The House Finance Committee took House Bill 2001, which was written by the Rules Committee specifically to pay $1,600 Permanent Fund dividends to Alaskans…

"An Act making a special appropriation from the earnings reserve

account for the payment of permanent fund dividends; and

providing for an effective date."

…and the committee hoisted a substitute amendment that stuffed $444 million in spending into it, every cent of spending that Gov. Michael Dunleavy had vetoed out of the operating budget for the fiscal year that began July 1.

[Read the House Finance substitute that reverses the vetoes]

The dividend amount remaining would be about $929 per eligible Alaskan.

All in a day’s work.

A problem exists for the House and Senate Majorities, both of which are operating as bipartisan coalitions: Even the Legislature’s own attorney is hinting that the stuffing of the unrelated spending into the Permanent Fund appropriation is “outside the call” of the Special Session.

Because the session was called by the governor, he sets the agenda, just as he sets the location.

If the Legislature wants to restore those cuts, they need to call themselves into Special Session. They don’t have the votes to do that.

But the stuffing of the spending today served a purpose. Should it ever get to the floor of the House, and should the Juneau Special Session be deemed legal by the courts, such a spending spree only requires a simple majority vote, rather than the three-quarters vote needed to access the Constitutional Budget Reserve. The majorities have that vote, it appears.

Perhaps that is why the Board of Regents of the University of Alaska system took no action today to start the reorganization of the universities. They are hoping for one last miracle to restore higher education’s $130 million veto.

The governor would likely veto this spending a second time, and the Legislature still doesn’t have the votes to override his vetoes. He might even veto the $929 or $1,600 Permanent Fund dividend and send lawmakers back to the drawing board.

Today’s action was a clear message that spending comes first for the House and Senate Majority, and anything else left over will be used to pay Permanent Fund dividends.

That wasn’t the intent of Senate Bill 26 last year, when the Legislature agreed on a structured draw of the Earnings Reserve Account to pay for state operations. Nor was it the intent of those who created the Permanent Fund dividend program.

Critics of SB 26 predicted that this would be the result of an incomplete SB 26, however. The Legislature could not agree on how to restructure the formula for paying dividends, and punted the problem to this year.

In a Journal of Commerce article by Elwood Brehmer in May, 2018, Sen. Bill Wielechowski warned that “leaving the existing formula in place … means the Legislature will continue to bypass the PFD in law in favor of providing more cash to government agencies.”

“One statute will inevitably be violated and my prediction is it will probably be that statute that provides for a full dividend,” Wielechowski told the Journal. “In fact, that’s what’s happening this year, in this budget [2019 fiscal year]. That’s what’s happened the last two years.”

Also in the report by Brehmer, Rep. David Eastman, R-Wasilla, argued that SB 26 reversed the Legislature’s historic priorities by putting government funding ahead of the dividend and ahead of inflation-proofing the fund. Both Wielechowski and Eastman were prescient, as the first year after SB 26 was passed into law, the Legislature is still arguing over the Permanent Fund Dividend well into the second Special Session.

[Read: Legislature approves draw from Permanent Fund]

The Legislature first gaveled into session on Jan. 15, some 181 days ago and has yet to pass the funding of the dividend or a funded capital budget.

By existing statute, which the Legislature could change if it wants, the dividend payout is about $3,000 for every man, woman and child who qualifies.

Jennifer Johnston is CO-CHAIR of Finance. I guess her rejection of the PFD has finally been confirmed by her!

Personally I support the – PFD. as it stimulates the economy!!

“The governor would likely veto this spending a second time, and the Legislature still doesn’t have the votes to override his vetoes. He might even veto the $929 or $1,600 Permanent Fund dividend and send lawmakers back to the drawing board.”

And if he does that he puts the capitol budget in jeopardy. Which means a 0 dollar PFD. Which means a recession. Which means no federal road money.

.

The governor is playing chicken with a lighthouse.

Good trade. Zero capital budget for zero pfd. I like it. And at 30 trillion in debt there will be no federal anything soon enough.

Yeah let’s see what happens when Alyeska maintenance can’t access the pipeline because people like you don’t understand how government works.

And he doesn’t realize he’s on a boat and can steer. Or where the wheel is.

If you want to talk about an immovable object wait till you see what the voters do to any politician that supports taking there $12,000 dollar pfd for a family of four.

I have been telling Bryce that many times now. He don’t listen

Yeah… THEIR p f d… Leave it THERE….Thank you!!!

If we want to play the metaphor game, it’s less like playing chicken with a lighthouse and more like he’s on a speeding train headed for a brick wall and he is trying to apply the brakes while the steward on the train is trying to cut the brake line.

Adam, I believe the governor can line item veto whatever the legislature sends to him. The legislature is “playing chicken with a lighthouse” and they are responsible for the loss of federal funds for transportation (if that happens).

The lighthouse is where we don’t have the wherewithal to maintain the TAP and it doesn’t matter whose fault it is.

I find it quite interesting that those on the higher side of the economic register mostly support a lower PFD in order to pay for a bloated state government. That includes a majority of politicians and business owners.

I also find it very curious how when the Governor proposes or actually make cuts, it is always the programs that provide services for our most vulnerable citizens. The elderly, the poor, education and the disabled.

It is getting to be where the ultimate discrimination is taking place in a very real way against us who have the audacity to be poor.

I am calling Gov. Dunleavy out about his outrageous practices when it comes to the economics of the State.

But I don’t want to complain without a solution and I pray that you will read this and take it to heart.

Pass an 8% statewide sales tax with no exemptions. Most rural communities already have a small local sales tax with almost zero enforcement. It is very simple and a cheap system to enact.

We would then help fund budgetory shortfalls every day when we buy something from a store. That money goes directly into state coffers.

Then, the share of the oil revenue can be distributed to everyone at the full statutory rate for individual PFD’S.

You see unlike all these rich people who do not nead extra money, our group depends on that money every year to fund such things as private education, pay off outstanding bills, help a child go to college and many other reasons including my favorite, expensive dental work.

Things that we cannot afford without a full PFD each year. A program such as this would end the annual bickering and mud slinging, IF the state will commit itself to living within its means like the rest of us have to do.

Robert, what is your argument for communities that already have a sales tax (Juneau has a 5% sales tax).

No such problem with an income tax IMO. The poor never pay income taxes but the poor have had their incomes reduced by the taking of their PFDs while the rich have skated-time for them (rich) to belly up IMO.

I told Bryce that too.

I agree! But there are many details to look at along the way to putting this in place!

I don’t have strong feelings about the PFD one way or the other but I vehemently oppose an income and/or a state sales tax(es). Both taxes seriously harms the lowest paid workers, people living in the Bush, and many local small businesses that are already struggling to survive. As a small company owner, I take great pains to take care of my four employees, and they, too, would rather see smaller PFD than taxes. Income and/or sales tax(es) means many people buy less or even struggle to pay rent.

Although I agree with most of Gov Dunleavy’s government cuts (and I didn’t even vote for him, either), I somewhat agrees with you, Adam. Yes, no capitol budget at all could lead to a recession. But I also think an income and/or sales tax(es) would be more harmful, overall, than a lower PFD.

If this current Administration and Legislature don’t effectively work towards reducing the size of a bloated SOA Government, taking advantage of this opportunity/ responsibility by reasonably making common sense cuts to budgets now, when will this occur? Or, are they going to just continue to kick it down the road, with the foolish thought of taxing a path to prosperity?

Gov Dunleavy should swiftly ‘veto’ this additional $444M, without delay!

DOA just like these politicians will be in 2020 if they continue to play only into the hands of the Special Interests Industrial Complex.

Totally the right thing to do.

Even with the vetoes we can only afford so much.

Assuming the vetoes are compromised – the Dividend will be $1250.

Be thankful – I certainly am thankful for the blessings of a now $70 billion endowment.

Chris,

Just a couple days ago you stated you’re a libertarian capitalist. I’m calling BS.

I have many hard-core libertarians, and I myself are leaning more and more that direction as the years go by.

The first tenet of libertarianism is small government. You, Chris, in the same post, said “that the Dividend should be set at whatever is leftover after paying for “essential services” whether it be arts council, NPR, or whatever passes the legislature and the governor”.

Small government’s “essential services” do NOT include the Alaska State Council on the Arts or NPR.

A true capitalist opposes the Legislature handing out subsidies and tax credits to giant billionaire companies, passing a minimum wage law, and not making Alaska a Right to Work State, and passing all those ridiculous business licenses and fees.

And a true libertarian, like my true hard-core libertarian friends, opposes the Legislature butting into the PFD just to continue to pay for the same poor services we receive.

Chris, I don’t care what you think you’re ideology is, that’s your business, but please quit giving true libertarians a bad reputation and linking them to our current (mostly) Democratic narrative.

Sean I assume that is you.

I can make the same argument against you. How can a Libertarian Capitalist support a Socialist tenet: Universal Income.

How can a Libertarian Capitalist support ongoing budget deficits and borrowing against the public trust?

Your opinion that the Dividend is the “peoples money” is correct. If you read the State Constitution you will see that we also have “corresponding obligations”to the State (as in paying the bills). Our government is set up to allow the People to elect representatives to appropriate funding through legislative action. Of course the Governor has the right to veto and the Legislature has a chance to over-ride.

Sean, we agree to balance the budget – what is your proposal?

Please

To quote De Niro, “You talkin’ to me?” I do use a variety of pseudonyms across the web, but I’ve never used one on this website.

D O A

Yes, the right and reasonable thing to do. Consistent with the intent of the 1976 constitutional amendment – the earnings from the permanent fund would cover basic government services and the residual (still an entitlement) can go back to the citizens. Better than cutting funds to low income seniors, the pioneer home, the homeless, and deconstructing public higher education only to afford the 1.9 BILLION dollar ENTITLEMENT.

The Governor is trying to help poor people by getting them their share of the states oil wealth. But government bureaucrats want it ALL. The goverment already gets 75% of everything that comes out of the ground. No more. NO MORE.

The governor has plenty of red ink left in his pen. We elected this governor last November because he told us what he was going to do: rollback government spending. It sounded like a good campaign platform. But he meant business. If Mark Begich, or heaven forbid, Bill Walker was re-elected, there would have been more government spending (to the point of deficit spending), and an even smaller PFD. The times are changing for government employees. It’s their turn to participate in layoffs and rollbacks. This is a GREAT governor. The newspapers and ultra Lefties can beat him up however they may, but Dunleavy isn’t going away.

Gypsy,

The are two different “take aways” from what was said on the campaign trail last year…

“From Dermot Cole’s July 5 opinion piece in the ADN, “KTVA debate, Aug. 17: At the 36-minute mark, Dunleavy said he would not cut public education spending, the Pioneer Homes, the court system, prisons, Troopers, Power Cost Equalization, the prison system or the University of Alaska.”

Obviously, you cannot distribute a $3,000 PFD this year without either

A: Implementing an income tax.

B: lowering oil tax credits.

C: cutting services to Alaskans.

The Governor has made it clear that A and B are not on the table so I am sure we will see a compromise between services lost and our PFD garnished.

Bingo!

The compromising has now started with Gov. Dunleavey’s cave on The Thrilla in Wasilla, Steve.

Ok first of all, that money is not gov spending. Second it was established by Jay Hammond for the people. Keep your establishment hand off Alaskan money. And before you say it’s an entitlement, I guarantee if any of you were on the chopping block to have your funds cut personally, you’d be a hell of a lot more vocal, and with much more than just the governor. All trolls should stay in there caves, because none of them get it.

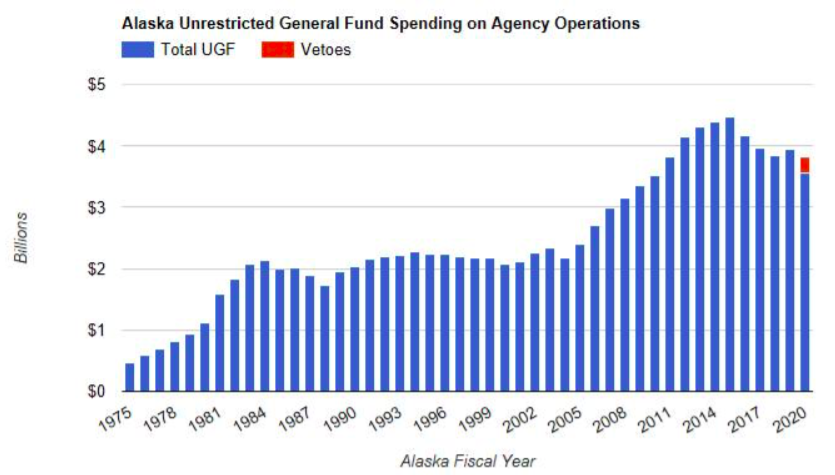

That bar graph is amazing! I didn’t realize government spending shot up so much with the high oil prices 10 years ago. When you look at historic budgets before that spike and the cuts suggested recently, they don’t look at all that bad. I hope Dunleavy again vetos this as well. Judging by his press conference last night, he has a solid plan and is confident in his policies.

The visual here is impressive. Thanks, Suzanne.

.

The fact is the rabid “occupy” folks will never, ever stop. They will never be satisfied until everything is in the hands of the “government” and then, and only then they will really understand what happened to their world. They will realize they are in control of absolutely nothing. There will be nothing left. There will be no one left for their “government” to take from. Be careful what you wish for folks.

.

So, those with some sense to keep a balance must also never stop. Ignore the noise. Hit the polls. Elect people with some sense. Remove the turncoats. Stay focused.

Looking at the graph provided it really looks like spending took a wild “up tick” during the Republican led administrations between 2008-2014 under Palin/Parnell but I bet conservatives would say that was because of Democrats in the Legislature?

Truth is “Political Capitalism” has united both the Economic and Political Elites in Alaska and together both camps are to blame for Alaska’s budget crisis…

Sadly after the wasted Billions on “Dams to Nowhere”…unfinished rail lines…pipelines that never broke ground and unlimited high level bureaucracy….we still have Democrats with their unquenchable thirst for our PFD’s….

Actually Steve, the pissing match right now is between Republicans in House and Senate (as Democrats have come around on State needing services).

As for money wasted, the idea of studying projects to death was originally a Jay Hammond idea designed to spend much of the oil money on studies (by outside firms) to keep people from coming here (needing infrastructure like schools). His idea was initially involved in a PFD plan that would give long-term residents greater dividends than new comers, too.

It has a lot less to do with who was in what office with which letter behind their name and the price of oil. When the main driver of income to the state was at record levels government spending responded the way governments always do when they find themselves flush with cash…they spend it. If governments responded likewise when the main driver of income to the state dropped we would not be having this conversation. But the special interest groups like getting money and don’t care where it comes from or who pays as long as they get theirs.

See Walker’s expansion of Medicaid for this. The social services sector of government has been eating into essential services for years. So much of our essential services are 90% dependent on the capital budget it isn’t funny. The liberals have been tweaking everything in favor of social engineering for my adult life (in Alaska).

On the other hand the (R) cronies make sure that the subsidies keep flowing to the corporations and call it “private sector”. How much are those Princess buses and boats contributing to the State of Alaska and how much are they using while siphoning off our tourism dollars in an almost entirely proprietary closed loop system? What are the services provided to them (road and infrastructure) and what are thy doing to reimburse the people of Alaska for them?

Look at someone who makes $24,000 per year. If 1/2 of your income would be subject to an 8% sales tax, that means that you would pay $960 in one year. If you spread that out over 12 months, it would cost you $80 per month.

Now, if you receive a $3,000 dividend times two people in the household. You would have $6,000. Subtract the $960 you paid in taxes and your net for the year is $5,040.

If you do not pay a sales tax, the state cuts all programs to the poor and you receive about $2,000 for an annual PFD.

This option leaves you with $3,040 LESS money for the years.

With a sales tax, no programs get cut, the budget is balanced and we get a lot more money in the end.

So, yes I am considering all of us who live on the edge of poverty and its affects on us all.

Wrong

You don’t spend the whole wad on sales taxable items

When the ‘brownshirts’ in Germany had served their purpose and propelled hitler to power, guess what. The ‘leaders’ were murdered, the rank in file either agreed to be conscripted into the Wehrmacht (army) and those who refused went to forced labor camps. Payback for all their ‘good’ deeds for the ‘politicians’ they brought to rule their country. Careful what you wish for, lefties.

Yep. Exactly. Careful what you wish for.

I WANT MY FULL PFD….THAT IS ALL!

– A TRUE ALASKAN

I find it quite interesting that those on the higher side of the economic register mostly support a lower PFD in order to pay for a bloated state government. That includes a majority of politicians and business owners.

I also find it very curious how when the Governor proposes or actually make cuts, it is always the programs that provide services for our most vulnerable citizens. The elderly, the poor, education and the disabled.

It is getting to be where the ultimate discrimination is taking place in a very real way against us who have the audacity to be poor.

I am calling Gov. Dunleavy out about his outrageous practices when it comes to the economics of the State.

But I don’t want to complain without a solution and I pray that you will read this and take it to heart.

Pass an 8% statewide sales tax with no exemptions. Most rural communities already have a small local sales tax with almost zero enforcement. It is very simple and a cheap system to enact.

We would then help fund budgetory shortfalls every day when we buy something from a store. That money goes directly into state coffers.

Then, the share of the oil revenue can be distributed to everyone at the full statutory rate for individual PFD’S.

You see unlike all these rich people who do not nead extra money, our group depends on that money every year to fund such things as private education, pay off outstanding bills, help a child go to college and many other reasons including my favorite, expensive dental work.

Things that we cannot afford without a full PFD each year. A program such as this would end the annual bickering and mud slinging, IF the state will commit itself to living within its means like the rest of us have to do.

The state should have set up a pfd investment to fund K-12 education. The yearly dividend would stabilize K-12 education for all local communities and relieve property tax burdens. Still not a bad idea. This sort of investment would reduce my property taxes so it would have direct benefit.

After my 3 hours at the Wasilla LIO meeting yesterday, I am amazed at how much things have stayed the same over the last 25 years. The room was overpopulated (as always) with retired state workers, retired teachers and non-profit employees waxing on about the damnable budget cuts facing our vulnerable state. I am going to throw up if I hear one more time that kids are our future (always have been and will always be), how the aged sector is just on the edge of unrecoverable despair or the great recession we are headed for if state spending is cut by 10%,. If state spending needs to be propped up to avoid a recession then we need the business cycle adjustment now. But I maintain that cutting the PFD out of the state’s economy will hurt the same (check out the ISSER report from UAF) as cutting it from the state government. I pick the state’s general population and not the poor state workers if one sector is to be cut. The last group I need to hear from are retired teachers, state workers and non-profit employees telling me how to budget. This bunch is the very sector of our economy that has allowed expansive increases in costs with little evidence of a return on investment. Cut the budget and move on.

I find it so fascinating that when it’s a government hand out for the masses, Alaskans suddenly like the government.

Pathetic politics. Pathetic banter. This place needs to grow up.

Just look at the timeline. The governor’s cuts bring us down to the spending level of 2011- which was STILL a bloated budget.

People need to understand several things. Getting a government to downsize is practically impossible, so whenever you have a chance to do so, jump on it!

Even at the peak of state spending people were saying programs were underfunded and we needed a larger budget. The legislature shouldn’t even consider a budget that we can’t pay for.

The only way to downsize government and its insatiable spending is to cut off the money spigot. You have to force efficiencies through the budget. I had to do it in Anchorage after Begich increased city spending by 50% in just six years! Unsustainable, just like what the state has done over the last decade or so.

Comments are closed.