The Alaska Permanent Fund is one of the institutional investors that had exposure to the bankrupt cryptocurrency exchange FTX, which filed for bankruptcy on Friday, along with 134 of its associated companies. There will be losses.

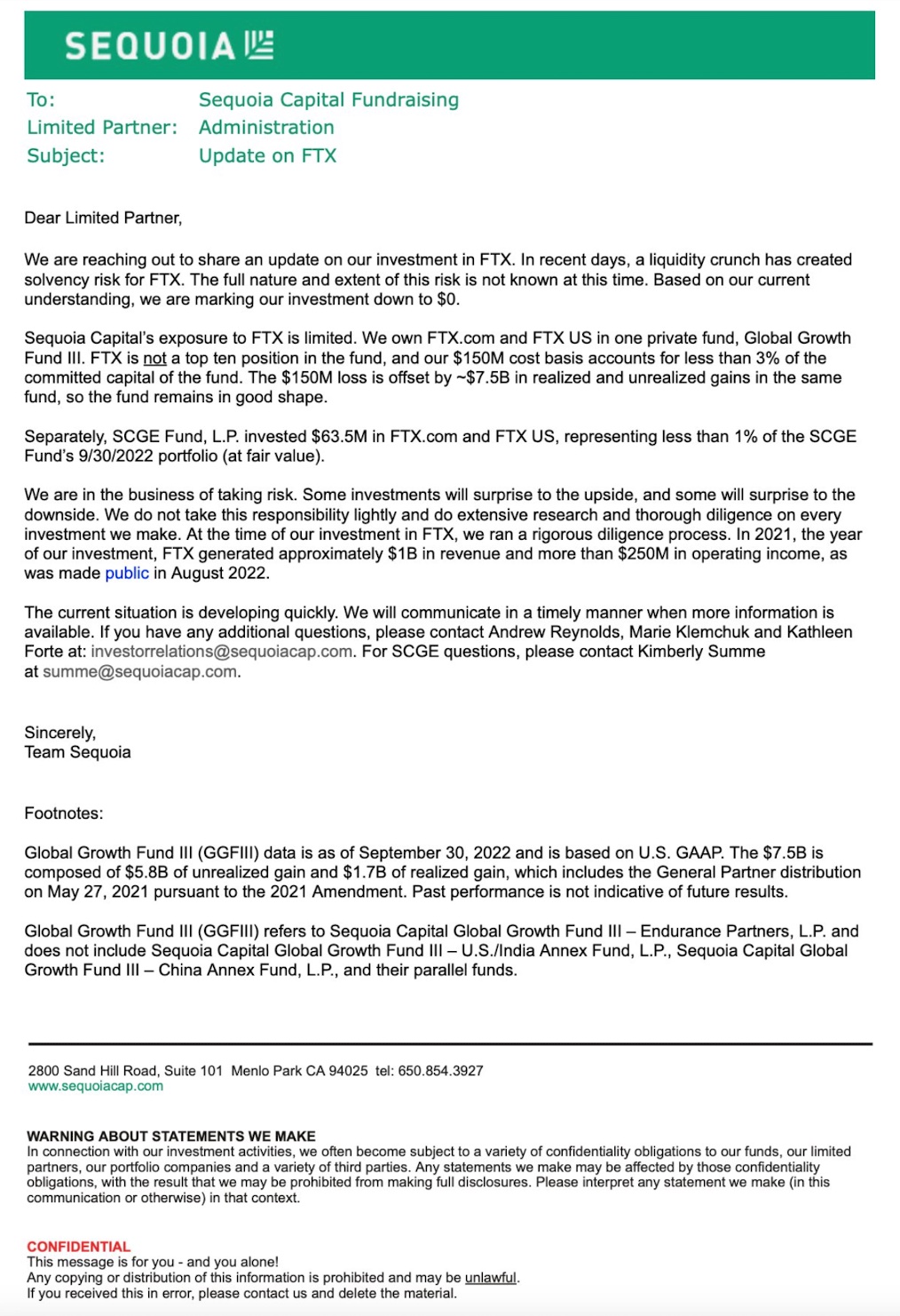

The Alaska Permanent Fund’s investments were through Sequoia Capital, headquartered in Menlo Park, Calif., and other venture capital firms. Sequoia sent a letter to its limited partners on Wednesday marking down the value of its investments in FTX to $0.

The Alaska Permanent Fund had committed as much as $200 million to Sequoia’s Global Growth Fund III, according to Pensions and Investments, an online blog. It was that fund that made the investment of up to $214 million of pooled money from various investors into FTX; thus, the Alaska Permanent Fund’s exposure was not the full amount.

Other institutional investors that had money tied up in FTX include the Ontario, Canada Teachers’ Pension Plan, and the Washington State Investment Board. The Ontario Teachers’ Pension Plan had $95 million invested in FTX Trading and FTX US, but reports that the loss will have a limited impact on the plan.

Sequoia Capital removed its glowing profile of FTX founder Sam Bankman-Fried from its website last week and replaced it with a markdown notice.

“A liquidity crunch has created solvency risk for FTX and its future is uncertain. Many have been affected by this unexpected turn of events. For Sequoia, our fiduciary responsibility is to our LPs. To that end, we shared this letter with them today regarding our investment in FTX. For FTX, we believe its fiduciary responsibility is first to its customers, and second to its shareholders. As such, FTX is exploring all opportunities to ensure its customers are able to recover their funds as quickly as possible.“

FTX users could be out as much as $8 billion in losses, after it appears that FTX CEO Sam Bankman-Fried used money from customer accounts to transfer to other accounts and fund risky investments. Those companies include FTX-owned Alameda Research, which owes FTX some $10 billion.

The loss on FTX is offset by the fund’s roughly $7.5 billion realized and unrealized gains, Sequoia said in its letter.

“We are in the business of taking risk. Some investments will surprise to the upside, and some will surprise to the downside. We do not take this responsibility lightly and do extensive research and thorough due diligence on every investment we make,” the letter explained, signed “Team Sequoia.”

“At the time of our investment in FTX, we ran a rigorous due diligence process,” the company said, although that is now in question, since it appears the CEO of FTX was running a Ponzi scheme to fund his political favorites in the Democrat Party.

Read: Meet young crypto billionaire who wants to change political fundraising

In 2018, the then-$81 billion Alaska Permanent Fund Corp. committed $200 million to Sequoia’s Global Growth Fund III, and the $161 billion Washington State Investment Board retirement system approved an allocation of up to $350 million, according to Pensions and Investments.

FTX founder and CEO Sam Bankman-Fried resigned Friday as CEO, and about 130 companies affiliated with FTX also began voluntary bankruptcy proceedings, according to FTX’s website.

Those companies that are also embroiled in the bankruptcy include:

1. Alameda Aus Pty Ltd

2. Alameda Global Services Ltd.

3. Alameda Research (Bahamas) Ltd

4. Alameda Research Holdings Inc.

5. Alameda Research KK

6. Alameda Research LLC

7. Alameda Research Ltd

8. Alameda Research Pte Ltd

9. Alameda Research Yankari Ltd

10. Alameda TR Ltd

11. Alameda TR Systems S. de R. L.

12. Allston Way Ltd

13. Altalix Ltd

14. Analisya Pte Ltd

15. Atlantis Technology Ltd.

21. Bancroft Way Ltd

28. Bitvo, Inc.

29. Blockfolio Holdings, Inc.

30. Blockfolio, Inc.

31. Blue Ridge Ltd

37. BTLS Limited Tanzania

38. Cardinal Ventures Ltd

39. Cedar Bay Ltd

40. Cedar Grove Technology Services, Ltd

41. Clifton Bay Investments LLC

42. Clifton Bay Investments Ltd

43. CM-Equity AG

44. Corner Stone Staffing

45. Cottonwood Grove Ltd

46. Cottonwood Technologies Ltd.

47. Crypto Bahamas LLC

48. DAAG Trading, DMCC

49. Deck Technologies Holdings LLC

50. Deck Technologies Inc.

51. Deep Creek Ltd

52. Digital Custody Inc.

53. Euclid Way Ltd

60. FTX (Gibraltar) Ltd

61. FTX Canada Inc

62. FTX Certificates GmbH

63. FTX Crypto Services Ltd.

64. FTX Digital Assets LLC

65. FTX Digital Holdings (Singapore) Pte Ltd

66. FTX EMEA Ltd.

67. FTX Equity Record Holdings Ltd

68. FTX Europe AG

69. FTX Exchange FZE

70. FTX Hong Kong Ltd

71. FTX Japan Holdings K.K.

72. FTX Japan K.K.

73. FTX Japan Services KK

74. FTX Lend Inc.

75. FTX Marketplace, Inc.

76. FTX Products (Singapore) Pte Ltd

77. FTX Property Holdings Ltd

78. FTX Services Solutions Ltd.

79. FTX Structured Products AG

80. FTX Switzerland GmbH

81. FTX Trading GmbH

82. FTX Trading Ltd

83. FTX TURKEY TEKNOLOJİ VE TİCARET ANONİM ŞİRKET

84. FTX US Derivatives LLC

85. FTX US Services, Inc.

86. FTX US Trading, Inc

87. FTX Vault Trust Company

88. FTX Ventures Ltd

89. FTX Ventures Partnership

90. FTX Zuma Ltd

91. GG Trading Terminal Ltd

92. Global Compass Dynamics Ltd.

93. Good Luck Games, LLC

94. Goodman Investments Ltd.

95. Hannam Group Inc

96. Hawaii Digital Assets Inc.

97. Hilltop Technology Services LLC

98. Hive Empire Trading Pty Ltd

99. Innovatia Ltd

100. Island Bay Ventures Inc

101. K-DNA Financial Services Ltd

102. Killarney Lake Investments Ltd

103. Ledger Holdings Inc.

104. LedgerPrime Bitcoin Yield Enhancement Fund, LLC

105. LedgerPrime Bitcoin Yield Enhancement Master Fund LP

106. LedgerPrime Digital Asset Opportunities Fund, LLC

107. LedgerPrime Digital Asset Opportunities Master Fund LP

108. Ledger Prime LLC

109. LedgerPrime Ventures, LP

110. Liquid Financial USA Inc.

111. LiquidEX LLC

112. Liquid Securities Singapore Pte Ltd

113. LT Baskets Ltd.

114. Maclaurin Investments Ltd.

115. Mangrove Cay Ltd

116. North Dimension Inc

117. North Dimension Ltd

118. North Wireless Dimension Inc

119. Paper Bird Inc

120. Pioneer Street Inc.

121. Quoine India Pte Ltd

122. Quoine Pte Ltd

123. Quoine Vietnam Co. Ltd

124. SNG INVESTMENTS YATIRIM VE DANIŞMANLIK ANONİM ŞİRKETİ

125. Strategy Ark Collective Ltd.

126. Technology Services Bahamas Limited

127. Tigetwit Ltd

129. Verdant Canyon Capital LLC

130. West Innovative Barista Ltd.

131. West Realm Shires Financial Services Inc.

132. West Realm Shires Services Inc.

133. Western Concord Enterprises Ltd.

134. Zubr Exchange Ltd

In July, Sam Bankman-Fried said he and FTX had a “few billion” on hand to shore up struggling crypto firms to prevent the collapse of the digital currency industry, and at the time he said the worst of the sector’s liquidity problem had likely passed.

Bankman-Fried, who lives in the Bahamas, and FTX, which is a company registered in the Bahamas, are now being investigated by as many as five U.S. regulatory entities, including the Securities and Exchange Commission, the Department of Justice, the Commodity Futures Trading Commission, the Texas State Securities Board, and California’s Department of Financial Protection and Innovation, according to decrypt.co.