lawyers representing Epstein’s accusers assert that the settlement came after certain revelations during the lawsuit shed light on the bank’s extensive dealings with Epstein over the years.

The lawsuit, filed on behalf of women who accused Epstein of abuse, revealed a troubling relationship between Epstein, the financier and the JPMorgan, the bank to which he brought customers.

The unnamed accuser who brought the lawsuit claimed that the bank turned a blind eye to multiple red flags regarding sex-offender Epstein until 2013, largely due to the wealthy clients he allegedly brought to the bank. JPMorgan Chase has denied any wrongdoing, but this settlement represents a blow to the bank’s reputation and raises questions about its due diligence processes.

The settlement, if approved by the court, would be one of the largest ever for a civil sex-trafficking case. In the settlement, the bank didn’t admit liability.

“The parties believe this settlement is in the best interests of all parties, especially the survivors who were the victims of Epstein’s terrible abuse,” JPMorgan and lawyers for the women said in a press release, as reported by the Wall Street Journal.

The bank also faces a related lawsuit filed by the government of the U.S. Virgin Islands, where Epstein once resided.

In another development, Alaska Attorney General Treg Taylor and other conservative attorneys general sent a letter to JPMorgan’s CEO Jamie Dimon, complaining that the bank is discriminating against Christians.

The eight-page letter reminded JPMorgan Chase that it terminated the National Committee for Religious Freedom’s account last year, an action referred to as “de-banking.” The account closure occurred shortly after the group opened an account at a Chase branch in Washington, D.C.