Few Alaskans had heard of the Glenfarne Group until it emerged last week as the company whose name was kept (unsuccessfully) under wraps by the Alaska Gasline Development Corporation during a Jan. 6 press conference. AGDC is a publicly owned agency tasked with building a gasline from the North Slope to Nikiski in order to develop another taxable export product for the state.

Who is this company that has stepped up to work with AGDC to finally get the gasline up and running?

The Glenfarne Group, started in 2011 by Australian Brendan Duval, is somewhat of a corporate conglomerate, working in several energy and capital-raising directions, including oil and gas, hydropower, and wind farms. But at its core, it raises money for big projects in energy. Based at 292 Madison Ave. in the heart of Manhattan, New York, it has offices around the world.

Although not a household name like ConocoPhillips or Exxon, Glenfarne is not a small player in the energy sector. It’s just a different type of player.

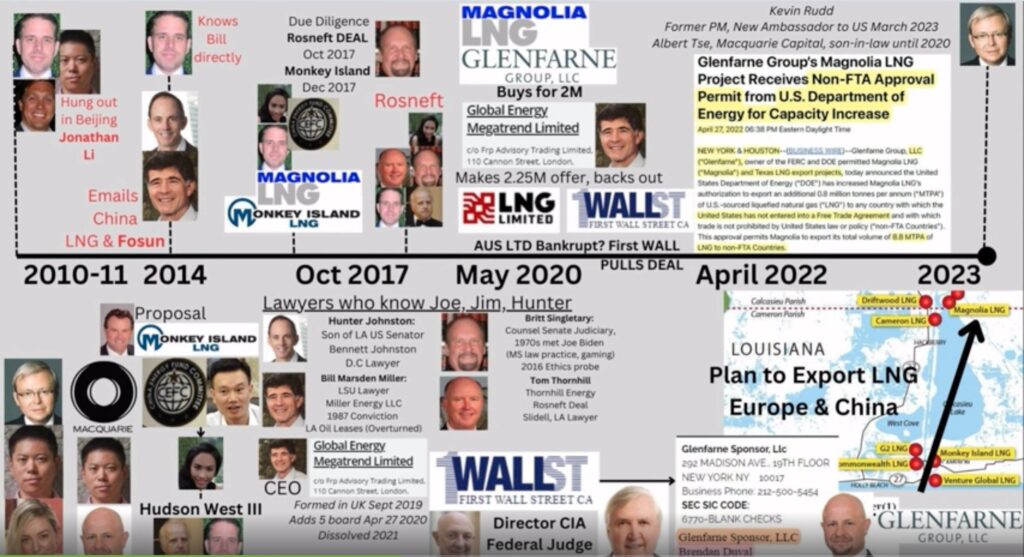

The company owns the Texas LNG project through Glenfarne Energy Transition, which has a “heads of agreement” for a long-term supply of liquified natural gas from a proposed facility at the Port of Brownsville, Texas. The Glenfare Energy Transition subsidiary is the same subset of Glenfarne that has the heads of agreement for the Alaska LNG project with AGDC.

Glenfarne subsidiaries also include:

EnfraGen, a developer, owner and operator of specialized renewable solar, hydro and grid stability assets across Latin American investment-grade countries. The firm is jointly controlled by Glenfarne Group and global private markets investment manager Partners Group founded in 1996 that has invested more than $221 billion (US) in private markets. EnfraGen has the Guanacaste Wind Farm in Costa Rica, and the Dos Mares Hydro Complex in Panama, which involves three run-of-river downstream hydro plants. It has two solar plants in Panama, and other energy properties as far south as Chile.

Alder Midstream, which is focused on building, owning and operating global energy infrastructure assets across the energy value chain. Magnolia LNG and Texas LNG are part of this business Glenfarne business line.

Glenfarne Energy Transition “provides critical solutions to lower the world’s carbon footprint, Through its strategic operations in Latin America and Southeast Asia addressing the ‘here and now’ of the global energy transition through its LNG, grid stability, and renewable power businesses.”

Glenfarne Energy Transition is owner and developer of the 8.8 million ton per year Magnolia LNG project in Lake Charles, Louisiana.

Prime Energia is a wholly owned subsidiary of Glenfarne Asset Company, LLC, a vehicle established by Glenfarne Group that is working in Colombia.

Glenfarne Merger Corp. was a “blank check company” incorporated as a Delaware corporation and registered with the Security and Exchange Commission “for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization, recapitalization or other similar business combination with one or more businesses.” CEO Duval was the owner of more than 50% of the stock of the company that popped up and delisted from the NASDAQ in 2022.

The now-shuttered corporation was a publicly traded special purpose acquisition company (SPAC). A SPAC raises capital through an initial public offering and then acquires or merges with a private company, that then becomes a public company without having to do its own initial public offering. It’s a new-fangled business workaround.

Harvard Business Review describes it this way: “A SPAC is a publicly traded corporation with a two year life span formed with the sole purpose of effecting a merger or “combination” with a privately held business to enable it to go public. SPACs raise money largely from public equity investors and have the potential to derisk and shorten the IPO process for their target companies, often offering them better terms than a traditional IPO would.”

Learn more about SPACs in this Harvard Business Review article.

It’s apparent that Glenfarne has the bonafides and business sophistication to complete the Alaska LNG project. It owns projects in Panama, Costa Rica, Colombia, Chile, and is part of ventures across the globe.

In 2024, AGDC President Frank Richards told the Legislature that AGDC was engaging potential developers and investors to fund the front-end engineering and development and commercial and legal contracts to move to final investment decisions.

As part of this process, Goldman Sachs was screening possible investors to ensure they have access to capital.

Richards said in his slide deck last year that the “Primary challenge is to build a coalition of investors that combined have

the capital and capability to move the entire project forward.”

That universe of potential investors is limited due to the relative size and complexity of the project, but at least the Alaska LNG project already has its federal permits. Some companies showed interest, met with AGDC, analyzed the project, and took a pass, but Glenfarne took the bait.

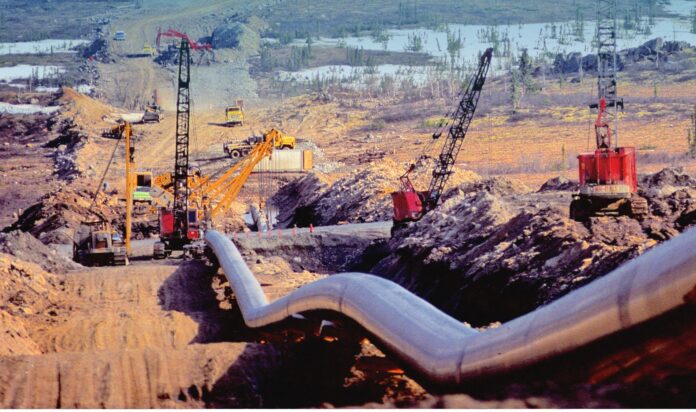

Glenfarne now must raise the $44 billion or more needed to build a carbon-capture plant on the North Slope, an LNG export facility in Nikiski, and an 800-mile gas pipeline with off-takes along the way to supply natural gas to Southcentral Alaska.

Where will the needed capital come from? Another two-year SPAC?

It’s a global investment opportunity and it will involve billionaires looking for return on investment.

In other projects Glenfarne has been part of, China has factored as a partner, but not always directly.

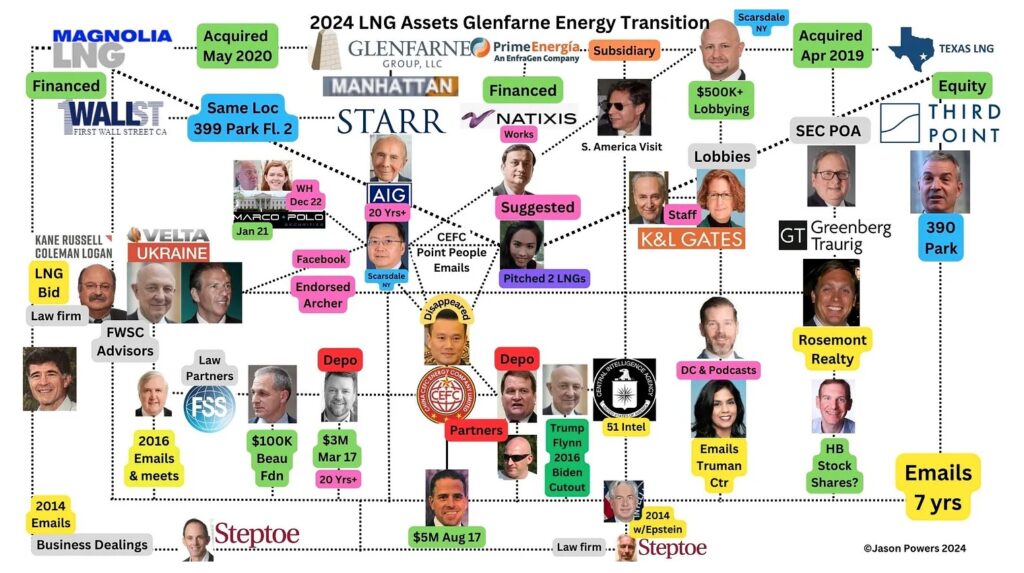

According to energy writer Jason Powers, who publishes a Substack newsletter focusing on big energy and pharmaceutical deals, Hunter Biden factors into this world of LNG, and not only with the Burisma project in Ukraine, where he served on the board while his father was vice president:

“As we have noted (here, here, here), Hunter [Biden]’s game involves U.S. LNG projects: Texas LNG and Magnolia LNG. These projects are still very hot – and moving forward under Glenfarne Energy Transition’s ownership. Both LNG projects were key CEFC’s targets – through their associate JaiQi Bao’s emails to Hunter – and both were acquired out of New York City-based entities, located just blocks from Glenfarne’s HQ on Madison Avenue (see below).”

Glenfarne has also had a partnership with Gunvor, a company that, according to Powers, has ties to the Russian oligarchy:

“Gunvor has an interesting history. Gunvor Group was co-founded by Russian Oligarch, Gennady Nikolayevich Timchenko, who allegedly sold his entire ownership in March 2014 due to his being placed on the U.S. sanctions list due to Ukraine-Russia confrontation. Tellingly, in terms of later targeting, Gunvor settled a $661,000,00 criminal fine with Biden’s DOJ on Friday, March 1, 2024, tied to committing fraud through bribery and money laundering through the usual locations, including: Panama, Caymans and Singapore (FBI Special Agent Jeffrey Veltri noted),” Powers wrote.

Gunvor controls 60% of the volume transiting through Estonia, and 41% of that transit via the port of Primorsk, Leningrad, according to Wikipedia. It’s the second-largest port on the Baltic. It is the fourth-largest oil trader in the world.

In March, 2024, Texas LNG (Glenfarne), announced signed a Heads of Agreement with Gunvor Group through its subsidiary Gunvor Singapore Pte Ltd for a 20-year LNG FOB (free on board) sale and purchase agreement of LNG from Texas LNG.

“Gunvor’s overseas offices conveniently overlaps with a host of usual suspects tied to Hunter Biden’s CEFC-related emails – Noble Group, Trescorp Alliance, Natixis, HSBC, Starr Companies – located within a lunchtime stroll in downtown Singapore,” Powers wrote.

In his recent Kindle book on Hunter Biden’s dealmaking, “The Hunter Biden Dossier,” Powers wrote, “It is one’s analysis that Hunter & his CCP-connected associates have acquired a substantial percentage of 2 LNG projects: Magnolia and Texas LNG. This acquisition is guised yet again behind an LLC (limited liability corporation) and SPAC (special purpose acquisition company) with the added twist of being held as a Sponsor ownership.”

Starting in February 2023, researchers like Powers stumbled upon connections in reviewing emails sent between Xiaopeng “Rick” Niu and JiaQi Bao to Hunter Biden.

“In these emails, the above LNG projects, their preferred financier (Natixis), tied back to a shared physical address 399 Park Avenue, Floor 2, New York City, New York where Rick worked (at Starr Insurance) and Magnolia LNG was held by First Wall Street Capital. Other intriguing connections involved the highest levels of the intelligence apparatus of the United States of America; and yet again, a Ukrainian geopolitical angle arose tied to LNG exports and Titanium mining,” according to Powers.

“Project White Light was the name given to the 240-page, 3-phase master BRI (belt and road initiative) agenda assigned to Xiaopeng “Rick” Niu, for consultation and business preparation, in emails. Niu was contacting CEFC (China Energy Fund Committee) top director in China and regularly emailing with Hunter’s key partners (Tony Bobulinski, Rob Walker, James Gilliar, Jim Biden) in the Spring of 2017. But it was in the Fall of 2017, after Hunter and Jim (and cutting out Walker, Gilliar, Bobulinski) received over $5 million from CEFC to set up Hudson West’s operations in New York that this Project began in earnest, for China, at least,” Powers wrote.

“Enter JiaQi ‘Jackie’ Bao (CEFC), the seductive Chinese secretary for Hunter, to provide Chinese translation of all U.S. energy assets in presentation form and to recommend which projects enticed CEFC (& the CCP’s) appetites the most. Even with project disruption tied to the arrest of Patrick Ho in November 2017, Jackie was undeterred. By January 2018, she provided the investing financier – Natixis – that happened to be used by EnfraGen Capital and Glenfarne Group. Glenfarne is the company that acquired the rights to Magnolia and Texas LNG. As it turns out, Hunter knew Texas LNG’s owner personally in Third Point Management CEO Dan Loeb, a billionaire, and emailed Third Point personnel from 2010-2016,” Powers revealed.

Read the Tony Bobulinski interview about Hunter and Joe Biden in the FBI transcript here.

“Hunter’s involvement in CEFC seems to have ended in March 2018 with a final $1,000,000 deposit to his Wells Fargo account and “wrap-up emails” from China Jackie. But in March 2019, just days before his laptop was taken to a repair shop, both China Jackie and Slick Rick contacted Hunter Biden out of blue to encourage that Joe run for the presidency,” Powers continues.

“The story of how Hunter Biden (and/or his CCP-connected buddies) potentially acquired a stake in two export LNG projects lay inside this intelligence briefing,” he wrote.

While this was happening in 2017, Alaska briefly became part of China’s Belt and Road Initiative, when Gov. Bill Walker signed an agreement to have China and its communist-owned entities finance and build the Alaska LNG project. Walker and AGDC, under his close direction, nearly handed the entire project over to the communists.

One month after China President Xi Jinping met in Anchorage with Gov. Walker, the first China Belt and Road Forum was held in Beijing in May of 2017, attended by over 100 countries. UN Secretary-General Antonio Guterres lauded the Belt and Road Initiative’s “immense potential,'” praised it for having “sustainable development as the overarching objective,” and pledged the “United Nations system stands ready to travel this road with you,'” according to the Council on Foreign Relations.

Right after Gov. Mike Dunleavy was sworn in as governor in 2018, that agreement was cancelled by Dunleavy and the project was once again in search of a free-market financing and development partner. Meanwhile, China has expanded its Belt and Road Initiative to all corners of the world.

Soon, 139 countries were formally affiliated with China’s Belt and Road Initiative.

Since then, the Belt and Road Initiative, a movement toward China’s global dominance, has extended its reach to nearly every corner of the globe.

What does China now have to do with Alaska LNG?

America is still the big holy grail for the Chinese, who have become wise to the fact that they can’t participate directly in US LNG projects. Their experience in Alaska with Gov. Walker gave them a lot of information about public perception and political realities.

Yet China as a country and its Chinese billionaires had access to LNG through Hunter Biden and associates in the years that started while Joe Biden was vice president and up until he became president in 2020.

In January 2024, China was home to the most billionaires in the world — 814, surpassing the United States, according to the Hurun Global Rich List. Companies looking for big investors always have to consider China.

Whether Glenfarne or its subsidiaries have direct or indirect China investment ties is not clear, since it is a private equity firm whose investors are difficult to track due to how these companies are heavily layered with institutional and private investors, blind trusts, and the magic of the SPAC pop-ups.

But Jason Powers, whose particular interest is actually the Hunter Biden connections, believes there are, according to several of his slides in his recent documentary on Hunter Biden and LNG. Here are just two of them:

For instance, while President Joe Biden was shutting down petroleum projects around the country, Magnolia, the Louisiana subsidiary of Glenfarne, was getting a federal permit from the Biden Administration to export LNG to non-free trade countries. China is such a country. The project is still under development.

Read the company’s request for the permit at this federal Department of Energy link.

Read details from Global Energy Monitoring Wiki at this link.

Jason Powers pulls more of the threads of this complex weave of international private equity and energy investment players in his explanatory documentary on Rumble. It is over two hours long but has an explanation of how the financing of these international deals involve everything from China to the Bidens to the fentanyl drug trade: