IRS DIRECT PAY SITE IS DOWN, AND OTHER TIPS FOR THE DAY

The IRS says a billion dollars is waiting for up to one million people who may lose out on a fading tax refund simply because they did not file a federal income tax return in 2014.

It’s not too late, but the three-year window to file for it is about to close.

Many taxpayers choose not to file because they didn’t earn enough money to be required to file.

But for those who had federal taxes withheld by their employer, they could be due a refund of those taxes. Even if you aren’t required to file, you may qualify for benefits like the Earned Income Tax Credit.

However, you’ve got to file a tax return to get the money back from the government.

There is usually no penalty for failure to file, if you are due a refund, according to the IRS. You just can’t wait forever.

“Generally, after the three-year window closes, the IRS can neither send a refund for the specific tax year. nor apply any credits, including overpayments of estimated or withholding taxes, to other tax years that are underpaid,” according to the taxing agency.

Current and prior year tax forms and instructions are available on the IRS.gov Forms and Publications page.

Taxpayers who are missing Forms W-2, 1098, 1099 or 5498 should request copies from their employer, bank or other payer.

If you’re unable to get your missing forms from an employer or other payer, visit IRS.gov and use the Get a Transcript tool to order a “Wage and Income transcript.” Taxpayers can also file Form 4506-T to request a transcript of their tax return. Taxpayers can use the information on the transcript to file their return.

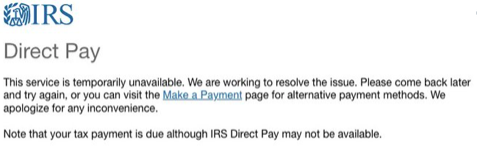

ONLINE DIRECT PAY SYSTEM HAS BEEN DOWN

Those trying to pay their taxes online today have encountered a broke IRS web site. The Direct Pay system, which lets people pay an estimate of taxes from their bank account gave users an error message today.

“This service is temporarily unavailable. We are working to resolve the issue. Please come back later and try again, or you can visit the Make a Payment page for alternative payment methods. We apologize for any inconvenience.”

You may be able to pay your taxes via the department’s other methods, such as debit or credit cards.

“Currently, certain IRS systems are experiencing technical difficulties. Taxpayers should continue filing their tax returns as they normally would,” was the statement from the IRS.

PERMANENT FUND IS TAXABLE

Dividends for adults are taxed by the IRS. Your child’s dividend may be taxable, if they reach a certain income threshold. Even if part or all of your dividend was garnished, the entire amount must be reported as taxable income.

The amount of the 2017 Permanent Fund Dividend was $1,100.00. The state’s Federal Tax Identification number is 92-6001185.

The PFD Division’s mailing address is:

Permanent Fund Dividend Division

PO Box 110462

Juneau, AK 99801-0462

If taxes were withheld from your or your child’s PFD, report the withheld amount on IRS form 1040 on the line for “Federal Tax Withheld.” If a refund is due after you report the dividend and taxes withheld, the IRS will issue any refund due.

For tax questions, call the IRS by calling 1 (800) 829-1040 or a tax preparer in your area for additional information.

And if you’re at this point in the story, you are probably going to need to file an extension.