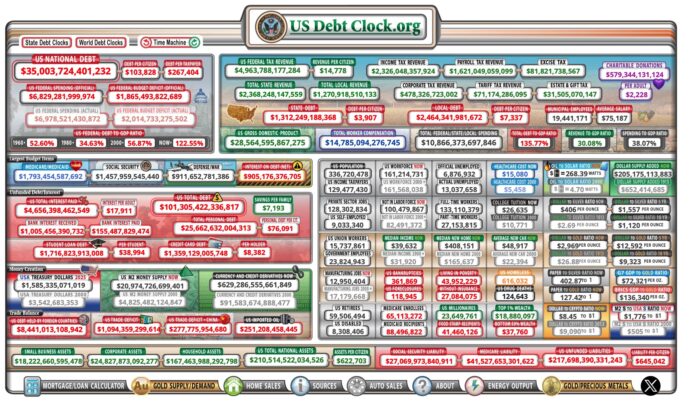

Overnight, the National Debt Clock turned a big number: $35 trillion is the current national debt for the United States of America. That’s $104,000 of debt for every individual in the United States, and over $267,400 for every actual taxpayer.

The public debt to gross domestic product ratio for the U.S. is now 89.72%, not the highest in the world. That honor belongs to Japan, which has a public debt to GDP ratio of over 300%. Japan is also the largest foreign holder of U.S. treasury securities, with Japanese banks, pension funds, and other financial institutions holding more than $1.1 trillion at the end of 2023.

When the federal government spends more than it takes in, the government simply borrows money to cover the deficit. Each year as the debt grows, the interest rate on it gobbles up more and more of the taxpayers’ contributions.

In the past, large deficits were linked to national emergencies like major wars or the Great Depression. But in 2024, there is a structural issue that involves shrinking participation in the workforce, aging baby-boomer population, the explosion of health care costs and transfers of that cost to the taxpayers. Even while many Americans pay up to 50% of their salaries to the government in the way of local, state, and federal taxes, the debt is outstripping their contributions.

View the U.S. National Debt Clock at this link.