ALASKA NEEDS A PRIMER ON DOING BUSINESS IN AND OUT OF INDIAN COUNTRY

By MARY BISHOP

GUEST CONTRIBUTOR

For the past 30 years I have been an occasional student of Alaska tribal sovereignty. I am committed to improving the knowledge of this issue among all Alaskans.

To begin with, each of Alaska’s 225 plus tribes are sovereign; each holds sovereign immunity from suit for breach of contract – absent a formal document waiving that sovereignty.

The Alaska Supreme Court affirmed that each tribe has sovereign powers over matters that directly affect their people — such as membership, marriage, adoption, inheritance and divorce. This legal concept is well-explained in the October, 2017 opinion by then-Attorney General Jahna Lindemuth, linked here.

Tribal sovereignty does not depend on the existence of “Indian Country,” the territory over which a tribe holds governing authority.

Attorney Gabriel Galanda explains in his 2009 American Bar Association article that “Tribal sovereignty is the single most important element of practicing [law] both because it protects tribal coffers from suit and because of its sacred importance…” In September, 2018 the ABA published a “primer” on doing business with sovereign tribes.

Alaska urgently needs such a primer, one addressing the Alaska situation, where tribes do business within Indian Country and tribes do business outside of Indian Country — and tribal businesses can incorporate under tribal, state, or federal law.

Tribal sovereign immunity complications are likely unknown in the Alaska business community. An ironic Alaska example occurred when on Sept. 8, 2017, the Alaska Supreme Court ruled that a Juneau area tribe could not be sued in state court by the Douglas Indian Association for alleged mismanagement of joint federal tribal transportation funds.

Why? No waiver of immunity had been negotiated between the tribes.

Years ago Alaska required agencies acquire tribal “waivers of sovereign immunity” when interacting with tribes for land and fuel agreements. I saw no recognition of that need in the state’s 2017 tribal agreements.

Second, Indian Country in Alaska is virtually the same as Lower 48 reservations, asserts the Bureau of Indian Affairs.

In 1971 Congress passed the Alaska Native Claims Settlement Act, which most people thought settled the question of Indian reservations and Indian Country. So how does Indian Country now come to exist in Alaska? It is done through the Interior Department’s “fee-to-trust” program, administered by the Bureau of Indian Affairs. That program allows tribal land which is owned in fee title to be transferred to federal trusteeship.

Because of an Interior Department 1978 interpretation of ANCSA, the fee-to-trust program was not available to Alaska tribes. But in 2014, the Bureau of Indian Affairs made a new rule to void this “Alaska exception” to fee-to-trust.

“Yet in no clearer way could Congress’ intent be undermined than by recreating something, through an administrative [BIA] process, that Congress expressly extinguished by law,” asserts State Attorney General Kevin Clarkson in a Jan. 25, 2019, letter to Interior in which he presents arguments against fee-to-trust lands in Alaska.

Following ANCSA, Alaska’s first tract of BIA-approved Indian Country is a parcel in downtown Craig, accepted for trust in 2017. The Craig Tribal Association’s website notes the tribe’s tax-free Smoke Shop, its mission, and sovereign immunity.

Indian Country in Alaska is free of state and municipal taxation, regulation and zoning. Think marijuana, gaming, tobacco, fuel, fish and game harvest. Consider the effect on competing private business.

Tribal members living within Indian Country have all rights of federal, state and municipal citizenship. They vote on bonding issues but are exempt from state and municipal taxation. Their property is generally expected to receive the usual state and municipal services. Federal courts may attempt a balancing act weighing state interests against tribal interests. “And, as with all balancing tests, the result is a crapshoot,” notes the 2017 ABA article.

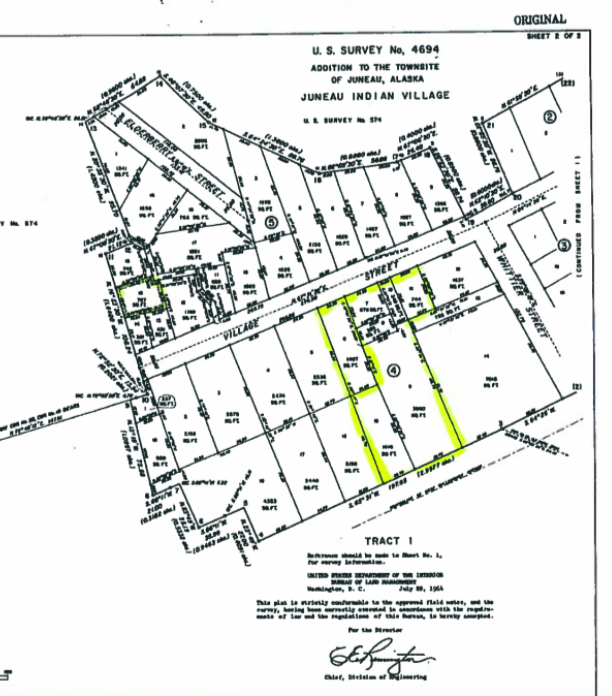

Land in downtown Juneau, Fort Yukon, and Ninilchik has been submitted for trust status. Native allotments within the Fairbanks City and Borough could be transferred to fee ownership of a tribe, which might then submit it to BIA for fee-to-trust status—tax and regulation free within the city or borough.

Alaska’s one pre-ANCSA reservation is Metlakatla, established by treaty with Canadian Indians.

Through ANCSA, regional and village Native corporations received 11 percent of Alaska lands plus almost $1 billion. Tribes did not receive money or land. But both money and land have since gone to tribes through grants and for-profit businesses. Some village corporations have turned over ANCSA lands to tribes. Tribes can receive land through purchase and gift—and now own millions of acres.

Those who understand Indian law best are those who passionately and patiently advocate for increased tribal authority and financial benefit available through judicious use of this complex body of law.

However, they do not necessarily have the broader interests of all Alaskans in mind. That responsibility lies with the state.

I urge the Dunleavy Administration to move forward by providing an informative primer for the benefit of all Alaskans.

Mary Bishop has lived with her family in Fairbanks and Interior villages since 1961.