It has been seven years since Alaska Gov. Bill Walker and entities owned by the communist Chinese government signed a preliminary agreement granting extraordinary control over the planned Alaska LNG project to Chinese firms, including Sinopec, the Bank of China, and the China Investment Corporation, all owned by the communist government.

Under the agreement, Sinopec, a state-owned oil and gas company, would serve as the primary buyer, committing to purchase up to 75% of Alaska’s natural gas from the AKLNG project. The company would also be responsible for the engineering and construction of the gasline.

The Bank of China, also government-owned, would act as the primary lender, putting Alaska in financial dependency on China.

Additionally, the China Investment Corporation would take an equity stake in the project, giving China a direct ownership interest in Alaska’s natural gas infrastructure. This was all part of China’s international effort to buy up and control infrastructure. It is called the “Belt and Road Initiative.”

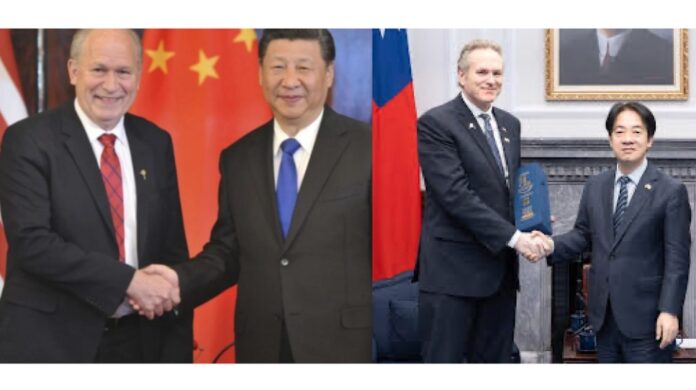

A widely circulated photo of Gov. Walker shaking hands with Chinese President Xi Jinping highlights the relationship Walker cultivated with China. This courtship began in April 2017, when President Xi made a stopover in Anchorage. Walker and then-AGDC head Keith Meyer later traveled to China to further negotiate details.

After Mike Dunleavy was elected governor in 2018 — his victory due in part to public opposition to Walker’s deals with China — he promptly canceled the agreement.

On July 19, 2019, Joe Dubler, interim president of the Alaska Gasline Development Corporation after Keith Meyer’s departure, testified before the Alaska House Resources Committee that the joint development agreement had effectively collapsed. The Dunleavy administration had informed the Chinese via teleconference that Alaska would instead pursue partnerships with North Slope producers and other potential buyers.

Then, in 2022, Sinopec was delisted from the New York Stock Exchange.

Six years into his administration, Dunleavy embarked on a trade mission to Asia to secure non-communist buyers for Alaska’s gas, notably avoiding China. He returned with at least one letter of intent from Taiwan’s President Lai Ching-te, expressing Taiwan’s interest in purchasing six million tons of LNG per year from Alaska and even investing in the project.

While the agreement with Taiwan is still non-binding, the Alaska Gasline Development Corporation has meanwhile secured a primary private-sector developer, Glenfarne Group, to lead the project. Similar to the Trans-Alaska Pipeline System, which is privately owned by Alyeska Pipeline Service Company, the gasline project is moving toward a private-sector ownership model, as it was before Walker took office in 2014 and started giving Alaska’s infrastructure to the communists.

When Gov. Walker made his deal with China, he had just one year left in his only term.

Now, Gov. Dunleavy has less than two years to finalize agreements with key stakeholders, including builders, buyers, and financiers, to ensure the gasline delivers energy to Alaska’s Railbelt region and international buyers in Taiwan, South Korea, Thailand, Japan, and beyond. He is spending a good deal of his time on this project to finalize it before he leaves office.

The project reached a new milestone on March 27, when AGDC signed binding, definitive agreements with Glenfarne Group, which will assume a 75% ownership stake, with AGDC retaining 25%. Glenfarne is expected to make its final investment decision in the fourth quarter of 2025 after securing additional investors.

The Alaska Industrial Development and Export Authority approved a $50 million line of credit in December for front-end engineering and design work, which Glenfarne estimates will cost around $150 million. Additionally, federal loan guarantees of $30 billion may enhance the project’s financial viability.

President Donald Trump has voiced strong support for the project, issuing an executive order on January 20, the day he was sworn into office, prioritizing the Alaska LNG initiative.