FORTY DIFFERENT REASONS FOR VOTING IT UP OR DOWN

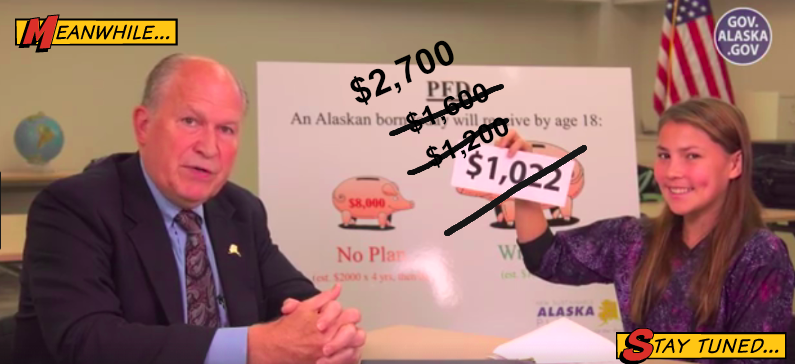

The Alaska House on Monday voted to fund this year’s Alaska Permanent Fund dividend at $2,700.

If it stands — and that’s a big if — that’s what qualifying Alaskans would get in October. The deadline to apply for this year’s Permanent Fund is March 31.

The move to restore the formula-based approach to the dividend came through an amendment to an amendment to the operating budget on Monday.

After several other amendments to the amendment, a version was approved 21 to 19 that adds between $450 million and $900 million (depending on how one calculates it) to a budget that already has a $2.6 billion gap, digging a hole that is more than $3 billion deep.

The budget patch would come from two places: the $2 billion that will be left in the Constitutional Budget Reserve and then some portion of the Permanent Fund’s $17 billion Earnings Reserve Fund, which is what is available for spending.

But the operating budget as a whole itself must pass, and getting the 21 votes to pass a budget that has bulked up with everything from a $500,000 Vitamin D study to unlimited authority for the Alaska Gasline Development Corporation to go it alone with third-party money, may prove difficult. It takes a simple majority vote to get into that Earnings Reserve Account, something that also has election-year ramifications.

With 19 days left in regular session, the House majority appears to be fracturing, still unable to pass an operating budget, and having its liberal members vote all over the map on the question of how much to fund the dividend shows that it’s not a binding caucus.

The disarray in the House under Speaker Bryce Edgmon leaves the Senate little time to process the operating budget through the required committees, vote on it, and then negotiate a settlement with the House through conference committee.

ELECTION YEAR NOISE-TO-SIGNAL RATIO

Politicizing the dividend for the first time in history, in 2016 Gov. Walker used his veto pen to set Alaskans’ portion of oil royalties at what he thought would be a tolerable amount. The $666.4 million he vetoed from their dividends stayed in the Permanent Fund’s Earnings Reserve Account and earned interest.

“If we don’t make a change in the dividend program, it goes away in four years,” Walker said two years ago.

But in 2018, the governor could be forced into vetoing half of the dividend once again, if the Senate goes along with the House’s decision to fully fund it.

And because it’s an election year, Walker could be forced into a corner by his opponents.

Many Democrats want to see Mark Begich run for governor, and the Permanent Fund dividend is a way of putting the “independent” Walker in a box: If he vetoes the dividend again, he may find no way to climb out of his political malaise. Walker won by joining with the Alaska Democratic Party to create a hybrid independent-Democrat ticket that won against incumbent Sean Parnell, a Republican.

Recent polling by Dittman Research shows that Walker’s popularity with voters has taken a dive, with only 41 percent prepared to vote for him again this year. Another poll by Morning Consult shows him as the least popular governor in the nation.

WHERE DID THE YES VOTES COME FROM?

If the dividend amount stands at $2,700, it would be the largest awarded in the Permanent Fund’s history, although not when inflation is calculated.

The yes votes on $2,700 dividend went across caucus lines: Speaker Bryce Edgmon, Neal Foster, Scott Kawasaki, Gabrielle LeDoux, John Lincoln, Justin Parish, Ivy Spohnholz, Geran Tarr, Chris Tuck, and Tiffany Zulkosky in the liberal majority and David Eastman, DeLena Johnson, Charisse Millett, Mark Neuman, George Rauscher, Lora Reinbold, Dan Saddler, Colleen Sullivan-Leonard, Dave Talerico, Cathy Tilton, and Tammie Wilson in the conservative minority.

All House members are up for re-election along with the governor. Ten of the 20 Senate members face re-election in 2018.

[Related news: Senate Democrats walk out rather than vote on spending cap]