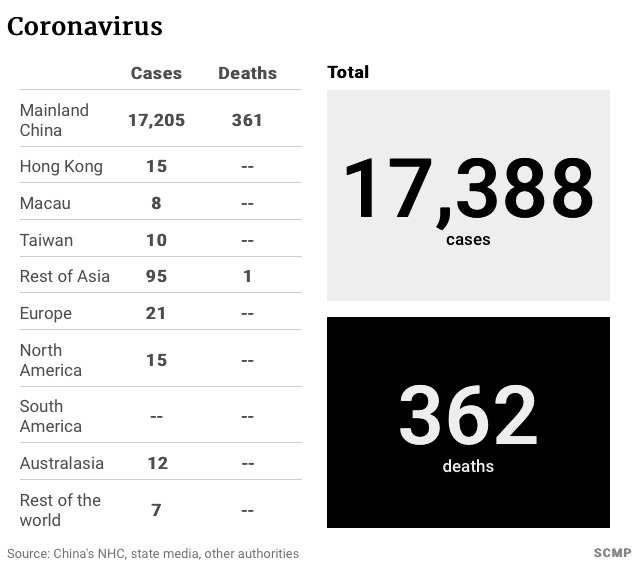

VIRUS HAS INFECTED 17,388, DEATHS NOW AT 362

The coronavirus outbreak may cut the demand for oil in China by as much as 250,000 barrels a day during the first quarter of 2020, as the country tries to contain a major coronavirus outbreak, according to Wood Mackenzie, a research firm.

“Chinese overseas travel increased from 20 million in 2003 to around 150 million in 2018 in terms of person-times,” Wood Mackenize said in its report. “As a survey shows that more than half of Chinese overseas travellers prefer group tours, the ban on tour packages will severely restrain the number of Chinese visitors to popular destinations in East/Southeast Asia, such as Japan and Thailand.”

China’s need for jet fuel will be greatly reduced as travel bans take effect and travelers begin to change their plans across Asia.

That, in our, will have an impact on world markets, and may soften the price of Alaska North Slope crude this week, if only temporarily.

On Jan. 30, ANS oil was trading at $60.43 per barrel. Brent was trading at $58.29, down from $68.60 on Jan. 3.

Global demand for crude oil in 2018 was 99.3 million barrels per day. It was projected to increase to 101.6 million barrels per day in 2020, according to Statista. China reducing its oil use by 250,000 barrels a day is statistically small, but is a significant event in commodities markets.

The Wood Mackenzie report assesses the impact of the ongoing coronavirus on oil demand, and compares it to what happened to oil demand during the 2003 SARS outbreak.

The WoodMac report is at this link. However, it will set you back $1,350.

STEEL AND MINING

The virus will also have an impact on steel and iron markets, WoodMac said in a separate report.

There will be a “direct impact on steel and raw material demand due to the delayed restart of some construction projects, and other downstream industries,” the report noted.

“However, we now expect that steel destocking will be put off by attempts to limit the spread of Coronavirus during the second quarter. With rebar inventories already higher than the last two years, steel prices and margins will be squeezed. Declining steel prices in China will likely also have a knock-on effect on steel markets outside China,” WoodMac reported.

“During the SARS outbreak construction activities slowed due to shortage of workers and a slump in consumer demand. SARs led to China’s economic growth slowing in the second quarter of 2003, by around 2.2% quarter on quarter,” WoodMac reported.

NATURAL GAS

The China Council for the Promotion of International Trade (CCPIT) has said it will offer force majeure certificates to companies that are impacted by the coronavirus pandemic.

Such certificates excuse a company from not performing its contractual obligations that becomes impossible or impracticable, due to an event or effect that the parties could not have anticipated or controlled.

Although the government has extended the Chinese New Year’s holiday through Feb. 2, some sectors, such as oil refineries in Shandong province and automakers will not reopen before Feb. 10, and the country’s economic growth is in for a slowdown in 2020.

Sinopec Corp, Asia’s largest refiner, will reduce throughput in February by around 600,000 barrels per day, according to Reuters.

The People’s Bank of China announced on Sunday that it will inject 1.2 trillion yuan, or $173 billion into the Chinese economy to cushion the effects of the virus on the markets.

Both Sinopec and the Bank of China were signatories on the gasline with Gov. Bill Walker; however those plans have been shelved since Walker left office.

The Shanghai Composite Index fell 8.7% Monday when trading opened, rebounding slightly as the Chinese government stepped in to stabilize it.

What better time to “Make/Keep America Great Again”. An object lesson on why America should have kept our manufacturing base in America and why the President is trying to bring it back. Sorry way for it to happen but true. The world’s socialist/communist countries would sure like to be America right about now.

Spot-on comment!

So the implied concern here is that the Chinese coronavirus will adversely impact oil prices, and hence State incomes and budgets, I guess. Such a compassionate point of view. How about an article about how much human suffering it will cause instead?

Perhaps giving people a heads up about what may be soon to hit the fan is one way of showing compassion, for to fail to give an heads up would demonstrate a lack of.

Everyone should be reassured that at least spice and fenentanol will still be exported to the U.S.

“The People’s Bank of China announced on Sunday that it will inject 1.2 trillion yuan, or $173 billion into the Chinese economy to cushion the effects of the virus on the markets.

That has to be really painful to the CCP leadership, as it’s coming directly out of their pockets; out of The People’s Bank and Money Laundromat of China’s Communist Party.

Comments are closed.