The Alaska Support Industry Alliance, which represents most of the major oil service and related contract companies in Alaska, is polling its membership to find out what they think of the tax that Sen. Bill Wielechowski inserted into the governor’s carbon credit bill, House Bill 50.

The bill seems likely to pass the Democrat-controlled Senate, which is a body where there are actually more Republicans than Democrats, but where all but three Republicans have given over the power to the Democrats. Taxes are the result.

“Please take one minute to complete our survey and let us know if your company is an S Corp and if you oppose the attempt by some legislators to circumvent the IRS Tax Code and impose the corporate tax rate of 9.4% on some S corps in Alaska. (This is meant to target Hilcorp but could have broader scope),” the Alliance wrote to its members.

Take the Alliance survey at this link.

House Bill 50, the carbon credit bill, was originally, “An Act relating to carbon storage on state land; relating to the powers and duties of the Alaska Oil and Gas Conservation Commission; relating to carbon storage exploration licenses; relating to carbon storage leases; relating to carbon storage operator permits; relating to enhanced oil or gas recovery; relating to long-term monitoring and maintenance of storage facilities; relating to carbon oxide sequestration tax credits; relating to the duties of the Department of Natural Resources; relating to carbon dioxide pipelines; and providing for an effective date.”

In plain language, the bill creates a framework for the Department of Natural Resources to lease State of Alaska lands for carbon storage projects, and for the Alaska Division of Oil and Gas to permit and regulate carbon storage facilities in Alaska.

Wielechowski inserted language from his earlier failed attempt in the past, SB 114 of 2022-23, which was also a tax aimed at Hilcorp.

The proposed tax could be expanded to include all private S corp. companies in a new 9.4% tax.

Critics warn that such a tax on Hilcorp, which took over operations on the North Slope when BP pulled out of Alaska, could dry up the company’s investments in the state, and the spin-off from that could leave many smaller companies without work.

A hearing in Senate Finance was set for Tuesday morning, then moved to Tuesday (May 7) afternoon at 1:30 p.m.

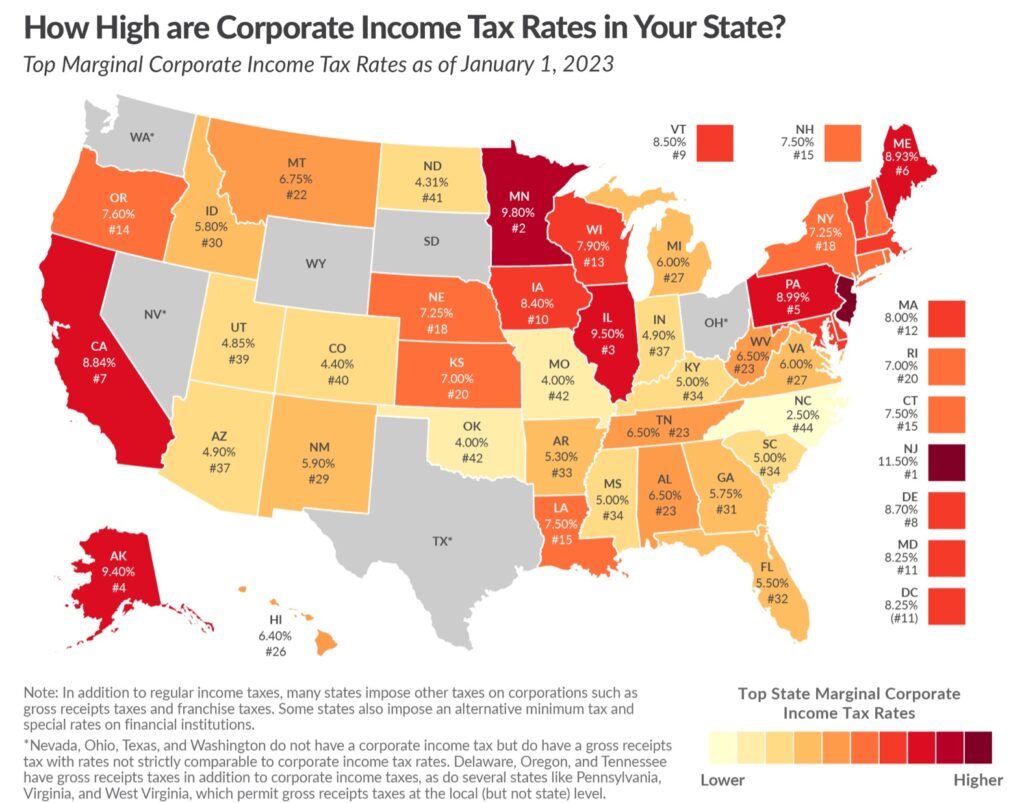

Alaska’s state taxes on C Corporations are among the highest in the nation, according to the Tax Foundation. “New Jersey levies the highest top statutory corporate tax rate at 11.5 percent, followed by Minnesota (9.8 percent) and Illinois (9.50 percent). Alaska and Pennsylvania levy top statutory corporate tax rates of 9.40 percent and 8.99 percent, respectively,” the foundation says.

Find documents and history of this SB 50 at this link.

Watch the Senate Finance Committee at this link at 1:30 p.m. on May 7.

Although the bill is likely to pass the Senate, due to the liberal makeup of the members, Must Read Alaska has learned that Gov. Mike Dunleavy may veto his own bill if it arrives on his desk with the Hilcorp tax.